- India

- /

- Healthcare Services

- /

- NSEI:KIMS

There's Reason For Concern Over Krishna Institute of Medical Sciences Limited's (NSE:KIMS) Massive 26% Price Jump

Despite an already strong run, Krishna Institute of Medical Sciences Limited (NSE:KIMS) shares have been powering on, with a gain of 26% in the last thirty days. The last 30 days bring the annual gain to a very sharp 27%.

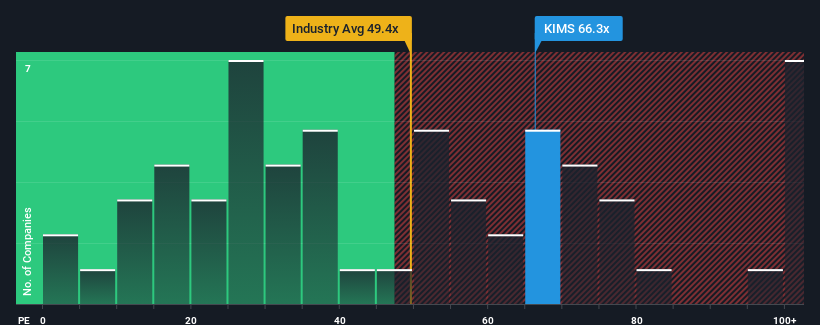

Following the firm bounce in price, Krishna Institute of Medical Sciences' price-to-earnings (or "P/E") ratio of 66.3x might make it look like a strong sell right now compared to the market in India, where around half of the companies have P/E ratios below 34x and even P/E's below 19x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Krishna Institute of Medical Sciences could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

View our latest analysis for Krishna Institute of Medical Sciences

Is There Enough Growth For Krishna Institute of Medical Sciences?

There's an inherent assumption that a company should far outperform the market for P/E ratios like Krishna Institute of Medical Sciences' to be considered reasonable.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 9.0%. This has soured the latest three-year period, which nevertheless managed to deliver a decent 6.9% overall rise in EPS. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 21% per annum as estimated by the twelve analysts watching the company. With the market predicted to deliver 20% growth each year, the company is positioned for a comparable earnings result.

With this information, we find it interesting that Krishna Institute of Medical Sciences is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

The Final Word

Shares in Krishna Institute of Medical Sciences have built up some good momentum lately, which has really inflated its P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Krishna Institute of Medical Sciences currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. When we see an average earnings outlook with market-like growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

You always need to take note of risks, for example - Krishna Institute of Medical Sciences has 1 warning sign we think you should be aware of.

If these risks are making you reconsider your opinion on Krishna Institute of Medical Sciences, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Krishna Institute of Medical Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KIMS

Krishna Institute of Medical Sciences

Provides medical and health care services under the KIMS Hospitals brand in India.

Exceptional growth potential with proven track record.

Market Insights

Community Narratives