- India

- /

- Personal Products

- /

- NSEI:GODREJCP

Those who invested in Godrej Consumer Products (NSE:GODREJCP) three years ago are up 79%

Low-cost index funds make it easy to achieve average market returns. But across the board there are plenty of stocks that underperform the market. Unfortunately for shareholders, while the Godrej Consumer Products Limited (NSE:GODREJCP) share price is up 79% in the last three years, that falls short of the market return. On the other hand, the more recent gain of 35% over a year is certainly pleasing.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for Godrej Consumer Products

SWOT Analysis for Godrej Consumer Products

- Debt is not viewed as a risk.

- Earnings declined over the past year.

- Expensive based on P/E ratio and estimated fair value.

- Annual revenue is forecast to grow faster than the Indian market.

- Annual earnings are forecast to grow slower than the Indian market.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

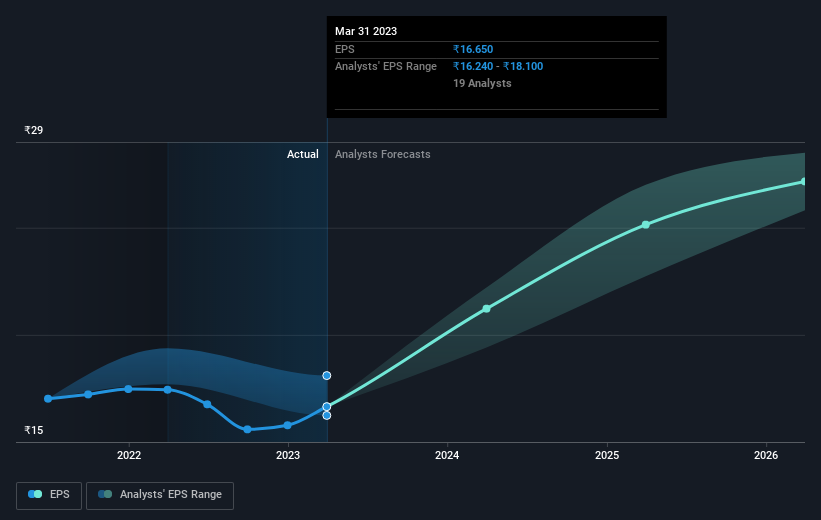

Godrej Consumer Products was able to grow its EPS at 4.4% per year over three years, sending the share price higher. This EPS growth is lower than the 21% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did three years ago. It is quite common to see investors become enamoured with a business, after a few years of solid progress. This optimism is also reflected in the fairly generous P/E ratio of 61.09.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Dive deeper into the earnings by checking this interactive graph of Godrej Consumer Products' earnings, revenue and cash flow.

A Different Perspective

It's good to see that Godrej Consumer Products has rewarded shareholders with a total shareholder return of 35% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 7% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Godrej Consumer Products by clicking this link.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GODREJCP

Godrej Consumer Products

A fast-moving consumer goods company, engages in the manufacture and marketing of personal care and home care products in India, Africa, Indonesia, the Middle East, the United States of America, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives