Over the past 7 days, the Indian market has risen 1.8%, and over the past 12 months, it is up an impressive 41%. In this thriving environment where earnings are expected to grow by 17% per annum over the next few years, identifying stocks with strong fundamentals and growth potential can be particularly rewarding.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bharat Rasayan | 8.15% | 0.10% | -7.93% | ★★★★★★ |

| Le Travenues Technology | 10.32% | 26.39% | 67.32% | ★★★★★★ |

| TechNVision Ventures | 100.73% | 20.37% | 68.50% | ★★★★★★ |

| Indo Tech Transformers | 2.30% | 22.05% | 60.31% | ★★★★★☆ |

| BLS E-Services | 1.67% | 15.04% | 51.58% | ★★★★★☆ |

| JSW Holdings | NA | 21.35% | 22.41% | ★★★★★☆ |

| Kalyani Investment | NA | 20.74% | 6.35% | ★★★★★☆ |

| Sky Gold | 127.01% | 22.02% | 48.03% | ★★★★☆☆ |

| Innovana Thinklabs | 13.59% | 12.51% | 20.01% | ★★★★☆☆ |

| SG Mart | 16.77% | 98.09% | 96.54% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

LT Foods (NSEI:LTFOODS)

Simply Wall St Value Rating: ★★★★★★

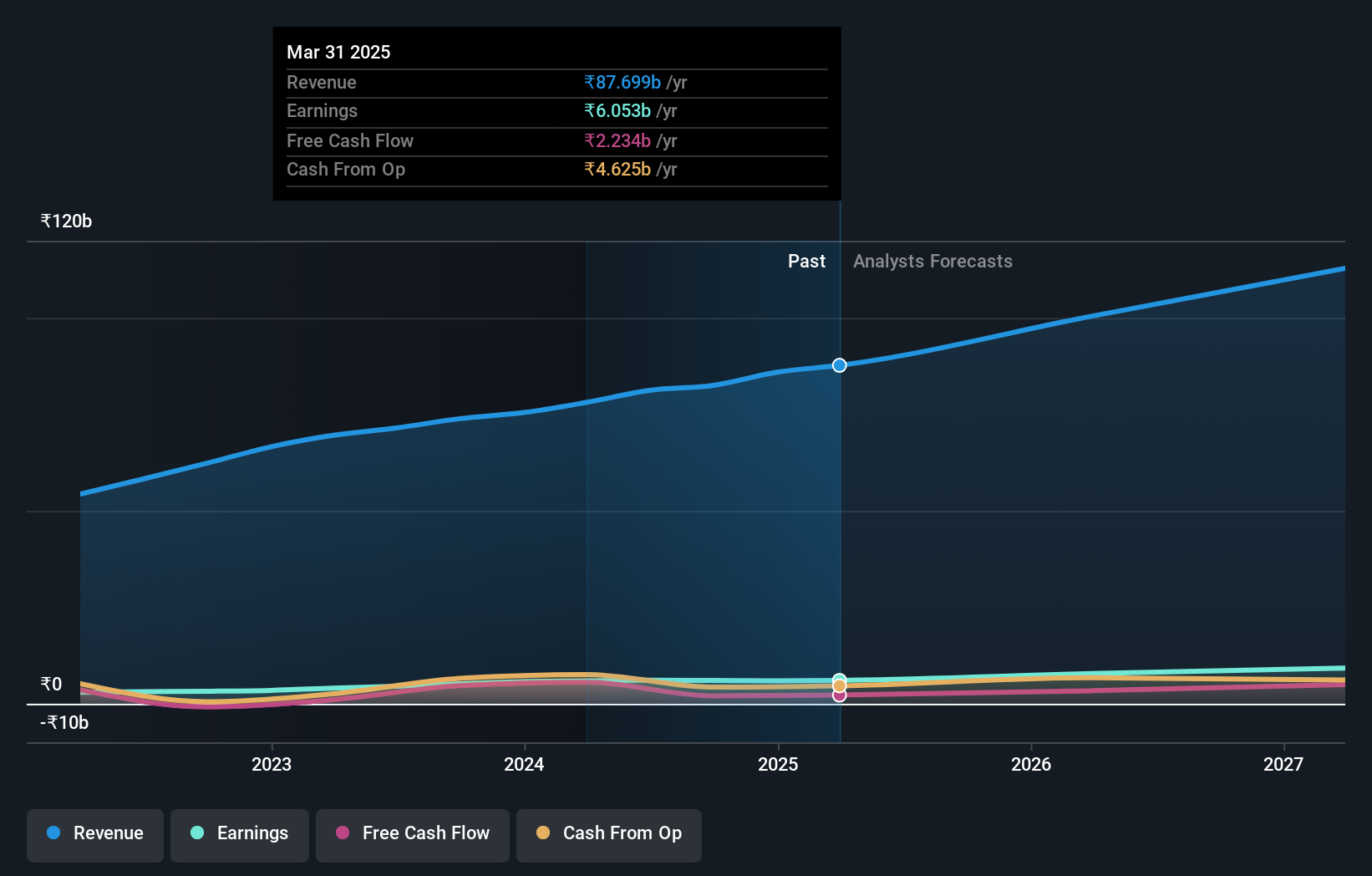

Overview: LT Foods Limited specializes in the milling, processing, and marketing of branded and non-branded basmati rice and rice food products in India, with a market cap of ₹152.77 billion.

Operations: The primary revenue stream for LT Foods Limited is the manufacture and storage of rice, generating ₹81.21 billion.

Earnings at LT Foods surged by 35.7% last year, outpacing the food industry’s 16.7% growth. The company’s price-to-earnings ratio stands at 25x, notably lower than the Indian market average of 34.6x, indicating good value relative to peers. Debt to equity has significantly improved from 116.4% to 26.8% over five years, with interest payments well covered by EBIT (10.8x). Additionally, LT Foods remains profitable and free cash flow positive despite recent regulatory challenges and legal notices impacting operations minimally with fines up to INR100K (~US$1K).

- Click to explore a detailed breakdown of our findings in LT Foods' health report.

Examine LT Foods' past performance report to understand how it has performed in the past.

Marksans Pharma (NSEI:MARKSANS)

Simply Wall St Value Rating: ★★★★★★

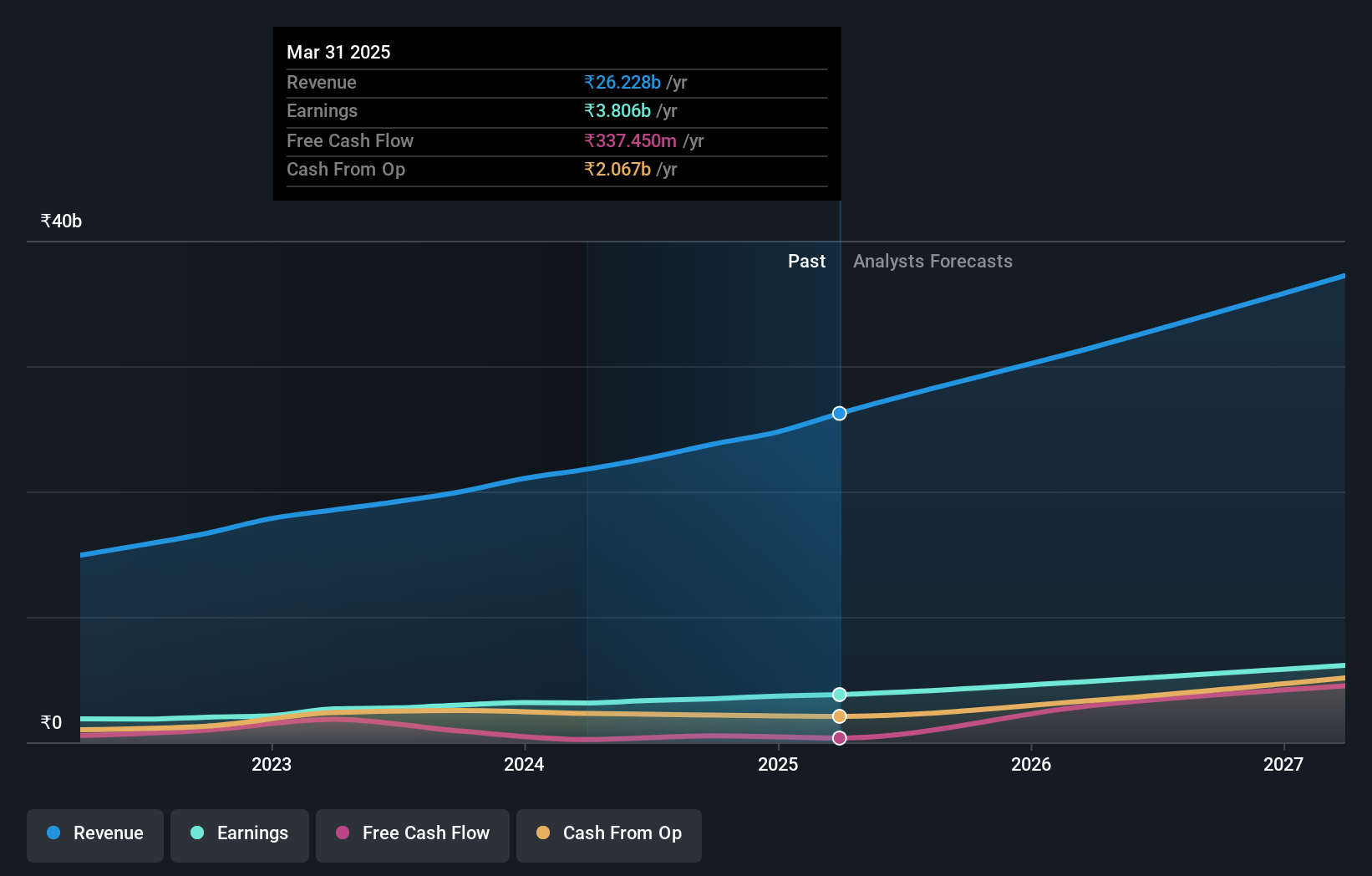

Overview: Marksans Pharma Limited, along with its subsidiaries, focuses on the research, manufacturing, marketing, and sale of pharmaceutical formulations across various international markets including the United States, North America, Europe, the United Kingdom, Australia, and New Zealand; it has a market cap of ₹134.31 billion.

Operations: Marksans Pharma generates its revenue primarily from the sale of pharmaceutical formulations, amounting to ₹22.68 billion. The company operates across various international markets including the United States, North America, Europe, the United Kingdom, Australia, and New Zealand.

Marksans Pharma has outpaced the Pharmaceuticals industry with a 21.7% earnings growth over the past year, compared to the industry’s 19.2%. The company’s debt to equity ratio has improved from 19.9% to 11.7% over five years, and its EBIT covers interest payments by a substantial margin of 32.2x. Recent developments include USFDA's successful inspection closure of their Goa facility and ongoing M&A explorations aimed at expanding in Europe, reflecting strategic growth initiatives.

Zaggle Prepaid Ocean Services (NSEI:ZAGGLE)

Simply Wall St Value Rating: ★★★★☆☆

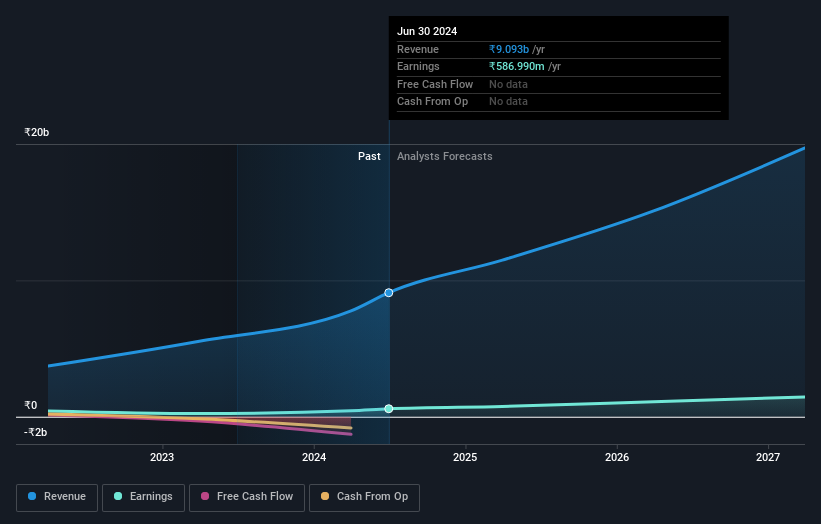

Overview: Zaggle Prepaid Ocean Services Limited develops financial products and solutions to manage business expenses for corporates, SMEs, and startups through automated workflows, with a market cap of ₹57.43 billion.

Operations: Zaggle Prepaid Ocean Services Limited generates revenue primarily from three segments: Program Fee (₹4.01 billion), Propel Platform Revenue/Gift Cards (₹4.76 billion), and Platform Fee/SaaS Fee/Service Fee (₹326.27 million).

Zaggle Prepaid Ocean Services has shown impressive earnings growth of 108.5% over the past year, significantly outpacing the software industry’s 32.4%. Recent agreements with HDFC ERGO and Blue Star Ltd highlight its expanding client base and service offerings. Zaggle's net income for Q1 2024 was INR 167.34 million, a substantial increase from INR 20.55 million the previous year. Notably, EBIT covers interest payments by a robust margin of 31.5x, indicating strong financial health.

Turning Ideas Into Actions

- Explore the 474 names from our Indian Undiscovered Gems With Strong Fundamentals screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade LT Foods, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:LTFOODS

LT Foods

Engages in the milling, processing, and marketing of branded and non-branded basmati rice, and rice food products in India.

Flawless balance sheet with reasonable growth potential and pays a dividend.