- India

- /

- Healthcare Services

- /

- NSEI:REMUS

Is Now The Time To Put Remus Pharmaceuticals (NSE:REMUS) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Remus Pharmaceuticals (NSE:REMUS). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Fast Is Remus Pharmaceuticals Growing Its Earnings Per Share?

In the last three years Remus Pharmaceuticals' earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Impressively, Remus Pharmaceuticals' EPS catapulted from ₹29.41 to ₹50.75, over the last year. It's a rarity to see 73% year-on-year growth like that. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

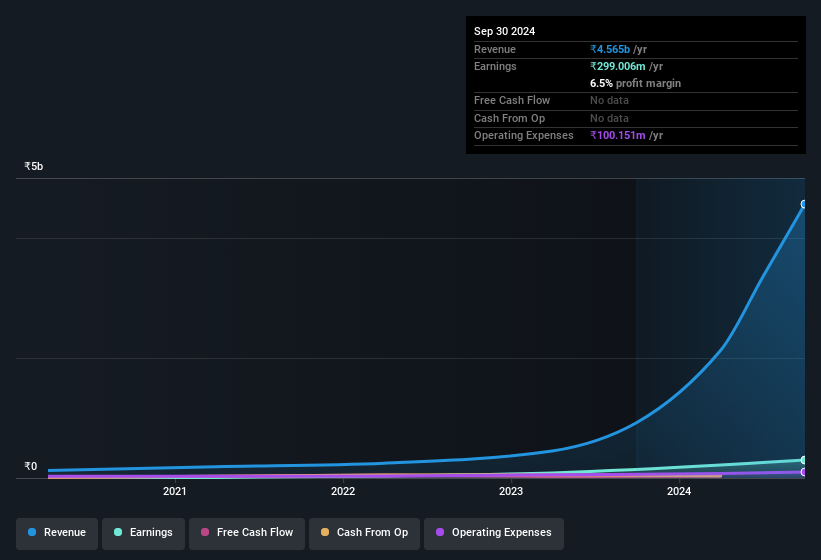

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. On the one hand, Remus Pharmaceuticals' EBIT margins fell over the last year, but on the other hand, revenue grew. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

See our latest analysis for Remus Pharmaceuticals

Since Remus Pharmaceuticals is no giant, with a market capitalisation of ₹13b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Remus Pharmaceuticals Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Our analysis into Remus Pharmaceuticals has shown that insiders have sold ₹2.9m worth of shares over the last 12 months. This falls short of the share acquisition by MD & Director Arpit Shah, who has acquired ₹8.4m worth of shares, at an average price of ₹2,269. So, on balance, that's positive.

These recent buys aren't the only encouraging sign for shareholders, as a look at the shareholder registry for Remus Pharmaceuticals will reveal that insiders own a significant piece of the pie. To be exact, company insiders hold 52% of the company, so their decisions have a significant impact on their investments. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. In terms of absolute value, insiders have ₹6.6b invested in the business, at the current share price. That's nothing to sneeze at!

Is Remus Pharmaceuticals Worth Keeping An Eye On?

Remus Pharmaceuticals' earnings per share growth have been climbing higher at an appreciable rate. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Remus Pharmaceuticals deserves timely attention. We don't want to rain on the parade too much, but we did also find 1 warning sign for Remus Pharmaceuticals that you need to be mindful of.

Keen growth investors love to see insider activity. Thankfully, Remus Pharmaceuticals isn't the only one. You can see a a curated list of Indian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Remus Pharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:REMUS

Remus Pharmaceuticals

Engages in the marketing, trading, and distribution of pharmaceutical finished formulations and products in India and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives