- China

- /

- Electronic Equipment and Components

- /

- SZSE:301628

Unearthing Undiscovered Gems with Promising Potential This October 2024

Reviewed by Simply Wall St

Amidst rising U.S. Treasury yields and a cautious economic outlook, small-cap stocks have faced increased pressure, as evidenced by the recent performance of indices like the S&P MidCap 400 and Russell 2000. However, in this challenging environment, identifying lesser-known stocks with strong fundamentals and growth potential can offer unique opportunities for investors seeking to navigate these market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Etihad Atheeb Telecommunication | NA | 26.82% | 62.18% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| ZHEJIANG DIBAY ELECTRICLtd | 24.08% | 7.75% | 1.96% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Zahrat Al Waha For Trading | 80.05% | 4.97% | -15.99% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

LT Foods (NSEI:LTFOODS)

Simply Wall St Value Rating: ★★★★★★

Overview: LT Foods Limited is involved in the milling, processing, and marketing of branded and non-branded basmati rice and rice food products in India, with a market capitalization of ₹131.59 billion.

Operations: LT Foods generates revenue primarily from the manufacture and storage of rice, amounting to ₹82.53 billion.

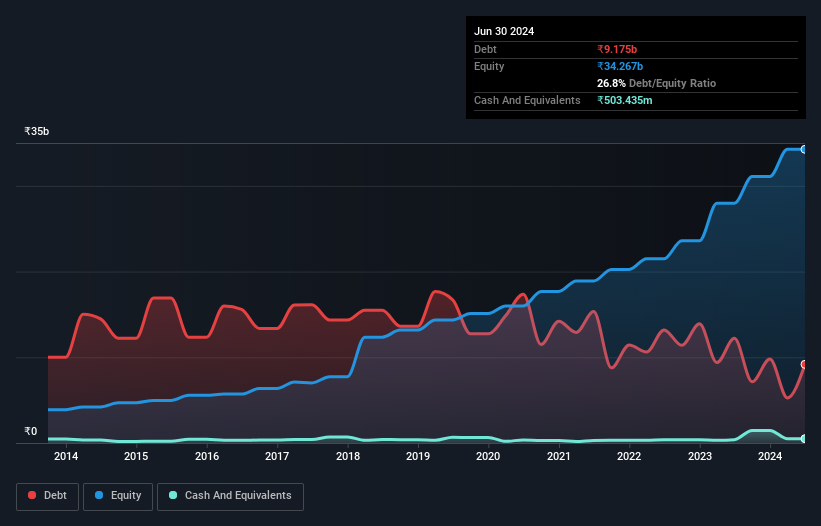

LT Foods, a notable player in the food industry, has seen its debt to equity ratio drop significantly from 84.3% to 22% over five years, indicating improved financial health. Its earnings have grown at an impressive annual rate of 26.6%, showcasing robust performance despite not outpacing the broader food industry. The company offers good value with a price-to-earnings ratio of 22.5x, lower than the Indian market average of 32.2x, and maintains high-quality earnings with satisfactory net debt levels at 14.7%. Recent regulatory challenges may impact operations but seem manageable given their financial standing and profitability trajectory.

- Take a closer look at LT Foods' potential here in our health report.

Gain insights into LT Foods' historical performance by reviewing our past performance report.

Zhejiang Chinastars New Materials Group (SZSE:301077)

Simply Wall St Value Rating: ★★★★★☆

Overview: Zhejiang Chinastars New Materials Group Co., Ltd. operates in the new materials industry and has a market capitalization of CN¥2.95 billion.

Operations: The company generates revenue primarily from its operations in the new materials industry. It has a market capitalization of CN¥2.95 billion, indicating its valuation in the stock market.

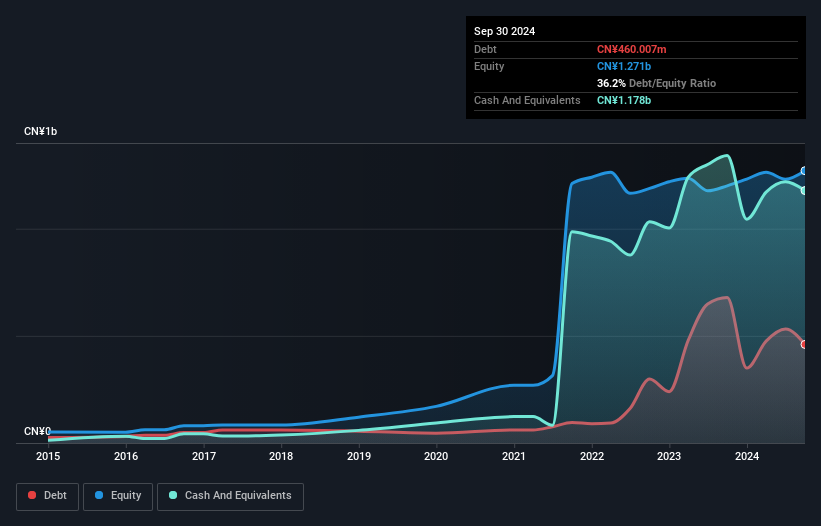

Zhejiang Chinastars New Materials Group, a relatively small player in its sector, has shown impressive financial performance. Over the past year, earnings surged by 47.7%, significantly outpacing the Luxury industry's growth of 5.7%. The company's price-to-earnings ratio stands at 25.3x, which is lower than the CN market average of 34x, suggesting potential undervaluation. With net income climbing to CNY 105.93 million for the first nine months of this year from CNY 63.46 million last year and basic earnings per share rising to CNY 0.88 from CNY 0.53, it seems poised for continued robust performance amidst strategic expansions and leadership changes approved recently.

Shenzhen Q&D Circuits (SZSE:301628)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shenzhen Q&D Circuits Co., Ltd. specializes in the manufacturing and distribution of electronic components, with a market cap of CN¥2.12 billion.

Operations: Q&D Circuits generates revenue primarily from the sale of electronic components. The company's financial performance is highlighted by its market capitalization of CN¥2.12 billion, reflecting its standing in the industry.

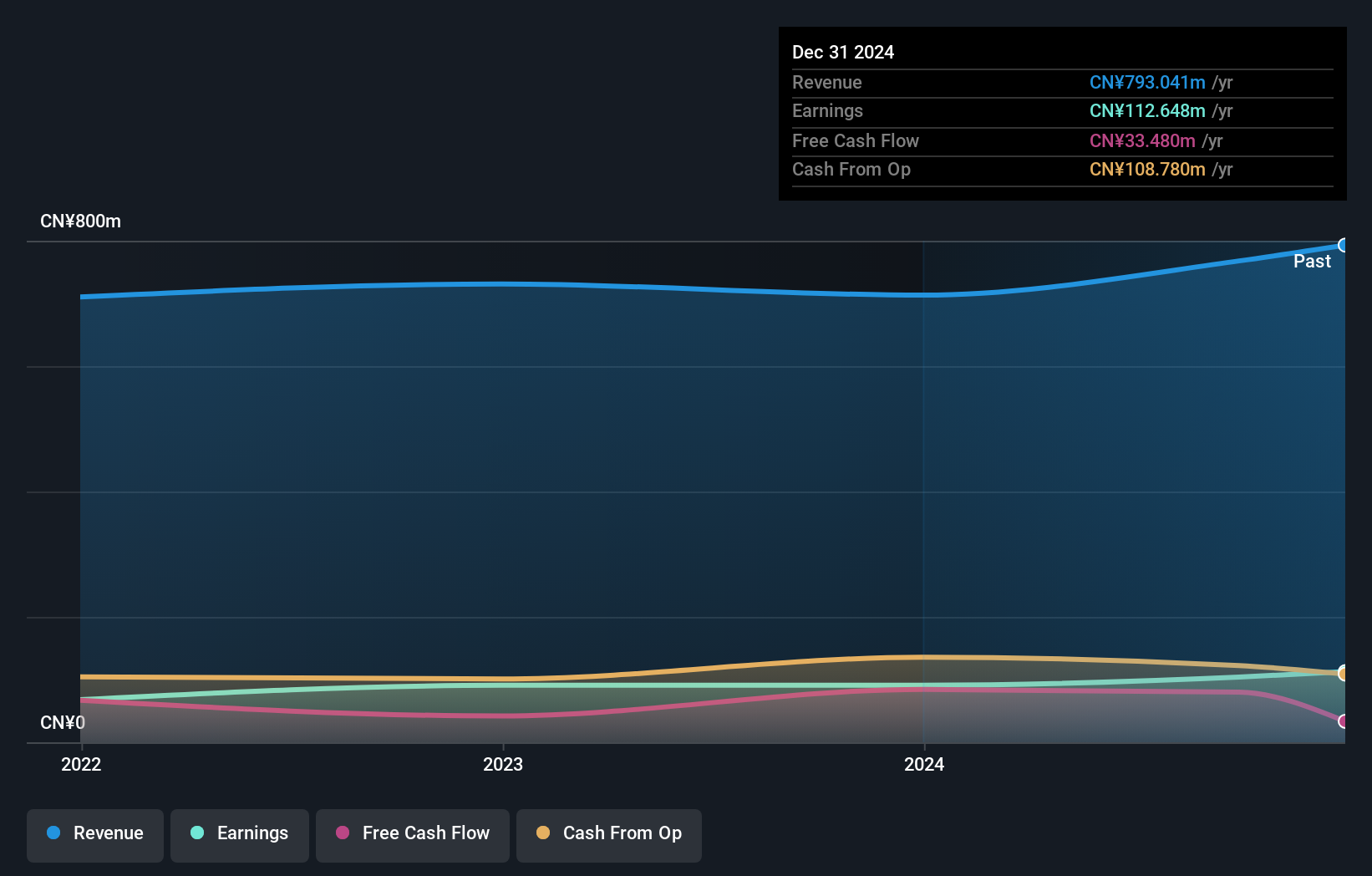

In the bustling world of electronics, Shenzhen Q&D Circuits stands out with its recent IPO raising CNY 531.02 million, signaling strong market interest. The company reported a net income of CNY 79.66 million for the first nine months of 2024, up from CNY 66.74 million the previous year, showcasing notable earnings growth. This growth rate surpasses industry averages with a solid earnings increase of 14.2%. Despite its illiquid shares, Q&D Circuits' inclusion in major indices like the Shenzhen Stock Exchange A Share Index enhances its visibility and potential appeal to investors seeking promising opportunities in this sector.

- Get an in-depth perspective on Shenzhen Q&D Circuits' performance by reading our health report here.

Gain insights into Shenzhen Q&D Circuits' past trends and performance with our Past report.

Key Takeaways

- Click through to start exploring the rest of the 4732 Undiscovered Gems With Strong Fundamentals now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301628

Shenzhen Q&D Circuits

Manufactures and distributes electronic components.

Excellent balance sheet with proven track record.