- India

- /

- Medical Equipment

- /

- NSEI:NURECA

Nureca Limited (NSE:NURECA) Stock Rockets 30% As Investors Are Less Pessimistic Than Expected

Nureca Limited (NSE:NURECA) shareholders have had their patience rewarded with a 30% share price jump in the last month. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 2.4% in the last twelve months.

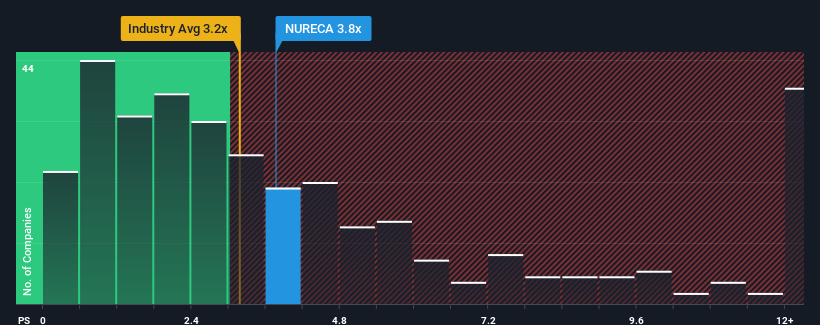

Since its price has surged higher, you could be forgiven for thinking Nureca is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.8x, considering almost half the companies in India's Medical Equipment industry have P/S ratios below 2.2x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Nureca

What Does Nureca's Recent Performance Look Like?

As an illustration, revenue has deteriorated at Nureca over the last year, which is not ideal at all. One possibility is that the P/S is high because investors think the company will still do enough to outperform the broader industry in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Although there are no analyst estimates available for Nureca, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Nureca's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Nureca's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 70% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 20% shows it's an unpleasant look.

With this information, we find it concerning that Nureca is trading at a P/S higher than the industry. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does Nureca's P/S Mean For Investors?

Nureca shares have taken a big step in a northerly direction, but its P/S is elevated as a result. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Nureca currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. When we see revenue heading backwards and underperforming the industry forecasts, we feel the possibility of the share price declining is very real, bringing the P/S back into the realm of reasonability. Should recent medium-term revenue trends persist, it would pose a significant risk to existing shareholders' investments and prospective investors will have a hard time accepting the current value of the stock.

Before you take the next step, you should know about the 3 warning signs for Nureca (1 is significant!) that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Nureca might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NURECA

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives