These 4 Measures Indicate That Uttam Sugar Mills (NSE:UTTAMSUGAR) Is Using Debt Extensively

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. Importantly, Uttam Sugar Mills Limited (NSE:UTTAMSUGAR) does carry debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Uttam Sugar Mills

What Is Uttam Sugar Mills's Net Debt?

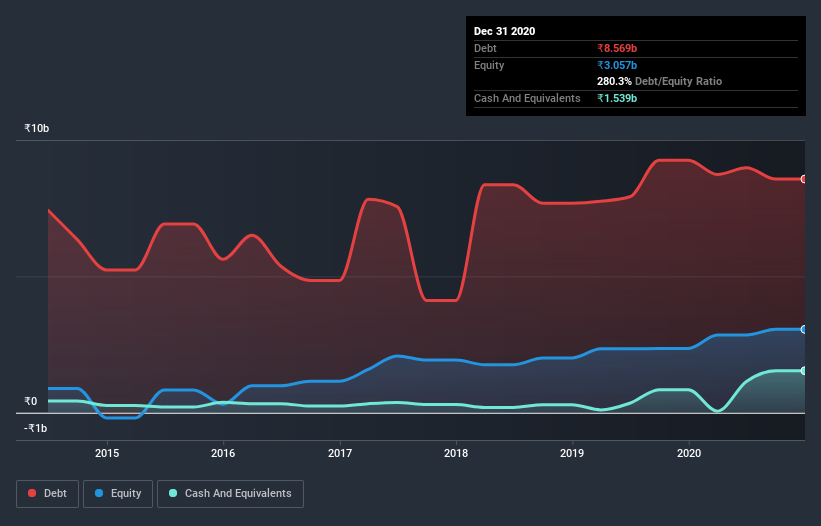

You can click the graphic below for the historical numbers, but it shows that Uttam Sugar Mills had ₹8.56b of debt in September 2020, down from ₹9.26b, one year before. On the flip side, it has ₹1.54b in cash leading to net debt of about ₹7.02b.

How Strong Is Uttam Sugar Mills' Balance Sheet?

The latest balance sheet data shows that Uttam Sugar Mills had liabilities of ₹9.16b due within a year, and liabilities of ₹3.11b falling due after that. Offsetting this, it had ₹1.54b in cash and ₹437.0m in receivables that were due within 12 months. So its liabilities total ₹10.3b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the ₹3.50b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, Uttam Sugar Mills would likely require a major re-capitalisation if it had to pay its creditors today.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Uttam Sugar Mills has a debt to EBITDA ratio of 3.3 and its EBIT covered its interest expense 2.5 times. Taken together this implies that, while we wouldn't want to see debt levels rise, we think it can handle its current leverage. The good news is that Uttam Sugar Mills grew its EBIT a smooth 32% over the last twelve months. Like the milk of human kindness that sort of growth increases resilience, making the company more capable of managing debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Uttam Sugar Mills's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Uttam Sugar Mills produced sturdy free cash flow equating to 53% of its EBIT, about what we'd expect. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Our View

Mulling over Uttam Sugar Mills's attempt at staying on top of its total liabilities, we're certainly not enthusiastic. But at least it's pretty decent at growing its EBIT; that's encouraging. Once we consider all the factors above, together, it seems to us that Uttam Sugar Mills's debt is making it a bit risky. Some people like that sort of risk, but we're mindful of the potential pitfalls, so we'd probably prefer it carry less debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for Uttam Sugar Mills (1 is a bit concerning!) that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading Uttam Sugar Mills or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:UTTAMSUGAR

Uttam Sugar Mills

Manufactures and sells sugar products under the Uttam brand in India and internationally.

Good value with adequate balance sheet.

Market Insights

Community Narratives