- India

- /

- Paper and Forestry Products

- /

- NSEI:AIROLAM

Here's Why We Think Airo Lam (NSE:AIROLAM) Might Deserve Your Attention Today

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Airo Lam (NSE:AIROLAM). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Airo Lam with the means to add long-term value to shareholders.

See our latest analysis for Airo Lam

How Fast Is Airo Lam Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That makes EPS growth an attractive quality for any company. Airo Lam managed to grow EPS by 13% per year, over three years. That's a pretty good rate, if the company can sustain it.

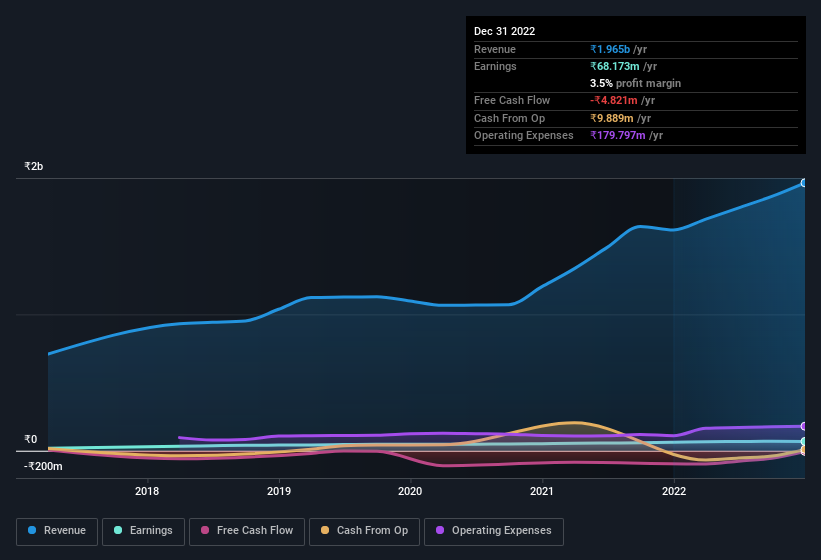

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. EBIT margins for Airo Lam remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 21% to ₹2.0b. That's encouraging news for the company!

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Since Airo Lam is no giant, with a market capitalisation of ₹1.1b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Airo Lam Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

One positive for Airo Lam, is that company insiders spent ₹1.2m acquiring shares in the last year. This might not be a huge sum, but it's well worth noting anyway, given the complete lack of selling. We also note that it was the Non Executive Director, Hardik Kumar Patel, who made the biggest single acquisition, paying ₹218k for shares at about ₹62.42 each.

On top of the insider buying, we can also see that Airo Lam insiders own a large chunk of the company. Owning 46% of the company, insiders have plenty riding on the performance of the the share price. This should be a welcoming sign for investors because it suggests that the people making the decisions are also impacted by their choices. Although, with Airo Lam being valued at ₹1.1b, this is a small company we're talking about. That means insiders only have ₹520m worth of shares, despite the large proportional holding. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Pravin Kumar Patel, is paid less than the median for similar sized companies. The median total compensation for CEOs of companies similar in size to Airo Lam, with market caps under ₹16b is around ₹3.4m.

The CEO of Airo Lam was paid just ₹840k in total compensation for the year ending March 2022. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Airo Lam Worth Keeping An Eye On?

One positive for Airo Lam is that it is growing EPS. That's nice to see. On top of that, we've seen insiders buying shares even though they already own plenty. That should do plenty in prompting budding investors to undertake a bit more research - or even adding the company to their watchlists. Still, you should learn about the 2 warning signs we've spotted with Airo Lam (including 1 which makes us a bit uncomfortable).

The good news is that Airo Lam is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:AIROLAM

Airo Lam

Engages in the production, processing, and marketing of decorative laminate sheets and plywood boards in India.

Slight risk with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives