- India

- /

- Basic Materials

- /

- NSEI:BIRLANU

Top Indian Stocks That May Be Trading Below Fair Value Estimates August 2024

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has risen 1.8%, driven by gains of 2.2% in the Financials sector, and is up 46% over the last 12 months. In this thriving environment, identifying stocks trading below their fair value estimates can be a prudent strategy for investors looking to capitalize on potential growth opportunities.

Top 10 Undervalued Stocks Based On Cash Flows In India

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Everest Kanto Cylinder (NSEI:EKC) | ₹192.17 | ₹306.00 | 37.2% |

| Apollo Pipes (BSE:531761) | ₹573.65 | ₹1142.23 | 49.8% |

| RITES (NSEI:RITES) | ₹649.25 | ₹1041.63 | 37.7% |

| Venus Pipes and Tubes (NSEI:VENUSPIPES) | ₹2237.80 | ₹4360.84 | 48.7% |

| IOL Chemicals and Pharmaceuticals (BSE:524164) | ₹449.95 | ₹762.32 | 41% |

| Updater Services (NSEI:UDS) | ₹352.95 | ₹621.86 | 43.2% |

| Prataap Snacks (NSEI:DIAMONDYD) | ₹885.15 | ₹1509.79 | 41.4% |

| Patel Engineering (BSE:531120) | ₹54.06 | ₹91.69 | 41% |

| Mahindra Logistics (NSEI:MAHLOG) | ₹501.25 | ₹995.26 | 49.6% |

| Manorama Industries (BSE:541974) | ₹852.90 | ₹1665.51 | 48.8% |

Let's dive into some prime choices out of the screener.

HIL (NSEI:HIL)

Overview: HIL Limited produces and distributes building materials and other solutions in India and internationally, with a market cap of ₹22.05 billion.

Operations: The company's revenue segments include ₹11.44 billion from Roofing Solutions, ₹11.63 billion from Flooring Solutions, ₹6.10 billion from Polymer Solutions, and ₹5.46 billion from Building Solutions.

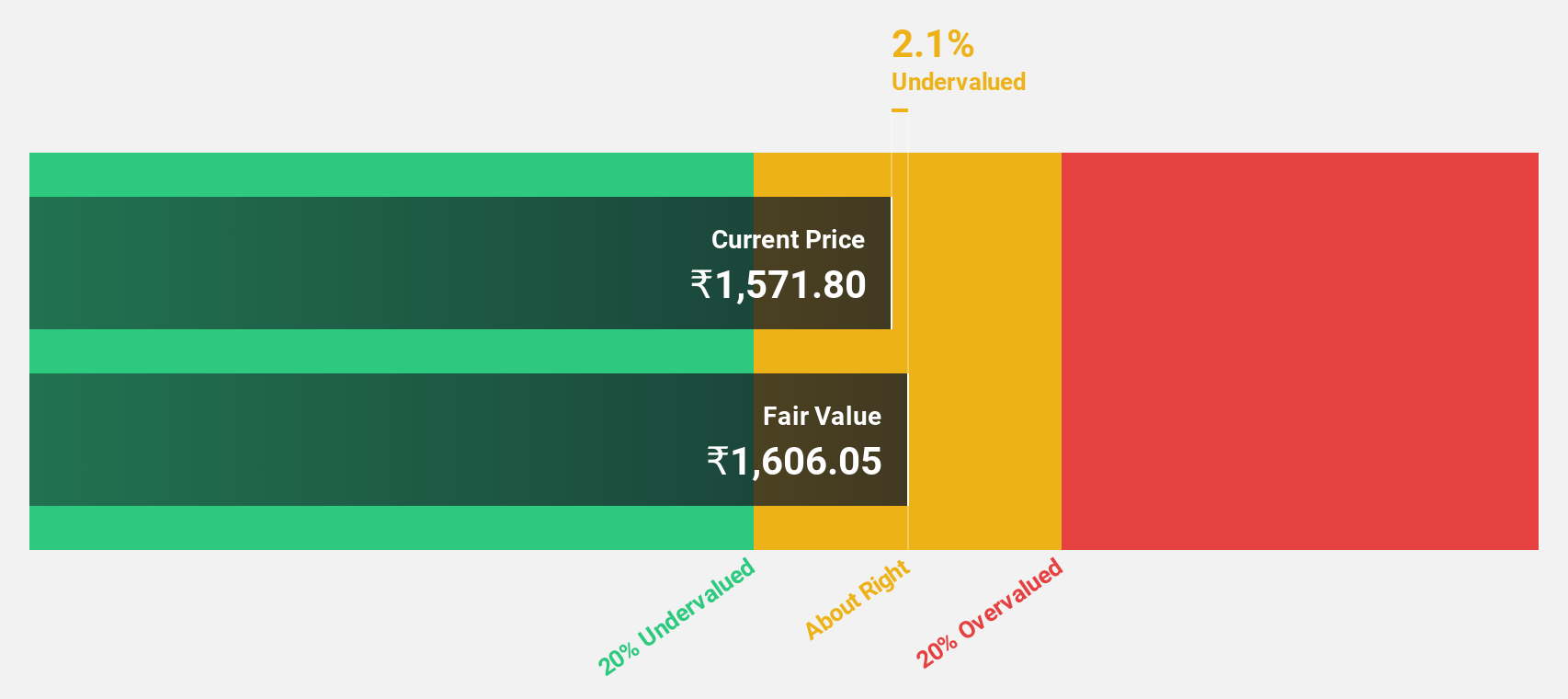

Estimated Discount To Fair Value: 18%

HIL Limited is trading at 18% below its estimated fair value of ₹3563.69, indicating it may be undervalued based on cash flows. Despite a forecasted revenue growth of 11.3% per year, which is above the Indian market average, recent earnings show a significant drop in net income to ₹126.2 million from ₹578.6 million a year ago. The company’s interest payments are not well covered by earnings, and it has an unstable dividend track record.

- Our earnings growth report unveils the potential for significant increases in HIL's future results.

- Unlock comprehensive insights into our analysis of HIL stock in this financial health report.

Krsnaa Diagnostics (NSEI:KRSNAA)

Overview: Krsnaa Diagnostics Limited provides diagnostic services and has a market cap of ₹23.83 billion.

Operations: Krsnaa Diagnostics Limited generates revenue of ₹6.50 billion from its Radiology and Pathology Services segment.

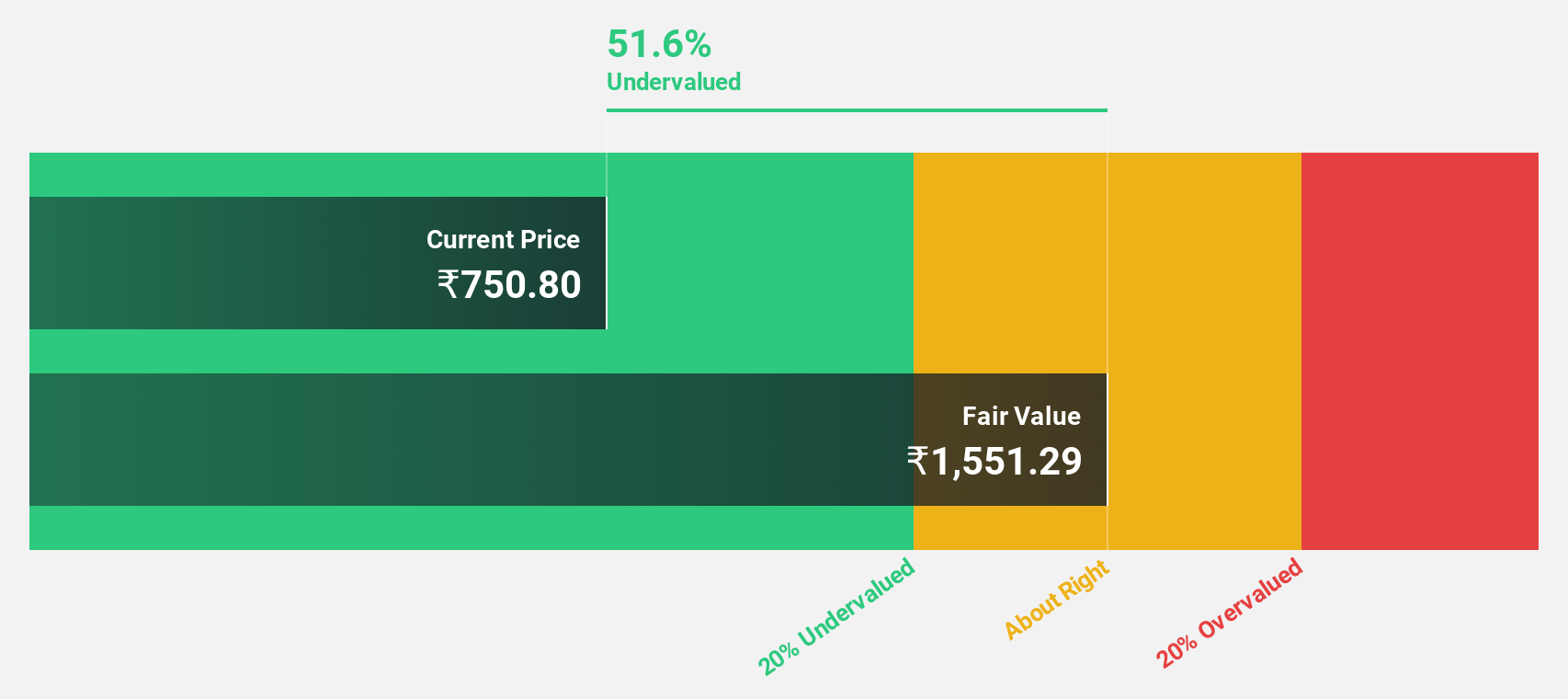

Estimated Discount To Fair Value: 36.7%

Krsnaa Diagnostics (₹738.15) is trading 36.7% below its estimated fair value of ₹1165.33, suggesting it may be undervalued based on cash flows. Earnings are forecast to grow significantly at 36.9% per year, with revenue expected to rise by 24.8% annually, outpacing the Indian market's growth rate. However, recent executive changes and a low dividend yield of 0.34%, not well covered by free cash flows, present some risks for investors.

- Upon reviewing our latest growth report, Krsnaa Diagnostics' projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Krsnaa Diagnostics.

RITES (NSEI:RITES)

Overview: RITES Limited, with a market cap of ₹156.02 billion, provides design, engineering consultancy, and project management services across various sectors including railways, highways, airports, metros, ports, ropeways, urban transport, inland waterways and renewable energy.

Operations: The company's revenue segments include Export Sale (₹699 million), Power Generation (₹177.80 million), Leasing - Domestic (₹1.41 billion), Consultancy - Abroad (₹766.10 million), Consultancy - Domestic (₹11.79 billion), and Turnkey Construction Projects - Domestic (₹9.10 billion).

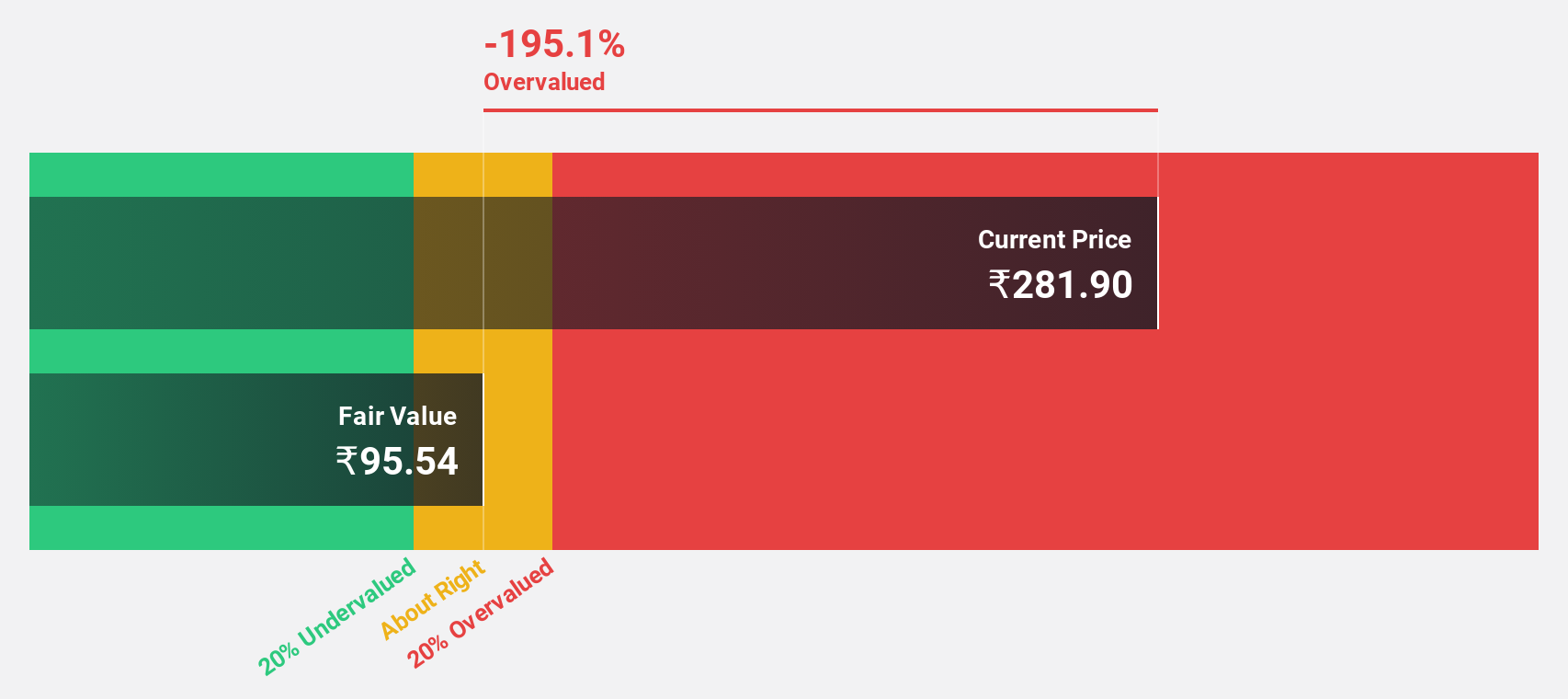

Estimated Discount To Fair Value: 37.7%

RITES (₹649.25) is trading 37.7% below its estimated fair value of ₹1041.63, indicating it may be undervalued based on cash flows. Earnings are forecast to grow at 23.5% annually, outpacing the Indian market's growth rate of 17%. However, a recent Show Cause Notice from the Haryana tax authority could pose potential financial risks, and dividends are not well covered by earnings or free cash flows at a yield of 2.77%.

- Insights from our recent growth report point to a promising forecast for RITES' business outlook.

- Click here to discover the nuances of RITES with our detailed financial health report.

Where To Now?

- Discover the full array of 32 Undervalued Indian Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BirlaNu might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:BIRLANU

BirlaNu

Produces and distributes building materials and other solutions in India and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives