The Indian market is up 3.4% in the last 7 days, with all sectors gaining ground, and has climbed 44% over the past year. In this thriving environment where earnings are forecast to grow by 17% annually, identifying stocks with strong fundamentals and growth potential becomes crucial for investors seeking undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| NGL Fine-Chem | 12.95% | 15.22% | 8.68% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 46.55% | 46.96% | ★★★★★★ |

| AGI Infra | 61.29% | 29.12% | 33.44% | ★★★★★★ |

| Network People Services Technologies | 0.24% | 81.82% | 86.36% | ★★★★★☆ |

| Genesys International | 12.13% | 15.75% | 36.33% | ★★★★★☆ |

| JSW Holdings | NA | 21.35% | 22.41% | ★★★★★☆ |

| Apollo Micro Systems | 38.51% | 10.59% | 11.93% | ★★★★☆☆ |

| SG Mart | 16.77% | 98.09% | 96.54% | ★★★★☆☆ |

| Vasa Denticity | 0.11% | 38.37% | 48.77% | ★★★★☆☆ |

| Abans Holdings | 91.77% | 13.13% | 18.72% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

IIFL Securities (NSEI:IIFLSEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: IIFL Securities Limited offers capital market services in India's primary and secondary markets and has a market cap of ₹78.48 billion.

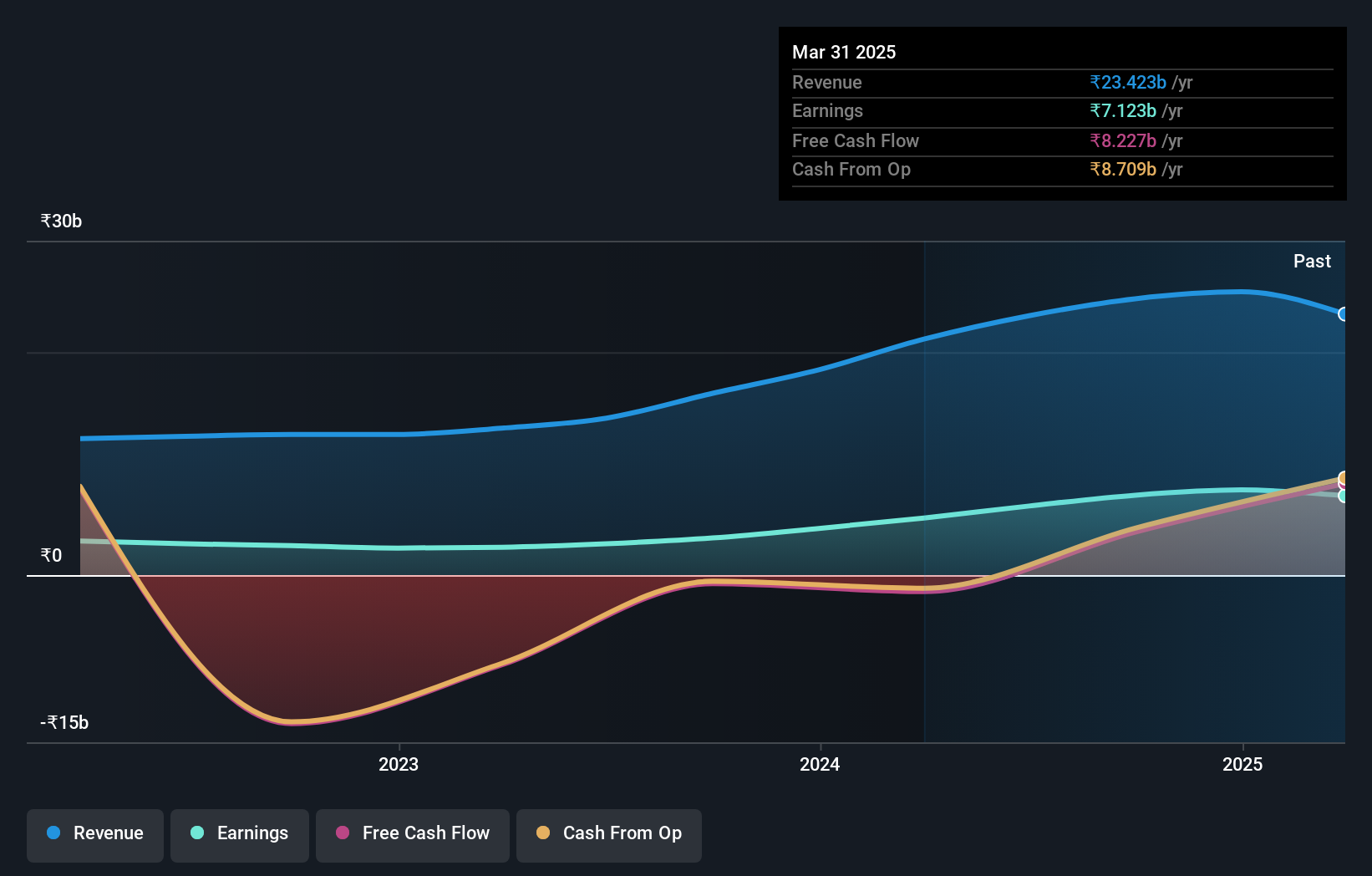

Operations: IIFL Securities generates revenue primarily from capital market activities (₹20.25 billion) and insurance broking and ancillary services (₹2.77 billion). The company also earns from facilities and ancillary services, contributing ₹375.25 million to its revenue.

IIFL Securities has shown impressive earnings growth of 120.4% over the past year, outpacing the Capital Markets industry. Its debt to equity ratio has improved significantly from 117.6% to 67.2% in five years, and its current net debt to equity ratio stands at a satisfactory 35.5%. The stock is attractively valued with a Price-To-Earnings ratio of 12.7x compared to the Indian market's average of 33.1x, despite recent share price volatility and regulatory challenges including a SEBI penalty for technical errors in client data management.

- Get an in-depth perspective on IIFL Securities' performance by reading our health report here.

Understand IIFL Securities' track record by examining our Past report.

LT Foods (NSEI:LTFOODS)

Simply Wall St Value Rating: ★★★★★★

Overview: LT Foods Limited engages in the milling, processing, and marketing of branded and non-branded basmati rice and rice food products in India, with a market cap of ₹122.75 billion.

Operations: The primary revenue stream for LT Foods Limited is the manufacture and storage of rice, generating ₹81.21 billion. The company focuses on branded and non-branded basmati rice products in India.

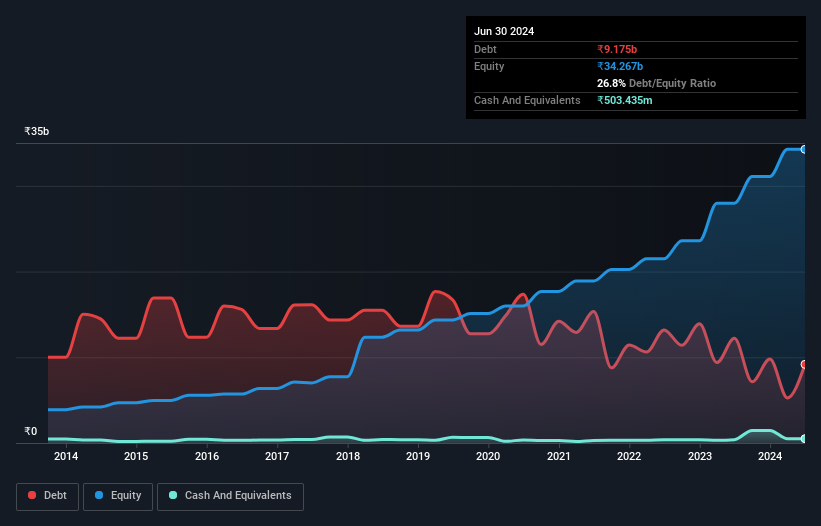

Profitable LT Foods has shown impressive earnings growth of 35.7% over the past year, outpacing the Food industry's 13.9%. Its net debt to equity ratio stands at a satisfactory 25.3%, a significant improvement from 116.4% five years ago, and its interest payments are well covered by EBIT at 10.8x coverage. The company's P/E ratio of 20.1x is attractive compared to the Indian market's average of 33.1x, indicating good value relative to peers and industry standards.

Netweb Technologies India (NSEI:NETWEB)

Simply Wall St Value Rating: ★★★★★★

Overview: Netweb Technologies India Limited designs, manufactures, and sells high-end computing solutions (HCS) in India with a market cap of ₹141.23 billion.

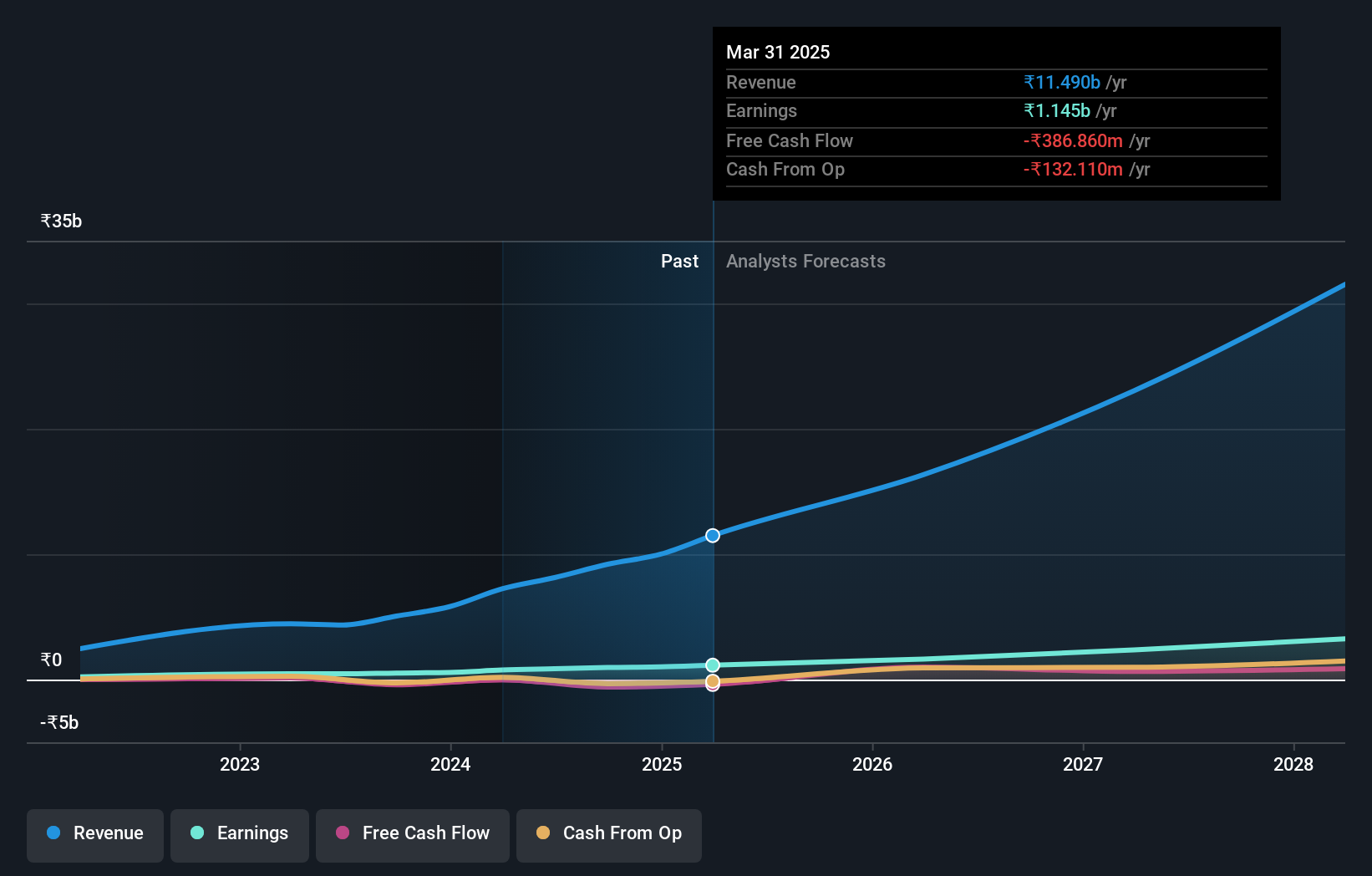

Operations: Netweb Technologies generates revenue primarily from the manufacturing and sale of computer servers, amounting to ₹8.14 billion. The company has a market cap of ₹141.23 billion.

Netweb Technologies India, a promising player in the tech sector, has shown impressive earnings growth of 85.8% over the past year, outpacing the industry average of 10.2%. The company's debt to equity ratio has significantly improved from 108% to 2.3% over five years, indicating robust financial health. Recent Q1 results highlight revenue reaching INR 1,532 million and net income at INR 154 million compared to last year's figures of INR 602 million and INR 51 million respectively.

Turning Ideas Into Actions

- Unlock our comprehensive list of 463 Indian Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:LTFOODS

LT Foods

An FMCG company, operates in the specialty rice and rice-based foods business.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives