Investors three-year losses continue as Atul (NSE:ATUL) dips a further 11% this week, earnings continue to decline

For many investors, the main point of stock picking is to generate higher returns than the overall market. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. We regret to report that long term Atul Ltd (NSE:ATUL) shareholders have had that experience, with the share price dropping 41% in three years, versus a market return of about 51%. Furthermore, it's down 26% in about a quarter. That's not much fun for holders. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

With the stock having lost 11% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Check out our latest analysis for Atul

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

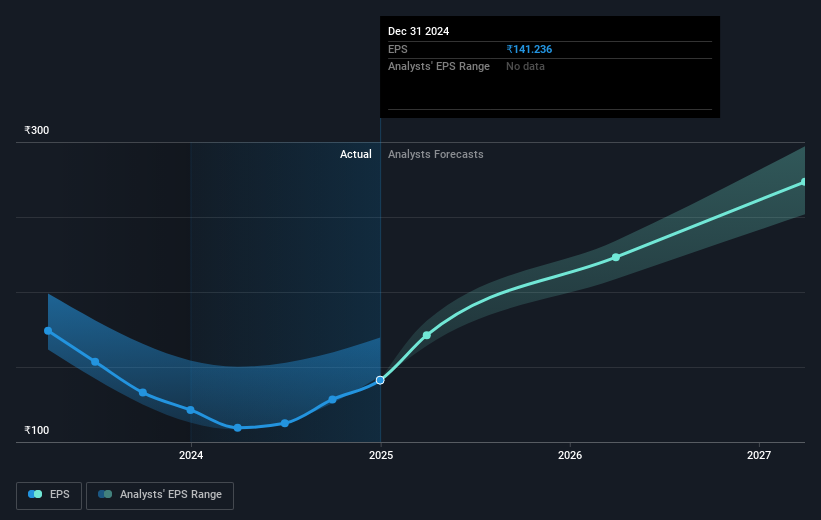

During the three years that the share price fell, Atul's earnings per share (EPS) dropped by 13% each year. This fall in EPS isn't far from the rate of share price decline, which was 16% per year. So it seems like sentiment towards the stock hasn't changed all that much over time. It seems like the share price is reflecting the declining earnings per share.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We know that Atul has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Atul will grow revenue in the future.

A Different Perspective

Atul shareholders are down 15% for the year (even including dividends), but the market itself is up 2.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Longer term investors wouldn't be so upset, since they would have made 1.1%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for Atul that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ATUL

Atul

Manufactures and sells chemicals and other chemical products worldwide.

Excellent balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives