Radico Khaitan Limited's (NSE:RADICO) Popularity With Investors Is Under Threat From Overpricing

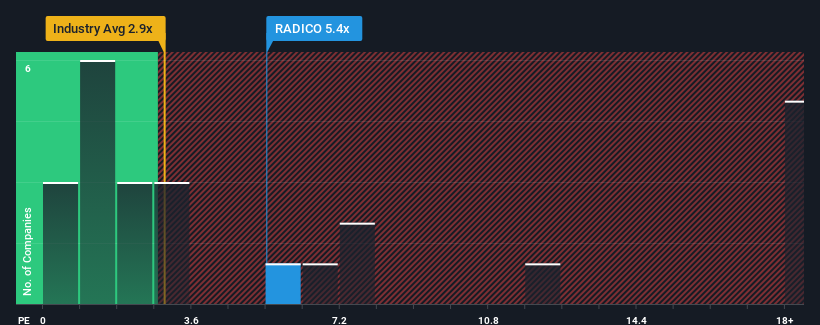

When close to half the companies in the Beverage industry in India have price-to-sales ratios (or "P/S") below 2.9x, you may consider Radico Khaitan Limited (NSE:RADICO) as a stock to avoid entirely with its 5.4x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Radico Khaitan

How Has Radico Khaitan Performed Recently?

Radico Khaitan certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Radico Khaitan will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Radico Khaitan?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Radico Khaitan's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 31% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 72% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 14% per year during the coming three years according to the eight analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 17% each year, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that Radico Khaitan's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've concluded that Radico Khaitan currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Radico Khaitan with six simple checks will allow you to discover any risks that could be an issue.

If these risks are making you reconsider your opinion on Radico Khaitan, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:RADICO

Radico Khaitan

Engages in the manufacture and trading of Indian made foreign liquor (IMFL) and country liquor in India, the United States, and internationally.

Flawless balance sheet with high growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives