- China

- /

- Aerospace & Defense

- /

- SZSE:300722

Undiscovered Gems With Promising Potential To Explore This December 2024

Reviewed by Simply Wall St

As December 2024 unfolds, global markets are navigating a landscape marked by fluctuating consumer confidence and mixed economic indicators, with U.S. stocks experiencing moderate gains despite a dip in consumer sentiment. Amid these dynamics, the search for promising opportunities in small-cap stocks becomes increasingly relevant, as investors look to uncover potential growth stories that align with current market conditions. Identifying such gems often involves assessing companies with strong fundamentals and resilience in volatile environments, making them well-suited to withstand economic uncertainties and capitalize on emerging trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Philippine Savings Bank | NA | 5.49% | 20.73% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Formula Systems (1985) | 37.70% | 9.99% | 13.08% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Likhami Consulting | NA | 1.68% | -12.74% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Y.D. More Investments | 69.32% | 30.27% | 27.89% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Dogu Aras Enerji Yatirimlari (IBSE:ARASE)

Simply Wall St Value Rating: ★★★★☆☆

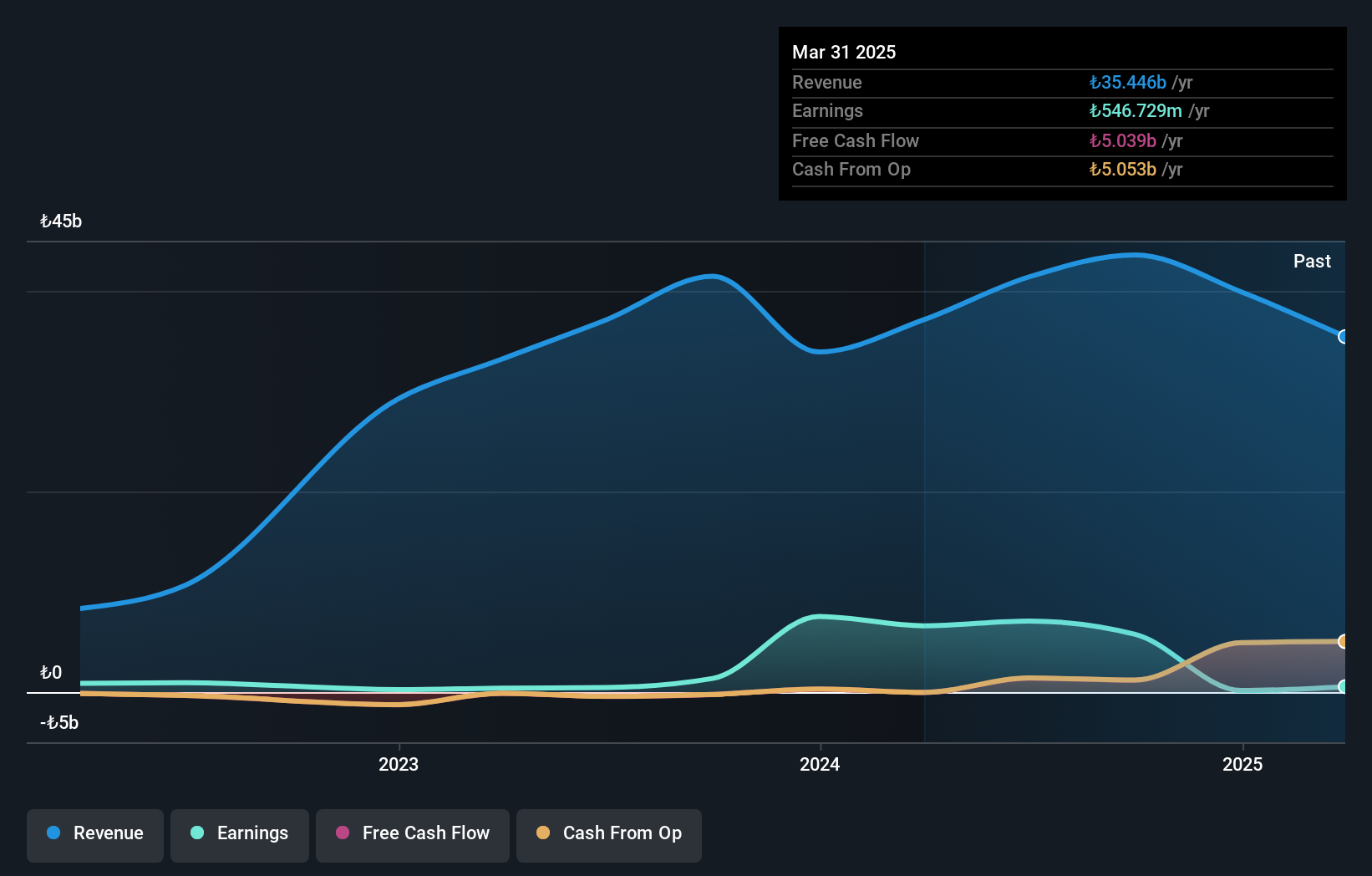

Overview: Dogu Aras Enerji Yatirimlari AS operates in Turkey through its subsidiaries, focusing on the retail sale and distribution of electricity, with a market capitalization of TRY13.26 billion.

Operations: Dogu Aras Enerji Yatirimlari generates revenue primarily through retail electricity sales and electricity distribution, with the former contributing TRY23.31 billion and the latter TRY9.39 billion. The company's financial performance is influenced by these core activities, which together form the bulk of its revenue streams.

Dogu Aras Enerji Yatirimlari, a small-cap player in the energy sector, recently showcased mixed financial results. Despite reporting a net loss of TRY 340.7 million for Q3 2024, sales jumped to TRY 10.16 billion from TRY 7.98 billion the previous year. The company's price-to-earnings ratio stands at an attractive 3.9x compared to the market's 15.9x, indicating potential value for investors seeking undervalued opportunities. Moreover, its net debt to equity ratio is a satisfactory 15%, suggesting manageable leverage levels while earnings growth over the past year outpaced industry norms significantly at 156%.

Bosun (SZSE:002282)

Simply Wall St Value Rating: ★★★★★★

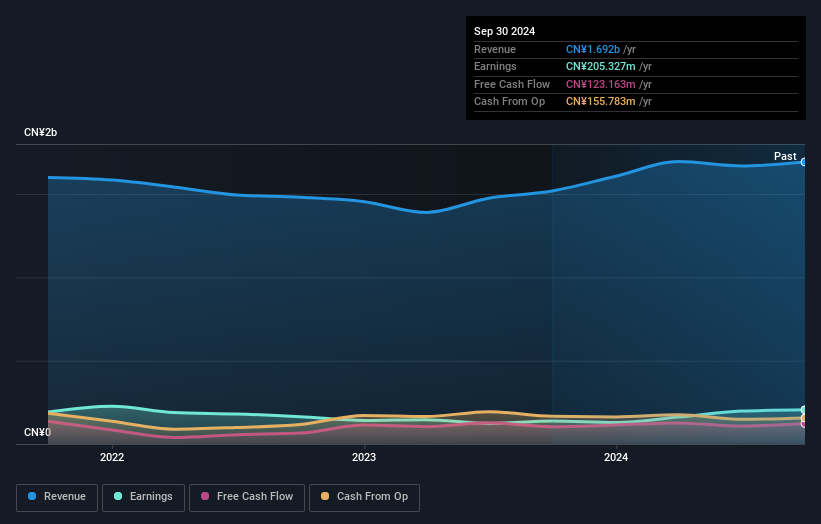

Overview: Bosun Co., Ltd. is engaged in the research, manufacturing, and sales of diamond tools both within China and internationally, with a market cap of CN¥3.98 billion.

Operations: Bosun generates revenue primarily from the sale of diamond tools. The company's financial performance includes a notable net profit margin trend, which provides insight into its profitability.

Bosun, known for its robust earnings quality, has demonstrated significant financial strength with a 49% earnings growth over the past year, outpacing the Machinery industry's -0.06%. The company is debt-free now compared to a 10.7% debt-to-equity ratio five years ago, highlighting its improved financial health. With a price-to-earnings ratio of 19.4x below the CN market average of 36.1x, Bosun seems attractively valued. Recent results show sales climbing to ¥1.25 billion from ¥1.16 billion and net income reaching ¥164 million from ¥88 million last year, indicating strong operational performance and potential for future growth in its sector.

- Navigate through the intricacies of Bosun with our comprehensive health report here.

Understand Bosun's track record by examining our Past report.

Jiangxi Xinyu Guoke Technology (SZSE:300722)

Simply Wall St Value Rating: ★★★★★★

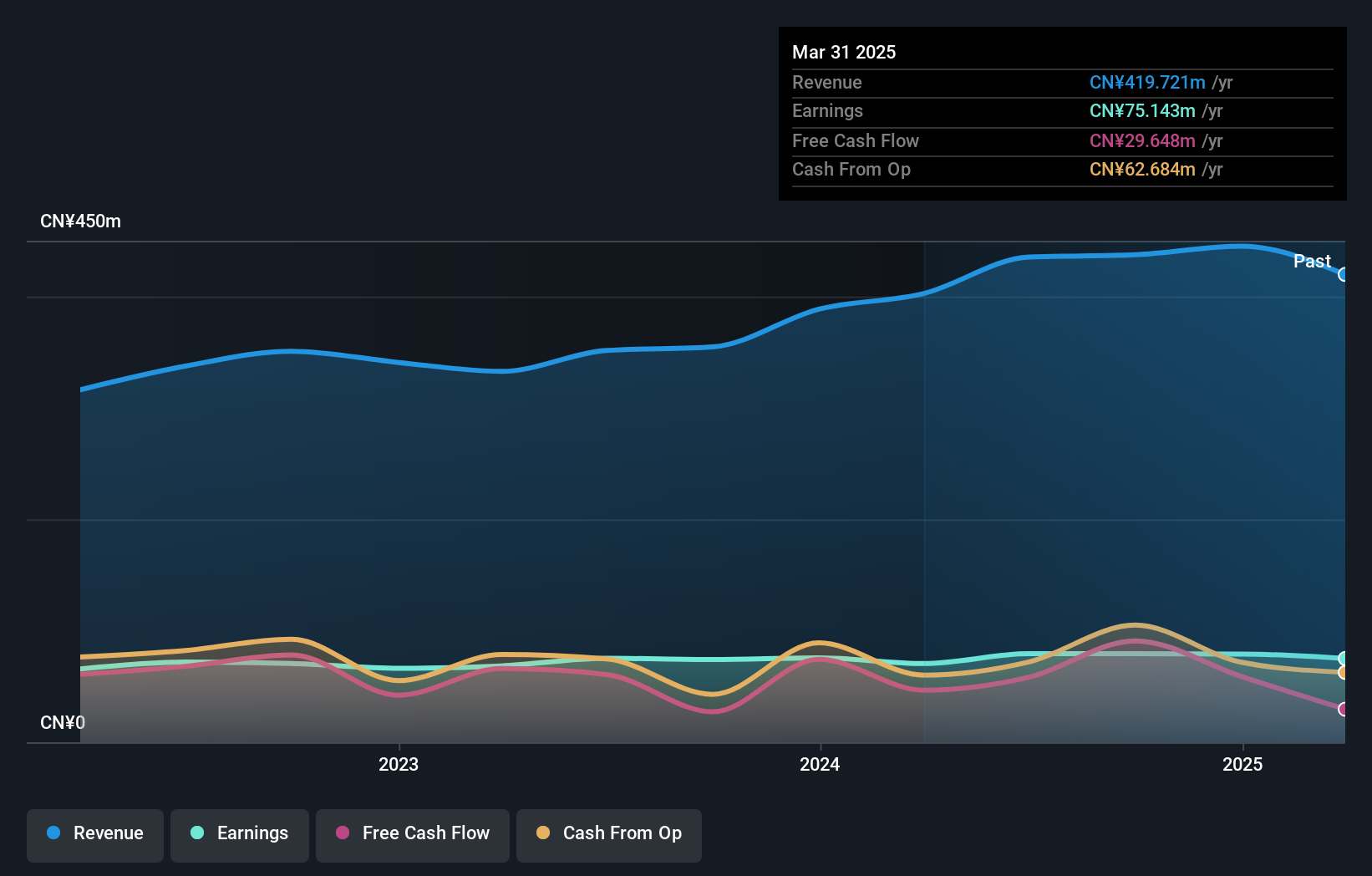

Overview: Jiangxi Xinyu Guoke Technology Co., Ltd specializes in the manufacturing and sale of military products, with a market cap of CN¥7.79 billion.

Operations: The company generates its revenue primarily from the manufacturing and sale of military products. It has a market capitalization of CN¥7.79 billion.

Jiangxi Xinyu Guoke Technology stands out with its strong financial footing, being debt-free and showcasing high-quality earnings. Over the past year, it reported a 7% growth in earnings, surpassing the -13.4% industry average for Aerospace & Defense. For the nine months ending September 2024, sales reached CNY 318.54 million from CNY 269.77 million previously, while net income rose to CNY 65.75 million from CNY 62.04 million a year earlier. The company is free cash flow positive and has maintained profitability without concerns over cash runway or interest coverage due to its no-debt status.

Summing It All Up

- Dive into all 4628 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300722

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives