Exploring High Insider Ownership Growth Companies On Indian Exchange With Earnings Up To 33%

Reviewed by Simply Wall St

The Indian stock market has experienced a slight dip of 1.3% over the last week, yet it maintains a robust annual growth of 43%, with earnings projected to increase by 16% per annum. In this environment, companies with high insider ownership can be particularly appealing, as they often indicate a strong alignment between company management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 30.8% |

| Pitti Engineering (BSE:513519) | 30.3% | 28.0% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 34.4% |

| Shivalik Bimetal Controls (BSE:513097) | 19.5% | 28.7% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.2% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| JNK India (NSEI:JNKINDIA) | 23.8% | 31.8% |

| Aether Industries (NSEI:AETHER) | 31.1% | 43.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

Anupam Rasayan India (NSEI:ANURAS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Anupam Rasayan India Ltd specializes in the custom synthesis and manufacturing of specialty chemicals, serving markets in India, Europe, Japan, Singapore, China, North America, and globally with a market capitalization of approximately ₹86.21 billion.

Operations: The company's revenue from manufacturing industrial chemicals totals ₹14.75 billion.

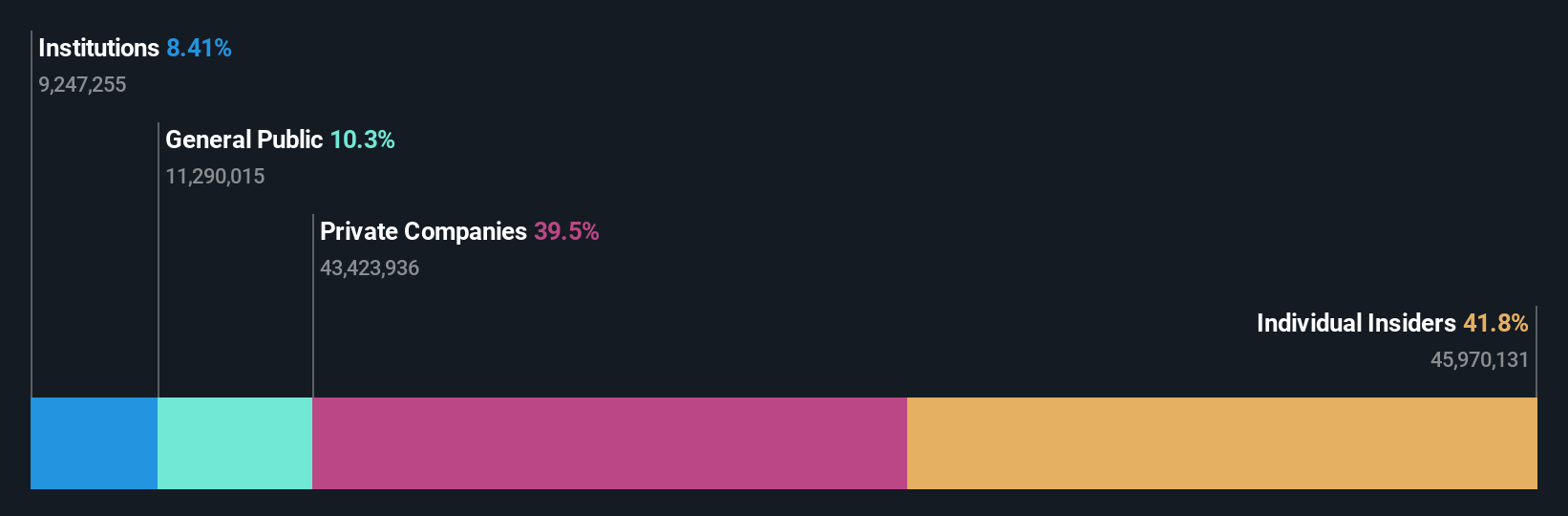

Insider Ownership: 39.6%

Earnings Growth Forecast: 33% p.a.

Anupam Rasayan India Limited, a player in the specialty chemicals sector, has shown a mixed financial performance with recent quarterly earnings showing a decline. Despite this, the company is expected to achieve significant growth with earnings forecasted to grow by 33% annually and revenue by 19% per year, both outpacing the broader Indian market. However, concerns include shareholder dilution over the past year and a forecast of low Return on Equity (11.2%) in three years.

- Get an in-depth perspective on Anupam Rasayan India's performance by reading our analyst estimates report here.

- Our valuation report here indicates Anupam Rasayan India may be overvalued.

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP)

Simply Wall St Growth Rating: ★★★★★☆

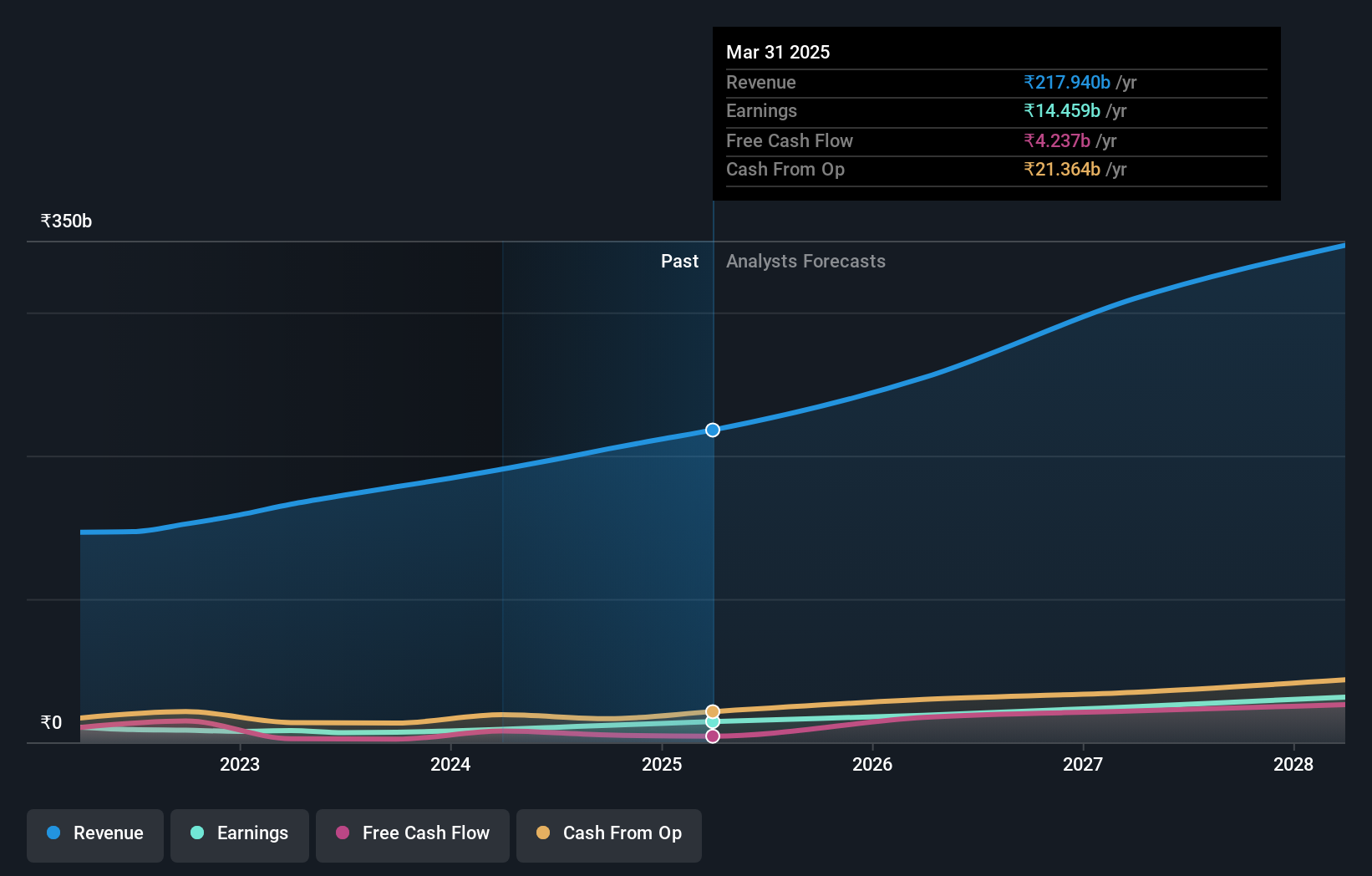

Overview: Apollo Hospitals Enterprise Limited operates a network of hospitals and healthcare services both in India and internationally, with a market capitalization of approximately ₹917.63 billion.

Operations: The company generates revenue primarily through three segments: Healthcare Services (₹99.39 billion), Retail Health & Diagnostics (₹13.64 billion), and Digital Health & Pharmacy Distribution (₹78.27 billion).

Insider Ownership: 10.4%

Earnings Growth Forecast: 33% p.a.

Apollo Hospitals Enterprise, a key entity in India's healthcare sector, shows promise with high insider ownership and robust growth prospects. The company is involved in significant M&A activities, recently expressing interest in acquiring Jaypee Healthcare. Financially, Apollo Hospitals has demonstrated solid performance with a notable increase in annual revenue to ₹191.65 billion and net income of ₹8.99 billion for FY 2024. Despite leadership changes and executive resignations, the firm maintains its growth trajectory with expected earnings growth outpacing the Indian market significantly over the next three years.

- Unlock comprehensive insights into our analysis of Apollo Hospitals Enterprise stock in this growth report.

- According our valuation report, there's an indication that Apollo Hospitals Enterprise's share price might be on the expensive side.

Dodla Dairy (NSEI:DODLA)

Simply Wall St Growth Rating: ★★★★☆☆

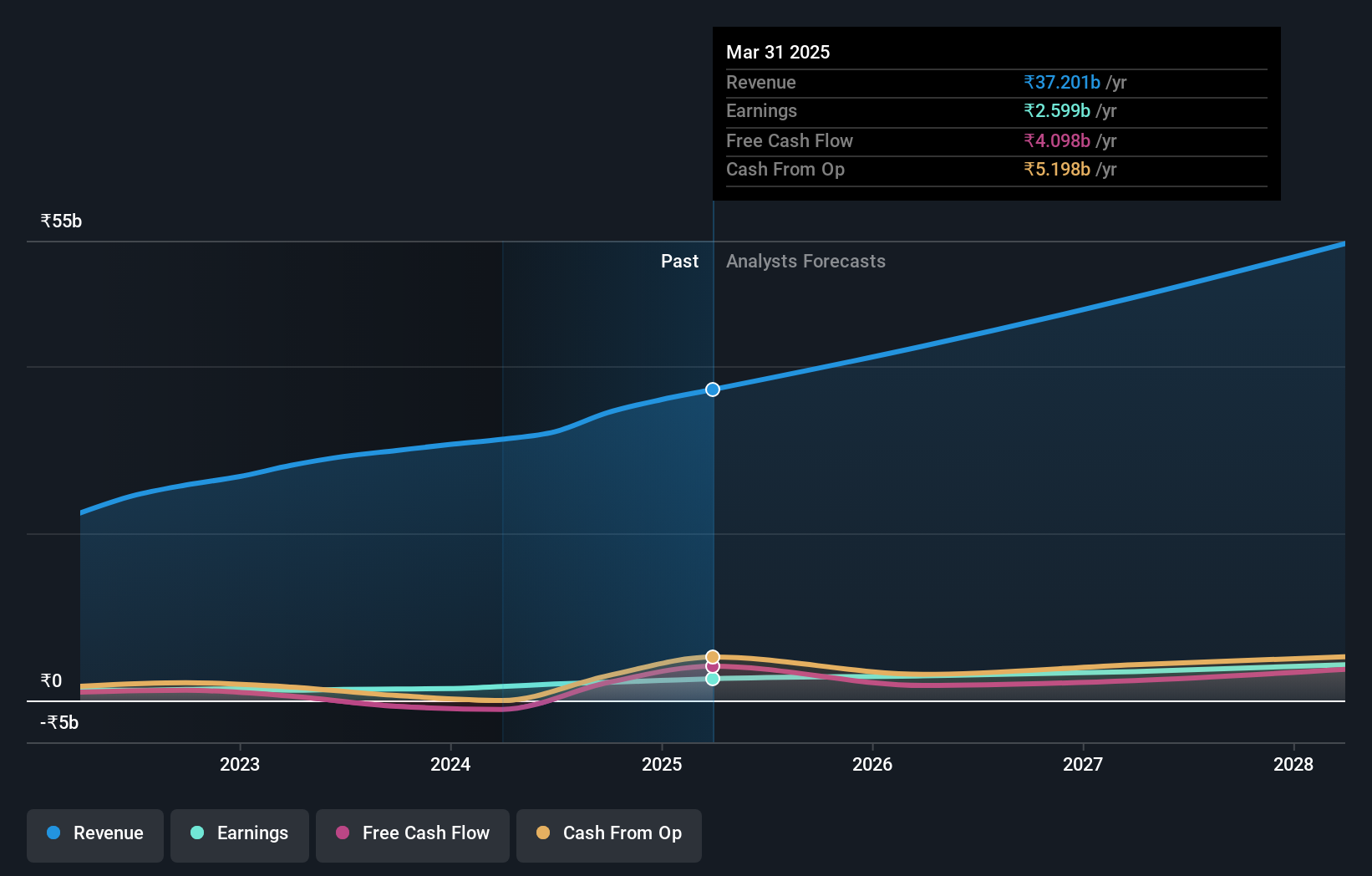

Overview: Dodla Dairy Limited operates in the dairy sector, producing and selling milk and milk products both in India and internationally, with a market capitalization of approximately ₹69.06 billion.

Operations: The company generates ₹31.25 billion in revenue from its milk and milk products segment.

Insider Ownership: 26.7%

Earnings Growth Forecast: 23.9% p.a.

Dodla Dairy Limited, an Indian dairy company, has shown substantial growth with a 36.4% increase in earnings over the past year. Despite no significant insider purchases recently, there has been considerable insider selling. The company’s revenue and earnings are projected to grow at 12.9% and 23.86% per year respectively, outpacing the broader Indian market forecasts of 9.6% and 15.9%. Recent financial results reflect strong performance with a notable jump in quarterly net income from INR 349.71 million to INR 650.24 million.

- Click here and access our complete growth analysis report to understand the dynamics of Dodla Dairy.

- Upon reviewing our latest valuation report, Dodla Dairy's share price might be too optimistic.

Where To Now?

- Click through to start exploring the rest of the 83 Fast Growing Indian Companies With High Insider Ownership now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:DODLA

Dodla Dairy

Engages in the production and sale of milk and milk products in India and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives