We Ran A Stock Scan For Earnings Growth And Astec LifeSciences (NSE:ASTEC) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Astec LifeSciences (NSE:ASTEC). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Astec LifeSciences

How Quickly Is Astec LifeSciences Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That means EPS growth is considered a real positive by most successful long-term investors. To the delight of shareholders, Astec LifeSciences has achieved impressive annual EPS growth of 39%, compound, over the last three years. That sort of growth rarely ever lasts long, but it is well worth paying attention to when it happens.

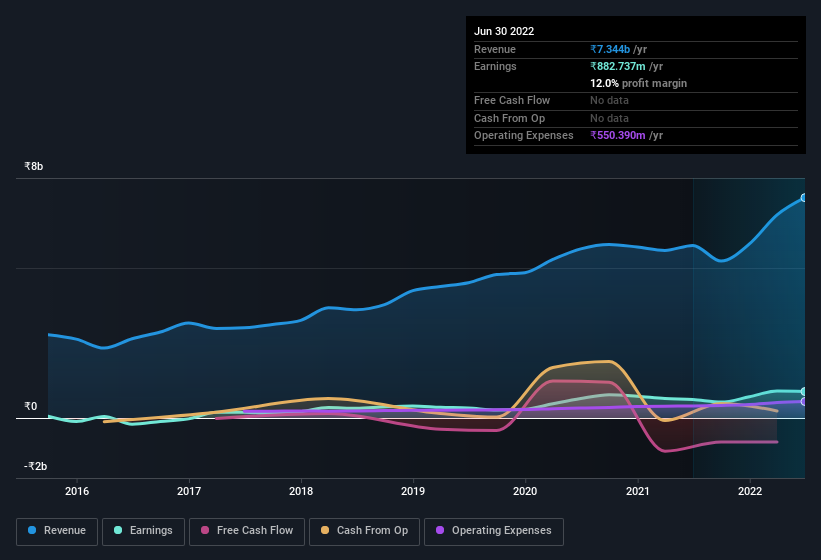

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Astec LifeSciences maintained stable EBIT margins over the last year, all while growing revenue 28% to ₹7.3b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Astec LifeSciences.

Are Astec LifeSciences Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Even though some insiders sold down their holdings, their actions speak louder than words with ₹40m more invested than sold by people who know they company best. An optimistic sign for those with Astec LifeSciences in their watchlist. We also note that it was the Non-Executive Director, Ashok Hiremath, who made the biggest single acquisition, paying ₹37m for shares at about ₹1,705 each.

The good news, alongside the insider buying, for Astec LifeSciences bulls is that insiders (collectively) have a meaningful investment in the stock. As a matter of fact, their holding is valued at ₹2.6b. That shows significant buy-in, and may indicate conviction in the business strategy. That amounts to 7.3% of the company, demonstrating a degree of high-level alignment with shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because Astec LifeSciences' CEO, Anurag Roy, is paid at a relatively modest level when compared to other CEOs for companies of this size. The median total compensation for CEOs of companies similar in size to Astec LifeSciences, with market caps between ₹16b and ₹64b, is around ₹21m.

The Astec LifeSciences CEO received ₹16m in compensation for the year ending March 2022. That is actually below the median for CEO's of similarly sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add Astec LifeSciences To Your Watchlist?

Astec LifeSciences' earnings per share growth have been climbing higher at an appreciable rate. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Astec LifeSciences deserves timely attention. You should always think about risks though. Case in point, we've spotted 1 warning sign for Astec LifeSciences you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Astec LifeSciences, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ASTEC

Astec LifeSciences

Manufactures and sells agrochemical active ingredients and pharmaceutical intermediates in India.

High growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026