- India

- /

- Personal Products

- /

- NSEI:GODREJCP

Godrej Consumer Products Limited's (NSE:GODREJCP) Subdued P/S Might Signal An Opportunity

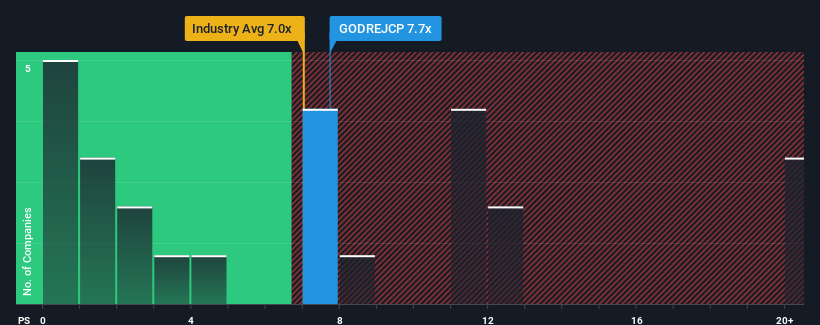

With a median price-to-sales (or "P/S") ratio of close to 7x in the Personal Products industry in India, you could be forgiven for feeling indifferent about Godrej Consumer Products Limited's (NSE:GODREJCP) P/S ratio of 7.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Godrej Consumer Products

What Does Godrej Consumer Products' P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, Godrej Consumer Products has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think Godrej Consumer Products' future stacks up against the industry? In that case, our free report is a great place to start.How Is Godrej Consumer Products' Revenue Growth Trending?

In order to justify its P/S ratio, Godrej Consumer Products would need to produce growth that's similar to the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Regardless, revenue has managed to lift by a handy 19% in aggregate from three years ago, thanks to the earlier period of growth. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 9.4% during the coming year according to the analysts following the company. That's shaping up to be materially higher than the 6.8% growth forecast for the broader industry.

In light of this, it's curious that Godrej Consumer Products' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at Godrej Consumer Products' analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Having said that, be aware Godrej Consumer Products is showing 1 warning sign in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GODREJCP

Godrej Consumer Products

A fast-moving consumer goods company, engages in the manufacture and marketing of personal care and home care products in India, Africa, Indonesia, the Middle East, the United States of America, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives