- China

- /

- Electrical

- /

- SHSE:600261

3 Penny Stocks With Market Caps Over US$200M Worth Considering

Reviewed by Simply Wall St

As global markets experience a mixed bag of results, with U.S. consumer confidence dipping and major indices showing moderate gains, investors are keenly observing potential opportunities in various sectors. Penny stocks, despite their somewhat outdated label, continue to intrigue investors due to their potential for significant growth at lower price points. These stocks often represent smaller or newer companies that can offer unique value propositions when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.14B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.895 | MYR297.09M | ★★★★★★ |

| MGB Berhad (KLSE:MGB) | MYR0.73 | MYR431.91M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.03 | HK$44.38B | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.955 | £490.66M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.928 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.60 | £68.66M | ★★★★☆☆ |

Click here to see the full list of 5,823 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Zhejiang Yankon Group (SHSE:600261)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhejiang Yankon Group Co., Ltd. focuses on the research, development, production, and sales of lighting appliances in China with a market capitalization of CN¥4.47 billion.

Operations: The company generates its revenue primarily from the Lighting and Electrical Industry, amounting to CN¥3.22 billion.

Market Cap: CN¥4.47B

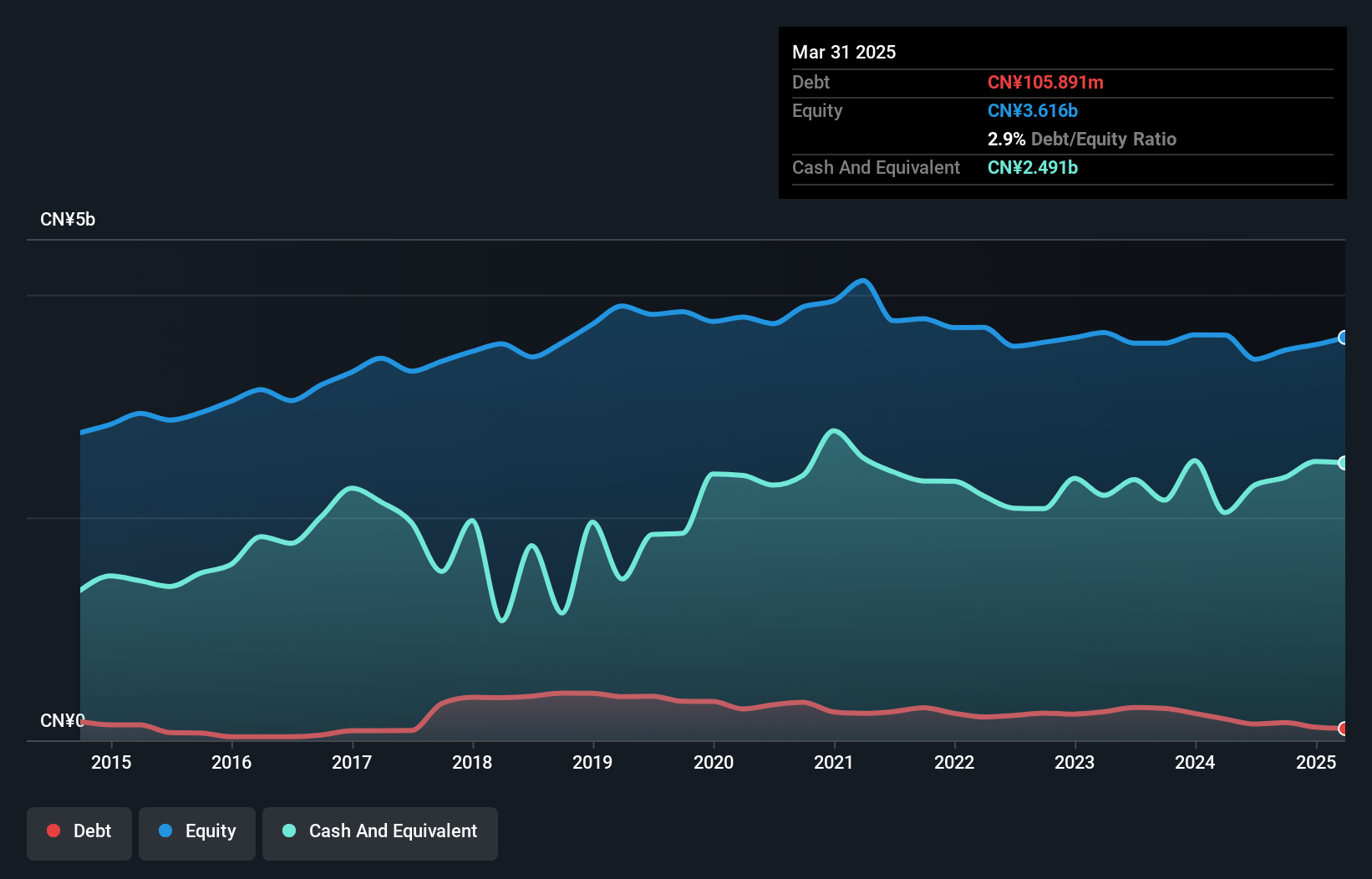

Zhejiang Yankon Group has shown improvement in financial stability, with a reduced debt-to-equity ratio from 9.1% to 4.5% over five years and operating cash flow well covering its debt. Recent earnings growth of 13.3% surpasses the Electrical industry average, though long-term profit trends remain negative with a decline of 25.6% per year over five years. The company’s net profit margin improved slightly to 6.9%, and it trades below estimated fair value by 16.6%. However, earnings have been influenced by significant one-off gains, and the board's short tenure suggests recent changes in governance structure.

- Click here to discover the nuances of Zhejiang Yankon Group with our detailed analytical financial health report.

- Evaluate Zhejiang Yankon Group's historical performance by accessing our past performance report.

Liaoning SG Automotive Group (SHSE:600303)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Liaoning SG Automotive Group Co., Ltd. manufactures and sells automobiles, axles, and other auto parts in China with a market cap of CN¥2.01 billion.

Operations: No specific revenue segments are reported for the company.

Market Cap: CN¥2.01B

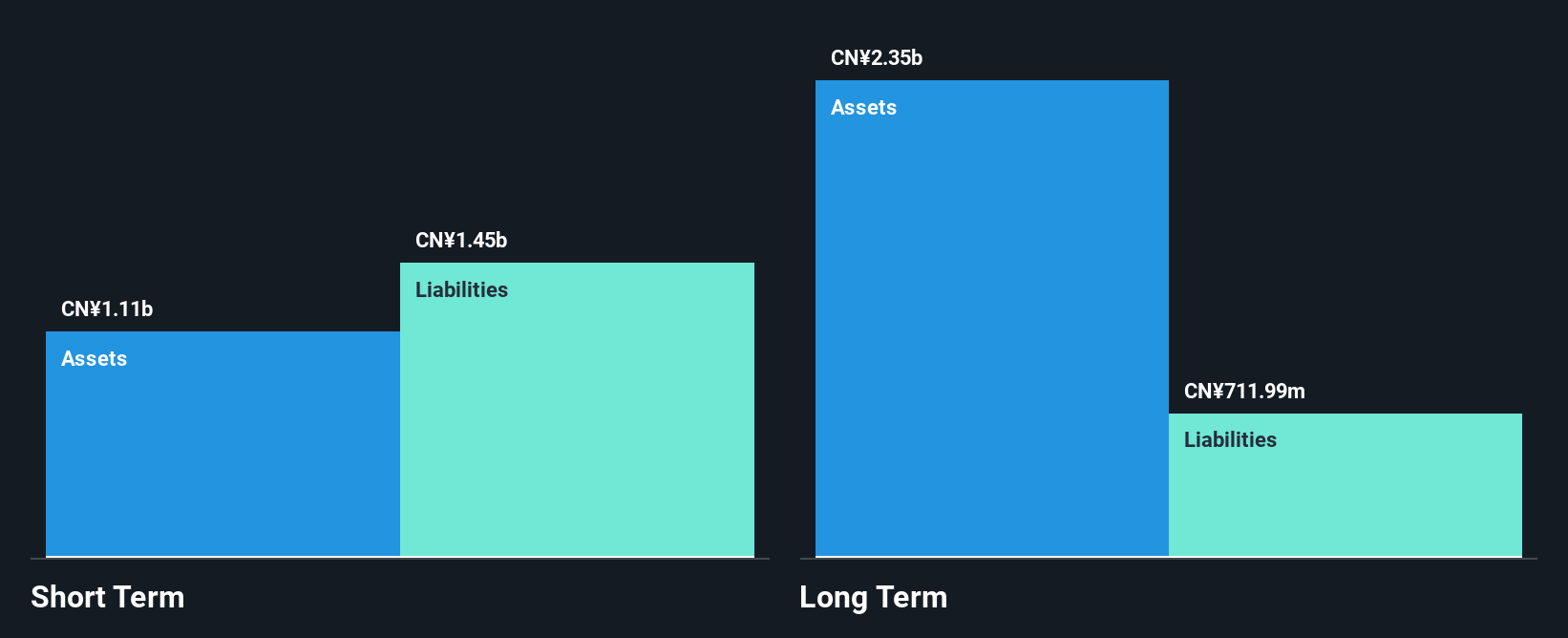

Liaoning SG Automotive Group's recent financial performance highlights challenges typical of penny stocks, with a net loss of CN¥223.66 million for the first nine months of 2024 and ongoing unprofitability. Despite this, the company has maintained stable weekly volatility and avoided significant shareholder dilution over the past year. Short-term assets of CN¥1.1 billion fall short against liabilities, yet they cover long-term obligations comfortably. The company's board is relatively new, indicating potential shifts in strategic direction. Recent capital raised through a private placement could bolster its cash runway beyond current forecasts but requires regulatory approvals to proceed further.

- Jump into the full analysis health report here for a deeper understanding of Liaoning SG Automotive Group.

- Explore historical data to track Liaoning SG Automotive Group's performance over time in our past results report.

Guangdong Jialong Food (SZSE:002495)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guangdong Jialong Food Co., Ltd. researches, develops, produces, and sells food products in China with a market cap of CN¥2.43 billion.

Operations: The company generates revenue primarily from its operations in China, amounting to CN¥241.98 million.

Market Cap: CN¥2.43B

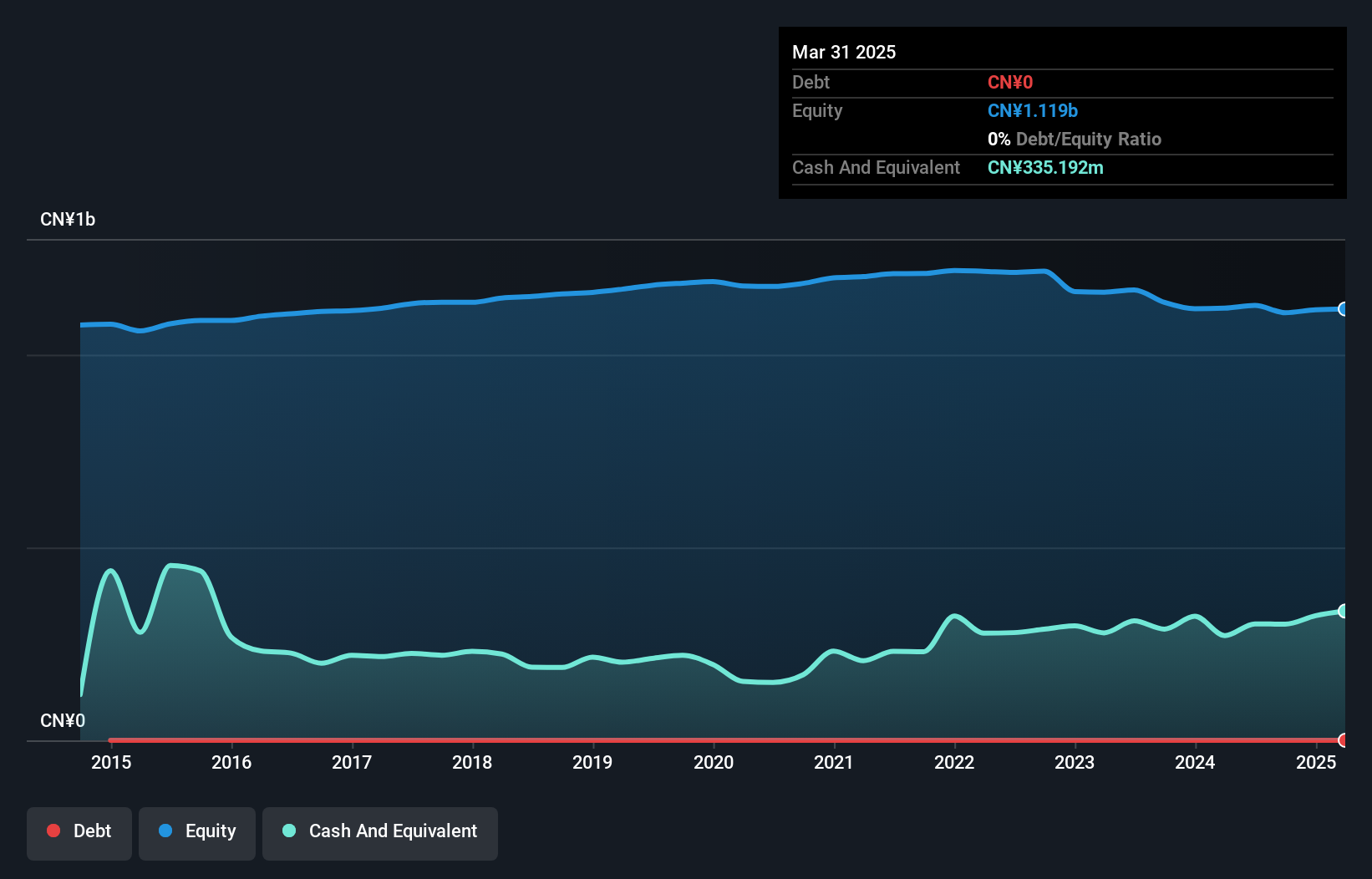

Guangdong Jialong Food's recent performance reflects some typical characteristics of penny stocks, with a reported net income of CN¥15.9 million for the first nine months of 2024, a turnaround from last year's net loss. The company has completed a share buyback, repurchasing 18 million shares for CN¥26.69 million, indicating confidence in its valuation. Despite being unprofitable over the past five years with declining earnings growth and negative return on equity, Guangdong Jialong Food benefits from strong liquidity as short-term assets significantly exceed both short- and long-term liabilities. The experienced board may provide stability amid volatility concerns.

- Unlock comprehensive insights into our analysis of Guangdong Jialong Food stock in this financial health report.

- Gain insights into Guangdong Jialong Food's past trends and performance with our report on the company's historical track record.

Taking Advantage

- Unlock more gems! Our Penny Stocks screener has unearthed 5,820 more companies for you to explore.Click here to unveil our expertly curated list of 5,823 Penny Stocks.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Yankon Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600261

Zhejiang Yankon Group

Engages in the research and development, production, and sales of lighting appliances in China.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives