- India

- /

- Healthcare Services

- /

- NSEI:LALPATHLAB

The Dr. Lal PathLabs (NSE:LALPATHLAB) Share Price Is Up 54% And Shareholders Are Holding On

If you want to compound wealth in the stock market, you can do so by buying an index fund. But you can significantly boost your returns by picking above-average stocks. For example, the Dr. Lal PathLabs Limited (NSE:LALPATHLAB) share price is up 54% in the last year, clearly besting the market return of around 4.7% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! And shareholders have also done well over the long term, with an increase of 44% in the last three years.

View 1 warning sign we detected for Dr. Lal PathLabs

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

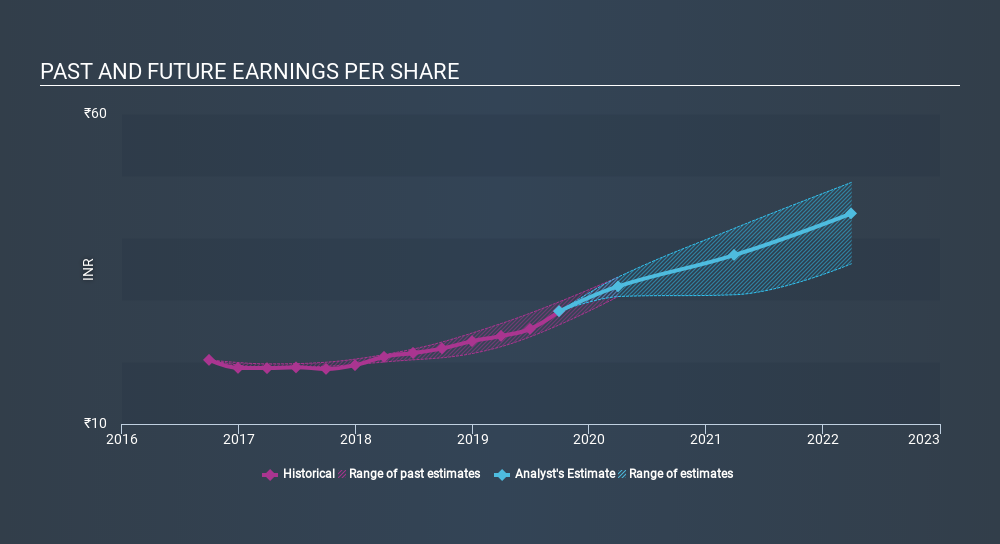

Dr. Lal PathLabs was able to grow EPS by 27% in the last twelve months. This EPS growth is significantly lower than the 54% increase in the share price. This indicates that the market is now more optimistic about the stock. The fairly generous P/E ratio of 52.09 also points to this optimism.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

While the share price will often move with EPS, other factors can also play a role. For example, we've discovered 1 warning sign for Dr. Lal PathLabs which any shareholder or potential investor should be aware of.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Dr. Lal PathLabs's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dr. Lal PathLabs's TSR of 55% for the year exceeded its share price return, because it has paid dividends.

A Different Perspective

We're pleased to report that Dr. Lal PathLabs rewarded shareholders with a total shareholder return of 55% over the last year. That's including the dividend. That gain actually surpasses the 14% TSR it generated (per year) over three years. Given the track record of solid returns over varying time frames, it might be worth putting Dr. Lal PathLabs on your watchlist. Before spending more time on Dr. Lal PathLabs it might be wise to click here to see if insiders have been buying or selling shares.

We will like Dr. Lal PathLabs better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:LALPATHLAB

Dr. Lal PathLabs

Operates laboratories for carrying out pathological investigations in India and internationally.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives