- India

- /

- Auto Components

- /

- NSEI:SUNDARMHLD

Three Undiscovered Gems In India With Strong Potential

Reviewed by Simply Wall St

The Indian market has stayed flat over the past seven days but is up 44% over the past year, with earnings forecasted to grow by 17% annually. In this dynamic environment, identifying stocks with strong potential involves looking for companies that are well-positioned to capitalize on growth opportunities and demonstrate robust fundamentals.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Bengal & Assam | 4.48% | 1.53% | 51.11% | ★★★★★★ |

| NGL Fine-Chem | 12.95% | 15.22% | 8.68% | ★★★★★★ |

| Timex Group India | 14.33% | 17.75% | 59.68% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 42.61% | 42.95% | ★★★★★★ |

| Kaycee Industries | 17.35% | 19.50% | 34.62% | ★★★★★☆ |

| Kalyani Investment | NA | 20.74% | 6.35% | ★★★★★☆ |

| Magadh Sugar & Energy | 85.44% | 6.65% | 13.60% | ★★★★☆☆ |

| Monarch Networth Capital | 32.66% | 30.99% | 50.24% | ★★★★☆☆ |

| Vasa Denticity | 0.11% | 38.37% | 48.77% | ★★★★☆☆ |

| Rir Power Electronics | 54.23% | 16.42% | 34.78% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

LT Foods (NSEI:LTFOODS)

Simply Wall St Value Rating: ★★★★★★

Overview: LT Foods Limited engages in the milling, processing, and marketing of branded and non-branded basmati rice and rice food products in India, with a market cap of ₹140.53 billion.

Operations: LT Foods Limited generates revenue primarily from the manufacture and storage of rice, amounting to ₹81.21 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

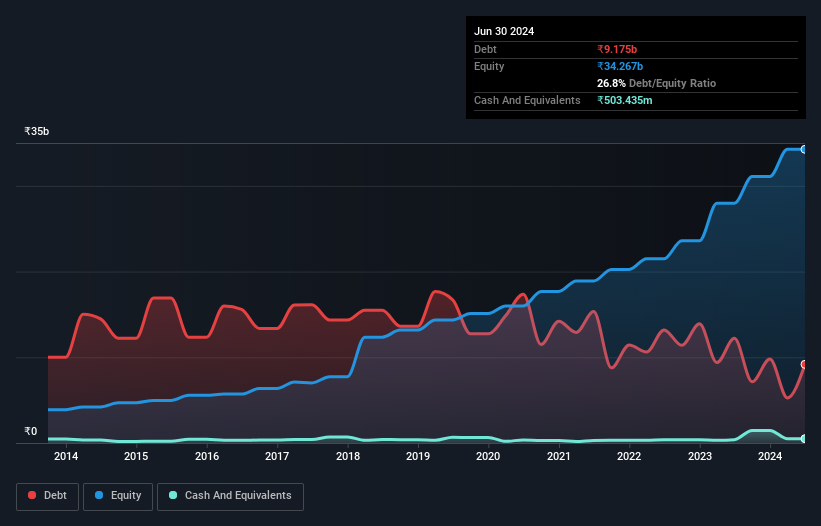

With a P/E ratio of 23x, LT Foods trades below the Indian market average of 34.2x, indicating good value. Over the past year, earnings surged by 35.7%, outpacing the food industry's 15% growth rate. The company's net debt to equity ratio stands at a satisfactory 25.3%, and its interest payments are well covered by EBIT (10.8x). Additionally, LT Foods' debt to equity ratio has significantly reduced from 116.4% to 26.8% over five years, showcasing improved financial health and stability in operations.

- Click here and access our complete health analysis report to understand the dynamics of LT Foods.

Review our historical performance report to gain insights into LT Foods''s past performance.

Netweb Technologies India (NSEI:NETWEB)

Simply Wall St Value Rating: ★★★★★★

Overview: Netweb Technologies India Limited designs, manufactures, and sells high-end computing solutions (HCS) in India with a market cap of ₹155.07 billion.

Operations: Netweb Technologies India Limited generates revenue primarily from the manufacturing and sale of computer servers, amounting to ₹8.14 billion. The company has a market cap of ₹155.07 billion.

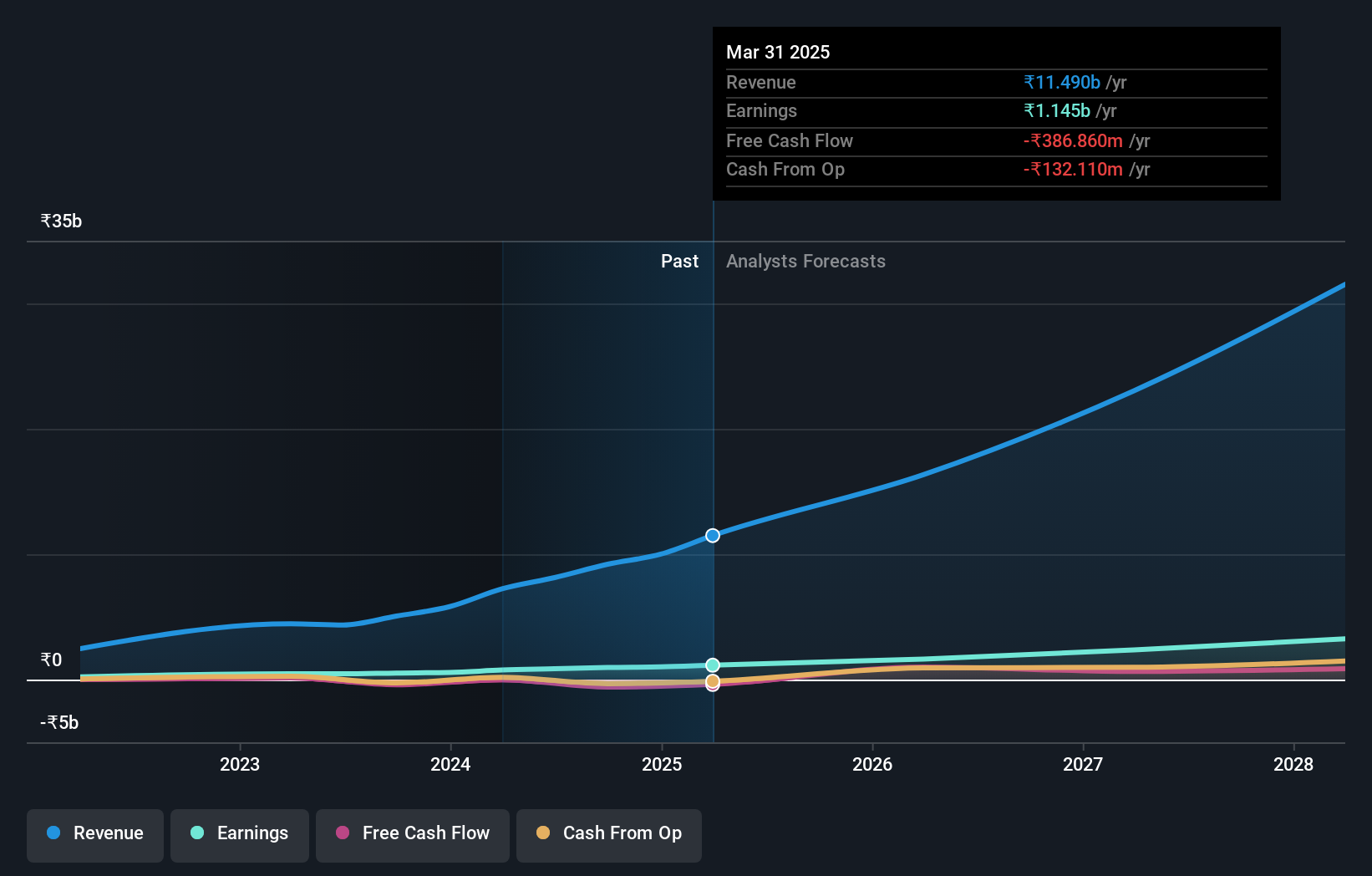

Netweb Technologies India has shown impressive growth, with earnings surging 85.8% over the past year, significantly outpacing the Tech industry’s 10.5%. The company’s debt to equity ratio has improved dramatically from 108% to just 2.3% in five years, and it holds more cash than its total debt. Recent quarterly results reported sales of INR 1.49 billion and net income of INR 154 million, reflecting robust financial health and strong market performance.

Sundaram Finance Holdings (NSEI:SUNDARMHLD)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sundaram Finance Holdings Limited operates in investments, business processing, and support services across India, Australia, and the United Kingdom with a market cap of ₹93.19 billion.

Operations: Sundaram Finance Holdings Limited generates revenue primarily from investments (₹2.51 billion), domestic shared services (₹105.51 million), and overseas shared services (₹489.78 million).

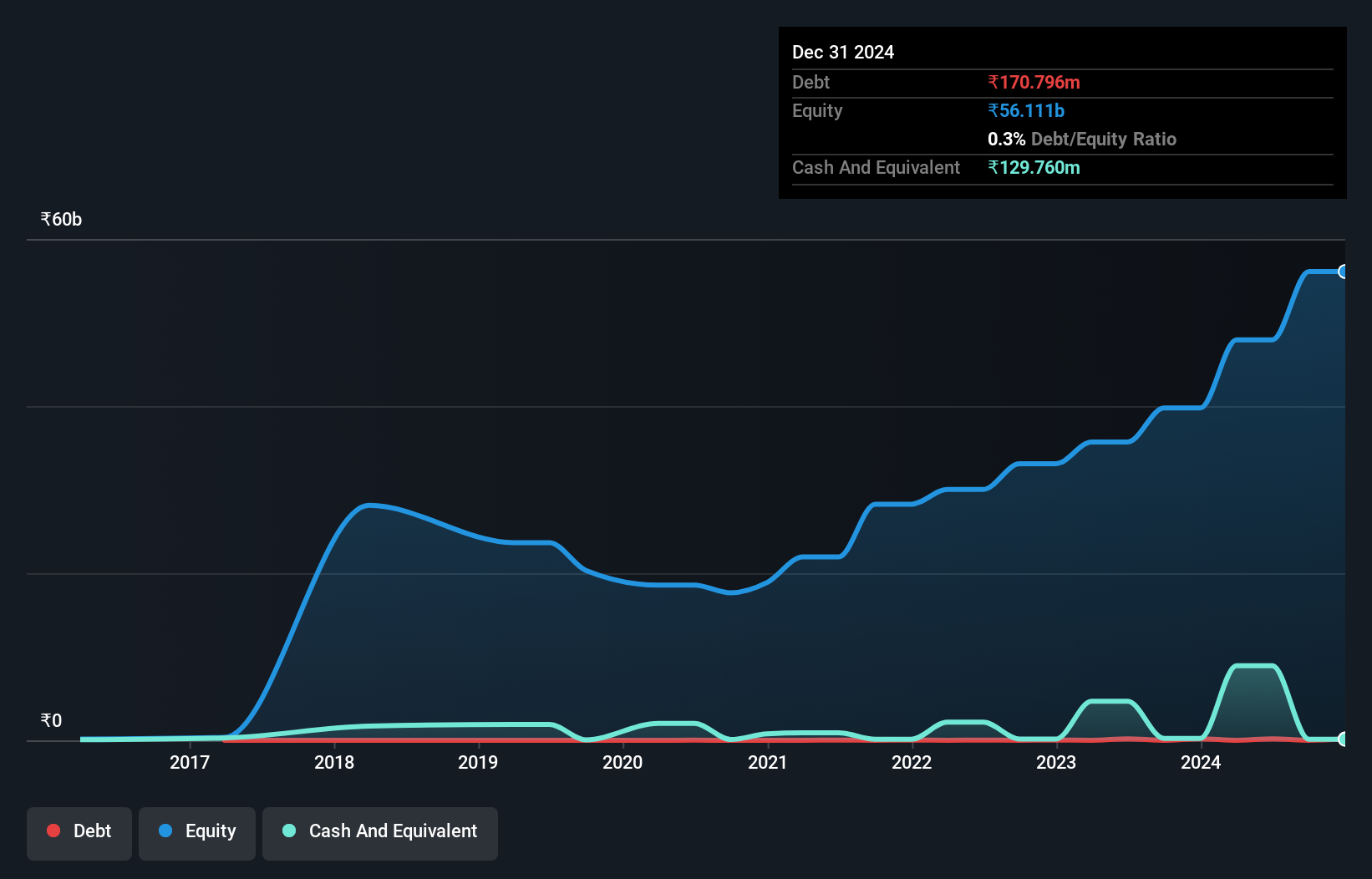

Sundaram Finance Holdings (SFHL) has demonstrated robust earnings growth, with a 114.5% increase over the past year, significantly outpacing the Auto Components industry's 20.1%. The company's price-to-earnings ratio of 16.3x is attractively lower than the Indian market average of 34.2x, indicating good value for investors. SFHL's interest payments are well covered by EBIT at a ratio of 265.4x, showcasing strong financial health despite a highly volatile share price in recent months.

- Click here to discover the nuances of Sundaram Finance Holdings with our detailed analytical health report.

Learn about Sundaram Finance Holdings' historical performance.

Make It Happen

- Investigate our full lineup of 474 Indian Undiscovered Gems With Strong Fundamentals right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:SUNDARMHLD

Sundaram Finance Holdings

Engages in the business of investments, business processing, and support services in India, Australia, and the United Kingdom.

Excellent balance sheet with proven track record.