- India

- /

- Capital Markets

- /

- NSEI:IIFLSEC

Three Undiscovered Gems In India To Enhance Your Portfolio

Reviewed by Simply Wall St

The Indian market is up 1.8% over the last week and has surged by 46% over the past 12 months, with earnings forecasted to grow by 17% annually. In this thriving environment, identifying lesser-known stocks with strong potential can be a strategic way to enhance your portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Shree Digvijay Cement | 0.01% | 13.97% | 16.37% | ★★★★★★ |

| Aeroflex Industries | 0.04% | 14.69% | 33.38% | ★★★★★★ |

| AGI Infra | 61.29% | 29.12% | 33.44% | ★★★★★★ |

| Gallantt Ispat | 18.85% | 37.56% | 37.26% | ★★★★★☆ |

| Voith Paper Fabrics India | 0.07% | 10.95% | 9.70% | ★★★★★☆ |

| Network People Services Technologies | 0.24% | 81.82% | 86.36% | ★★★★★☆ |

| Monarch Networth Capital | 32.66% | 30.99% | 50.24% | ★★★★☆☆ |

| SG Mart | 16.77% | 98.09% | 96.54% | ★★★★☆☆ |

| Vasa Denticity | 0.11% | 38.37% | 48.77% | ★★★★☆☆ |

| Abans Holdings | 91.77% | 13.13% | 18.72% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

IIFL Securities (NSEI:IIFLSEC)

Simply Wall St Value Rating: ★★★★☆☆

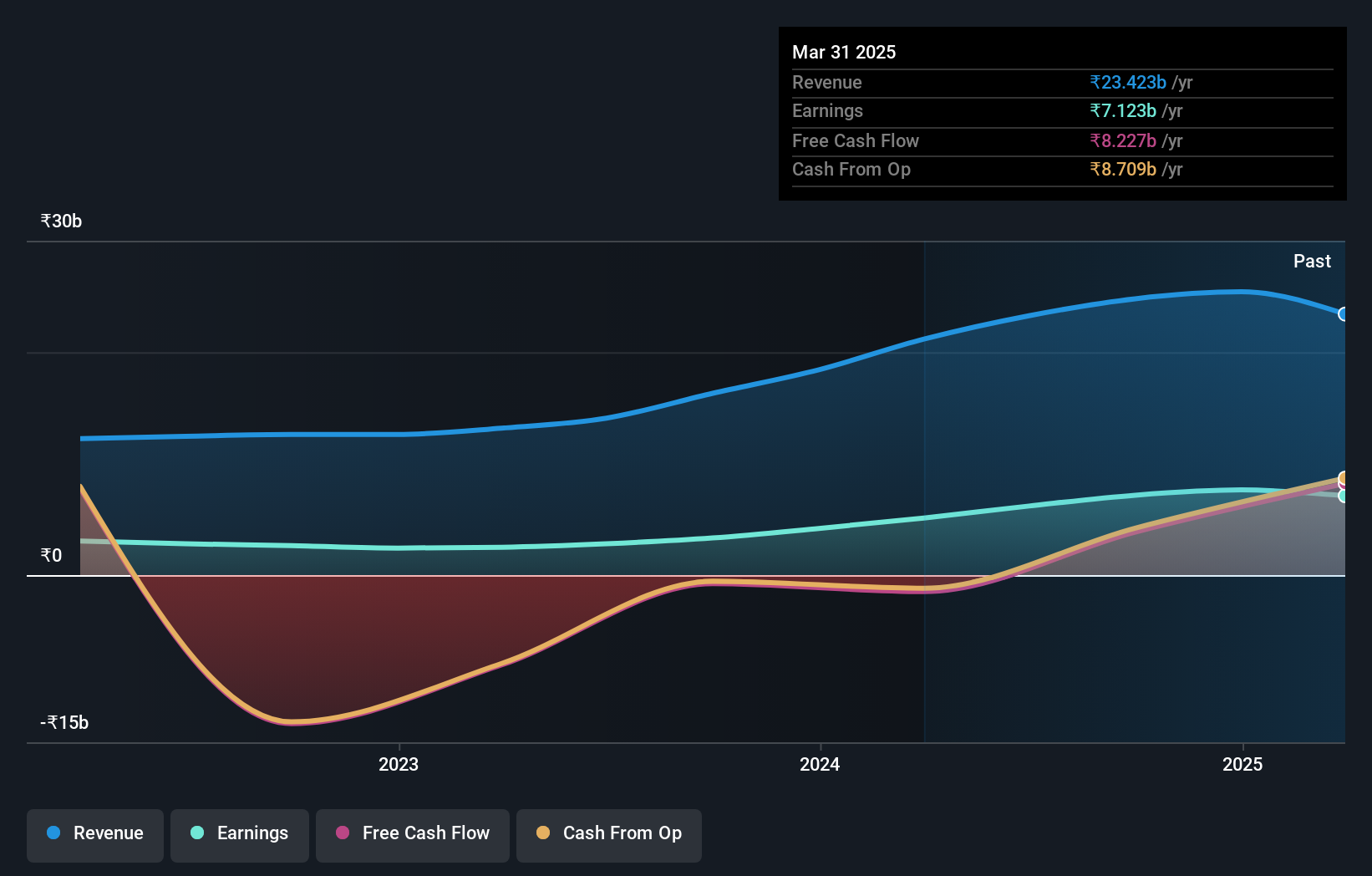

Overview: IIFL Securities Limited offers capital market services in the primary and secondary markets in India, with a market cap of ₹83.23 billion.

Operations: IIFL Securities Limited generates revenue primarily from capital market activities (₹20.25 billion), facilities and ancillary services (₹375.25 million), and insurance broking and ancillary services (₹2.77 billion).

IIFL Securities, a notable player in India's capital markets, has seen impressive earnings growth of 120.4% over the past year, outpacing the industry average of 63.6%. The company's P/E ratio stands at 13.4x, significantly lower than the Indian market's 33.9x, suggesting it may be undervalued. Additionally, IIFLSEC's net debt to equity ratio has reduced from 117.6% to a satisfactory 67.2% over five years and remains profitable with high-quality earnings despite recent regulatory penalties and executive changes.

- Navigate through the intricacies of IIFL Securities with our comprehensive health report here.

Gain insights into IIFL Securities' past trends and performance with our Past report.

LT Foods (NSEI:LTFOODS)

Simply Wall St Value Rating: ★★★★★★

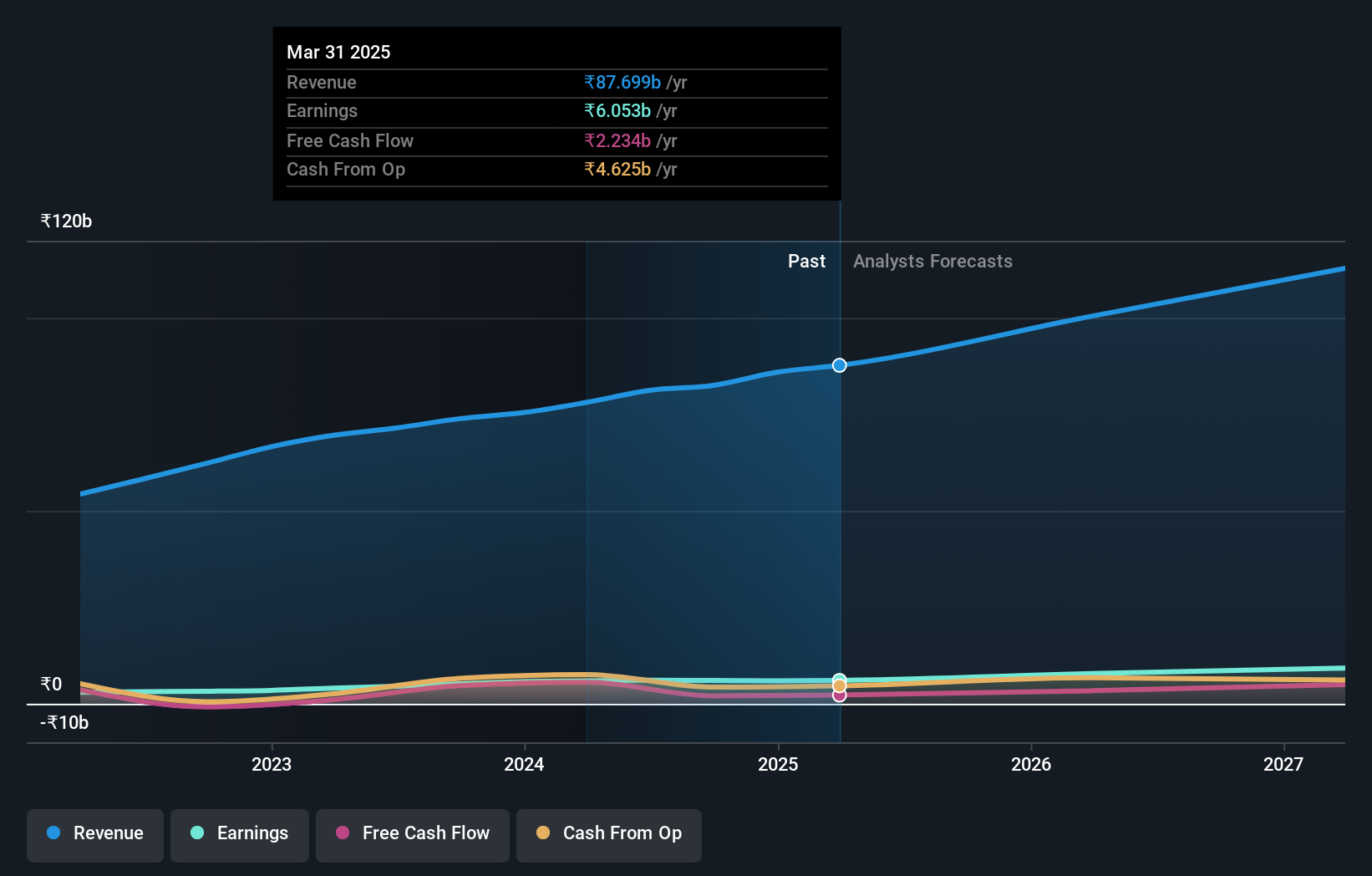

Overview: LT Foods Limited engages in the milling, processing, and marketing of branded and non-branded basmati rice and rice food products in India, with a market cap of ₹128.90 billion.

Operations: LT Foods generates revenue primarily from the manufacture and storage of rice, amounting to ₹81.21 billion. The company's net profit margin is a key financial metric to watch.

LT Foods, a promising player in India's food sector, has shown impressive financial health. Over the past five years, its debt to equity ratio improved from 116.4% to 26.8%, and interest payments are well covered by EBIT at 10.8x coverage. Recent earnings grew by 35.7%, outpacing the industry average of 15%. Trading at a P/E ratio of 21.1x, it's below the Indian market's average of 33.9x, indicating good value relative to peers and industry standards.

Netweb Technologies India (NSEI:NETWEB)

Simply Wall St Value Rating: ★★★★★★

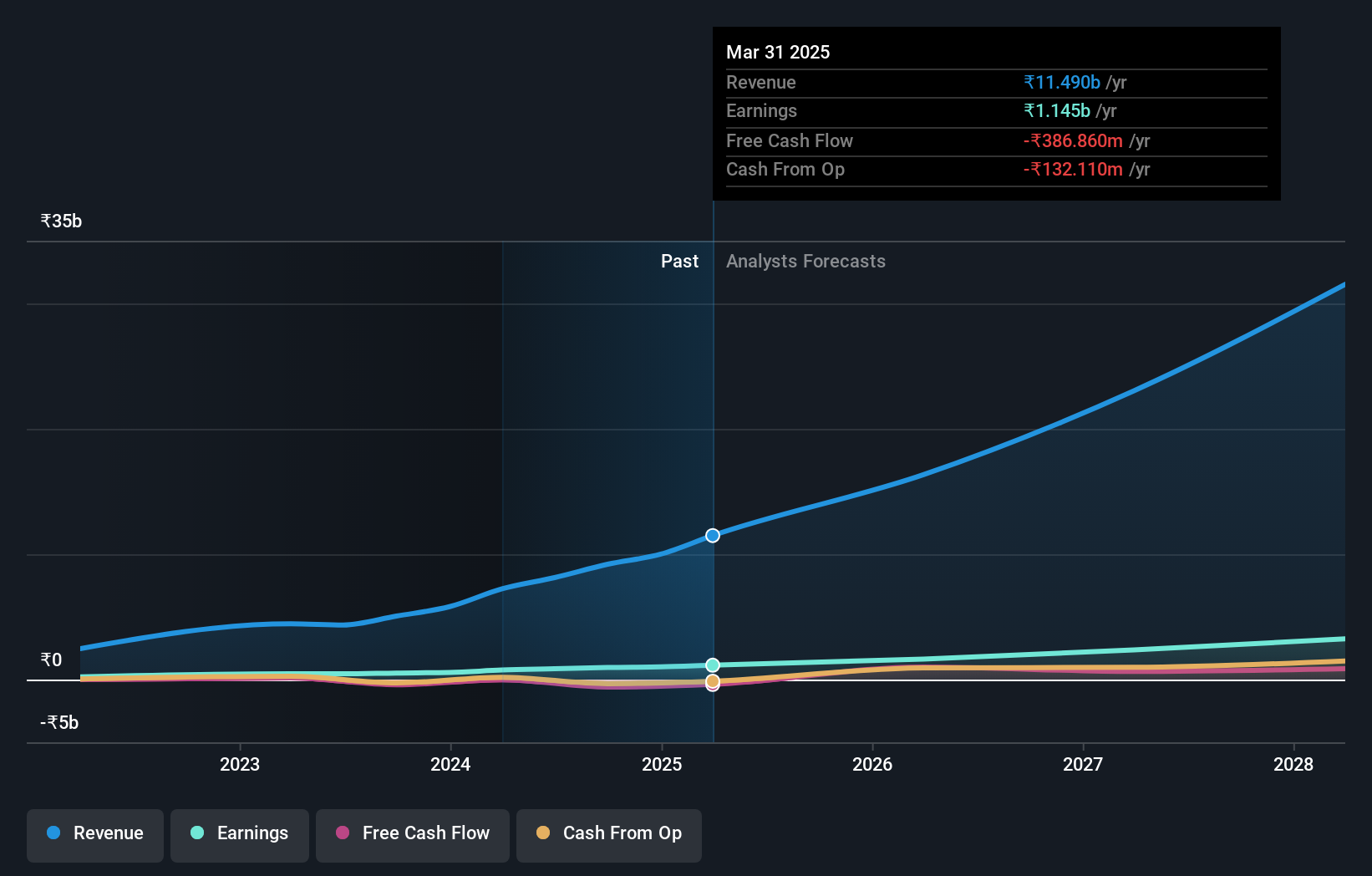

Overview: Netweb Technologies India Limited designs, manufactures, and sells high-end computing solutions (HCS) in India with a market cap of ₹151.50 billion.

Operations: Netweb Technologies India Limited generates revenue primarily from the manufacturing and sale of computer servers, amounting to ₹8.14 billion.

Netweb Technologies India has seen impressive earnings growth of 85.8% over the past year, significantly outpacing the tech industry's 11%. The company's debt to equity ratio has dramatically improved from 108% to just 2.3% in five years, showcasing strong financial management. Recent Q1 results revealed a net income of INR 154.44 million, up from INR 50.91 million last year, with basic earnings per share rising to INR 2.74 from INR 1 previously.

Seize The Opportunity

- Click here to access our complete index of 469 Indian Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:IIFLSEC

IIFL Capital Services

Provides capital market services in the primary and secondary markets in India.

Outstanding track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives