United Spirits' (NSE:MCDOWELL-N) Stock Price Has Reduced 12% In The Past Three Years

Many investors define successful investing as beating the market average over the long term. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term United Spirits Limited (NSE:MCDOWELL-N) shareholders, since the share price is down 12% in the last three years, falling well short of the market return of around 27%. It's down 3.1% in the last seven days.

View our latest analysis for United Spirits

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

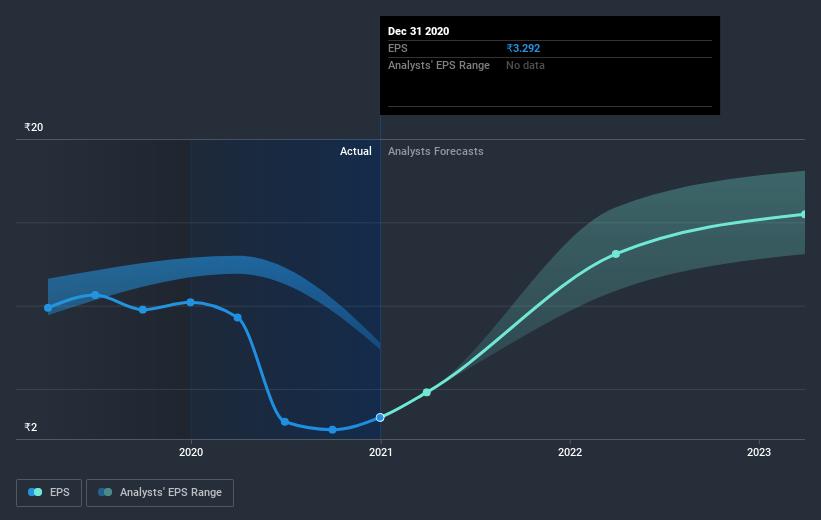

United Spirits saw its EPS decline at a compound rate of 28% per year, over the last three years. This fall in the EPS is worse than the 4% compound annual share price fall. So, despite the prior disappointment, shareholders must have some confidence the situation will improve, longer term. This positive sentiment is also reflected in the generous P/E ratio of 162.80.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into United Spirits' key metrics by checking this interactive graph of United Spirits's earnings, revenue and cash flow.

A Different Perspective

United Spirits shareholders are up 7.3% for the year. But that was short of the market average. On the bright side, that's still a gain, and it's actually better than the average return of 0.5% over half a decade It is possible that returns will improve along with the business fundamentals. It's always interesting to track share price performance over the longer term. But to understand United Spirits better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for United Spirits (of which 1 makes us a bit uncomfortable!) you should know about.

Of course United Spirits may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you’re looking to trade United Spirits, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:UNITDSPR

United Spirits

Engages in the manufacture, sale, and distribution of alcoholic beverages and other allied spirits in India and internationally.

Flawless balance sheet with reasonable growth potential.