- India

- /

- Capital Markets

- /

- NSEI:MAHSCOOTER

Undiscovered Gems In India 3 Small Cap Stocks With Strong Potential

Reviewed by Simply Wall St

The Indian market has been flat in the last week but is up 42% over the past year, with earnings forecast to grow by 17% annually. In this dynamic environment, identifying small-cap stocks with strong potential can uncover hidden opportunities for growth.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wealth First Portfolio Managers | NA | -47.95% | 40.47% | ★★★★★★ |

| ELANTAS Beck India | NA | 14.89% | 24.83% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 42.61% | 42.95% | ★★★★★★ |

| Timex Group India | 14.33% | 17.75% | 59.68% | ★★★★★★ |

| Indo Amines | 82.32% | 17.15% | 19.98% | ★★★★★☆ |

| Gallantt Ispat | 18.85% | 37.56% | 37.26% | ★★★★★☆ |

| Master Trust | 37.05% | 27.64% | 41.99% | ★★★★★☆ |

| Nibe | 39.26% | 80.75% | 84.69% | ★★★★★☆ |

| Genesys International | 12.13% | 15.75% | 36.33% | ★★★★★☆ |

| Lotus Chocolate | 13.51% | 28.10% | -6.06% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

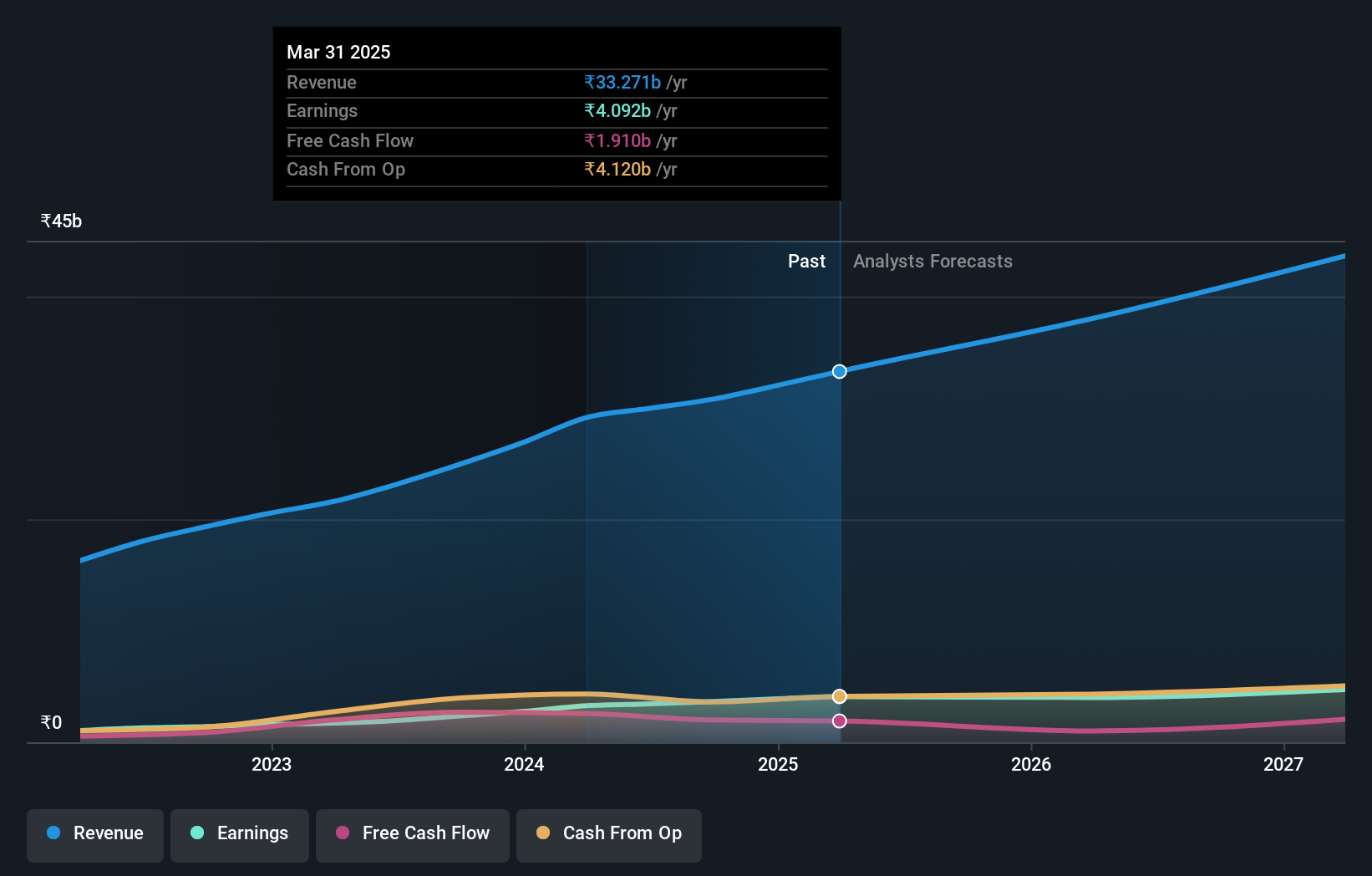

Action Construction Equipment (NSEI:ACE)

Simply Wall St Value Rating: ★★★★★★

Overview: Action Construction Equipment Limited manufactures and sells material handling and construction equipment primarily in India, with a market cap of ₹157.85 billion.

Operations: Action Construction Equipment Limited generates revenue primarily from its material handling and construction equipment segments, with additional income from agriculture equipment amounting to ₹2.05 billion. Segment adjustments contribute ₹27.92 million to the overall revenue figures.

Earnings for Action Construction Equipment (ACE) grew by 76.2% over the past year, significantly outpacing the Machinery industry’s 25.1%. The company's debt to equity ratio has improved from 18.5% to 0.4% in five years, and EBIT covers interest payments 14.4 times over, indicating strong financial health. Recent highlights include a Q1 net income of INR 841.8 million and a substantial order from the Ministry of Defence for special forklifts and cranes, showcasing robust demand and strategic growth initiatives aligned with national programs like Make in India.

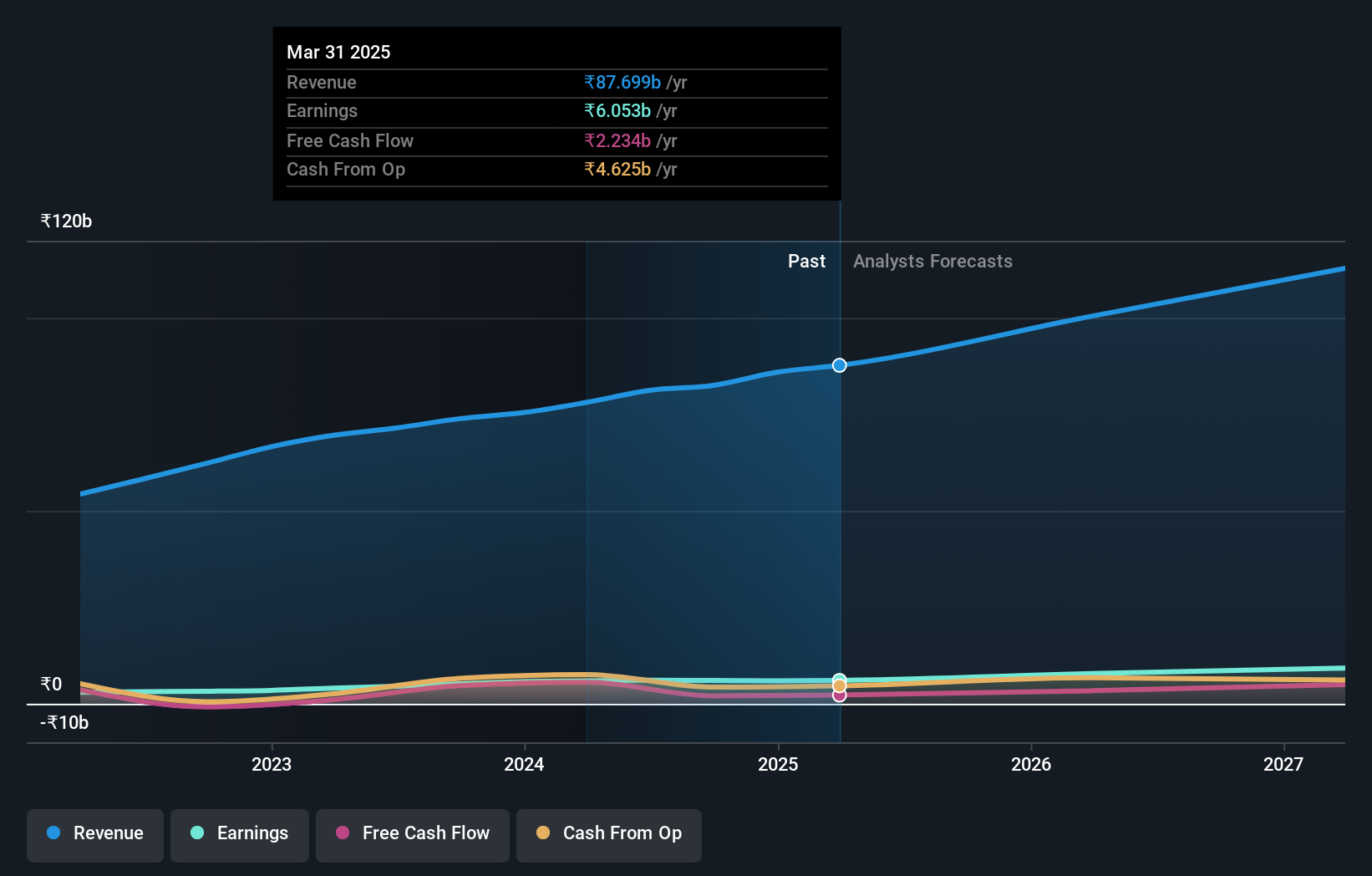

LT Foods (NSEI:LTFOODS)

Simply Wall St Value Rating: ★★★★★★

Overview: LT Foods Limited engages in the milling, processing, and marketing of branded and non-branded basmati rice and rice food products in India with a market cap of ₹148.12 billion.

Operations: The primary revenue stream for LT Foods Limited is the manufacture and storage of rice, generating ₹81.21 billion. The company's net profit margin is %.

Earnings for LT Foods have surged by 35.7% over the past year, outpacing the Food industry's 16.3% growth. The company’s debt-to-equity ratio has impressively fallen from 116.4% to 26.8% in five years, while its interest payments are well covered by EBIT at a ratio of 10.8x. With a price-to-earnings ratio of 24.2x below the Indian market average of 34.3x, LT Foods appears to be trading at good value relative to peers and industry standards.

- Click here to discover the nuances of LT Foods with our detailed analytical health report.

Assess LT Foods' past performance with our detailed historical performance reports.

Maharashtra Scooters (NSEI:MAHSCOOTER)

Simply Wall St Value Rating: ★★★★★☆

Overview: Maharashtra Scooters Ltd. manufactures and sells pressure die casting dies, jigs, fixtures, and die casting components primarily for the two and three-wheeler industry in India with a market cap of ₹137.76 billion.

Operations: Maharashtra Scooters Ltd. generates revenue primarily from investments (₹2.14 billion) and manufacturing activities (₹108.10 million). The company operates within the two and three-wheeler industry in India, focusing on pressure die casting dies, jigs, fixtures, and components.

Maharashtra Scooters, a debt-free entity for the past five years, has demonstrated consistent earnings growth at 19.3% annually over this period. Despite not matching the Capital Markets industry's 63.6% growth last year, it maintains high-quality earnings and positive free cash flow. Recently, the company declared an interim dividend of INR 110 per share and reported Q1 revenue of INR 85.7 million with net income soaring to INR 82.6 million from INR 4.8 million a year ago.

Key Takeaways

- Access the full spectrum of 471 Indian Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MAHSCOOTER

Maharashtra Scooters

Manufactures and sells pressure die casting dies, jigs, and fixtures, and die casting components primarily for the two and three-wheeler industry in India.

Adequate balance sheet second-rate dividend payer.

Market Insights

Community Narratives