Vadilal Industries Limited's (NSE:VADILALIND) Shares Bounce 25% But Its Business Still Trails The Market

Vadilal Industries Limited (NSE:VADILALIND) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.1% in the last twelve months.

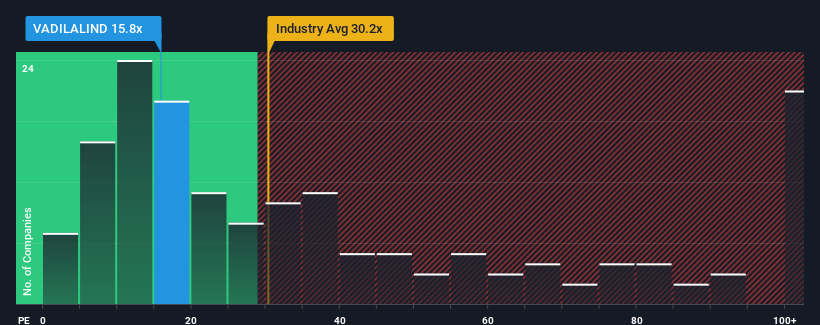

In spite of the firm bounce in price, Vadilal Industries' price-to-earnings (or "P/E") ratio of 15.8x might still make it look like a buy right now compared to the market in India, where around half of the companies have P/E ratios above 32x and even P/E's above 60x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for Vadilal Industries as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Vadilal Industries

How Is Vadilal Industries' Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Vadilal Industries' is when the company's growth is on track to lag the market.

If we review the last year of earnings growth, the company posted a terrific increase of 34%. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 25% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we can see why Vadilal Industries is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the bourse.

What We Can Learn From Vadilal Industries' P/E?

Despite Vadilal Industries' shares building up a head of steam, its P/E still lags most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Vadilal Industries revealed its three-year earnings trends are contributing to its low P/E, given they look worse than current market expectations. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Vadilal Industries with six simple checks on some of these key factors.

If you're unsure about the strength of Vadilal Industries' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:VADILALIND

Vadilal Industries

Manufactures and sells ice-cream in India and internationally.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives