Discovering 3 Undiscovered Gems In India With Strong Potential

Reviewed by Simply Wall St

In the last week, the Indian market has stayed flat while the Information Technology sector gained 4.0%. With the market up 44% over the past year and earnings forecast to grow by 17% annually, identifying stocks with strong potential is crucial for investors looking to capitalize on these favorable conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| 3B Blackbio Dx | 0.38% | -0.26% | -1.39% | ★★★★★★ |

| All E Technologies | NA | 40.78% | 31.63% | ★★★★★★ |

| Indo Amines | 82.32% | 17.15% | 20.00% | ★★★★★☆ |

| Voith Paper Fabrics India | 0.07% | 10.95% | 9.70% | ★★★★★☆ |

| Indo Tech Transformers | 2.30% | 22.04% | 60.31% | ★★★★★☆ |

| Piccadily Agro Industries | 50.57% | 13.86% | 42.85% | ★★★★★☆ |

| Macpower CNC Machines | 0.40% | 22.04% | 31.09% | ★★★★★☆ |

| Nibe | 39.26% | 80.75% | 84.68% | ★★★★★☆ |

| Lotus Chocolate | 13.51% | 28.07% | -10.66% | ★★★★★☆ |

| Monarch Networth Capital | 32.66% | 30.99% | 50.24% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

LT Foods (NSEI:LTFOODS)

Simply Wall St Value Rating: ★★★★★★

Overview: LT Foods Limited engages in the milling, processing, and marketing of branded and non-branded basmati rice and rice food products in India, with a market cap of ₹114.75 billion.

Operations: The primary revenue stream for LT Foods comes from the manufacture and storage of rice, generating ₹81.21 billion. The company has a market cap of ₹114.75 billion.

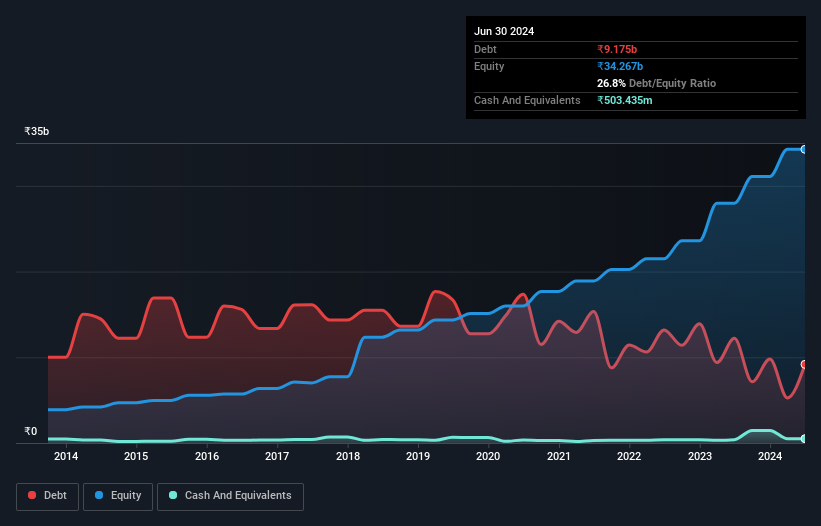

LT Foods has shown impressive performance with earnings growth of 35.7% over the past year, outpacing the food industry's 13.9%. Trading at 4.3% below its fair value, it offers good relative value compared to peers. The company's debt to equity ratio improved from 116.4% to 26.8% in five years, reflecting strong financial management. Recent earnings reported sales of ₹20,705 million and net income of ₹1,553 million for Q1 FY2025, indicating robust revenue growth and profitability.

- Delve into the full analysis health report here for a deeper understanding of LT Foods.

Review our historical performance report to gain insights into LT Foods''s past performance.

Newgen Software Technologies (NSEI:NEWGEN)

Simply Wall St Value Rating: ★★★★★★

Overview: Newgen Software Technologies Limited is a software company that offers software products and solutions across India, Europe, the Middle East, Africa, the Asia Pacific, Australia, and the United States with a market cap of ₹151.89 billion.

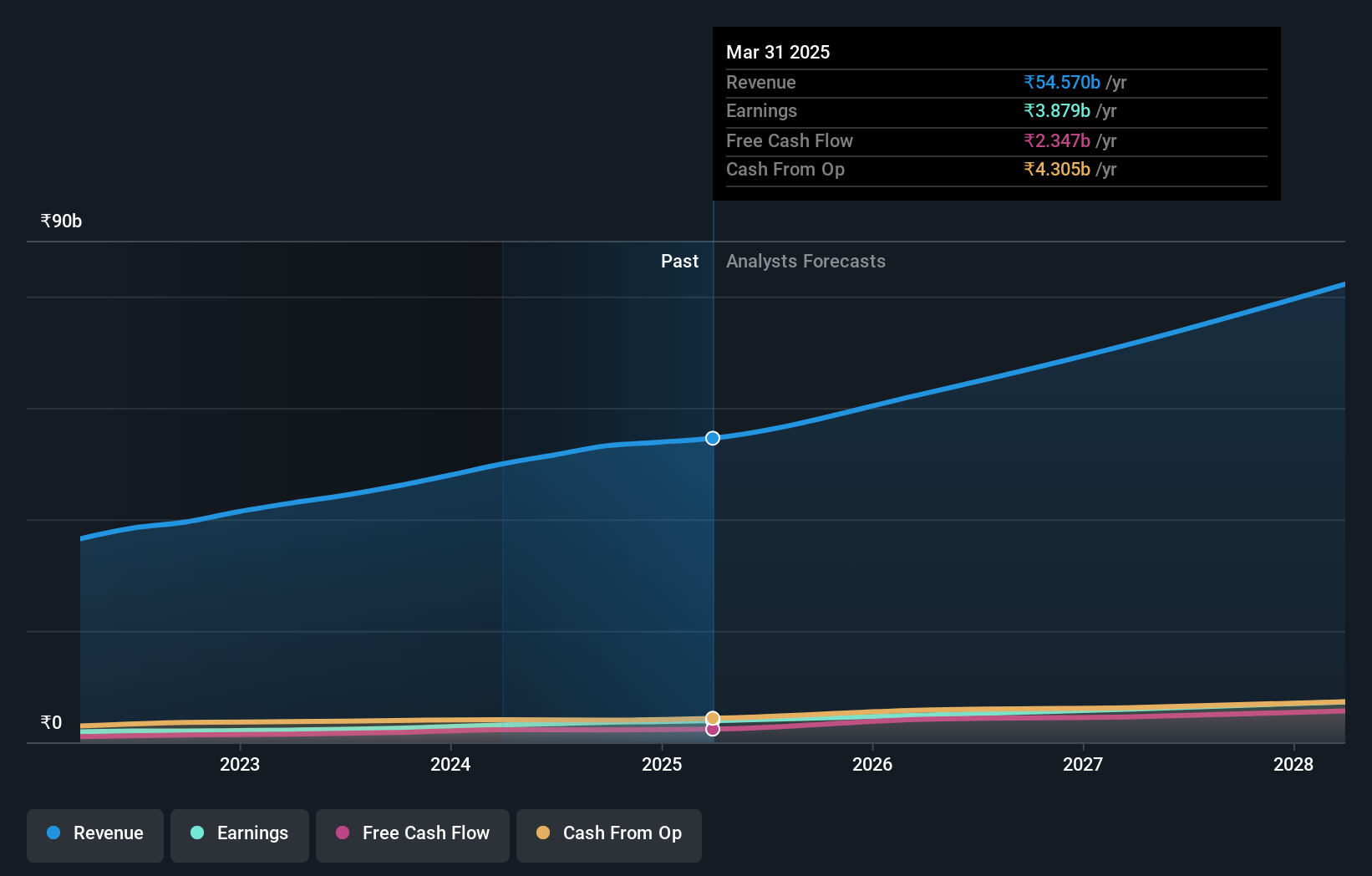

Operations: Newgen Software Technologies generates revenue primarily from its software and programming segment, which amounted to ₹13.07 billion. The company's market cap stands at ₹151.89 billion.

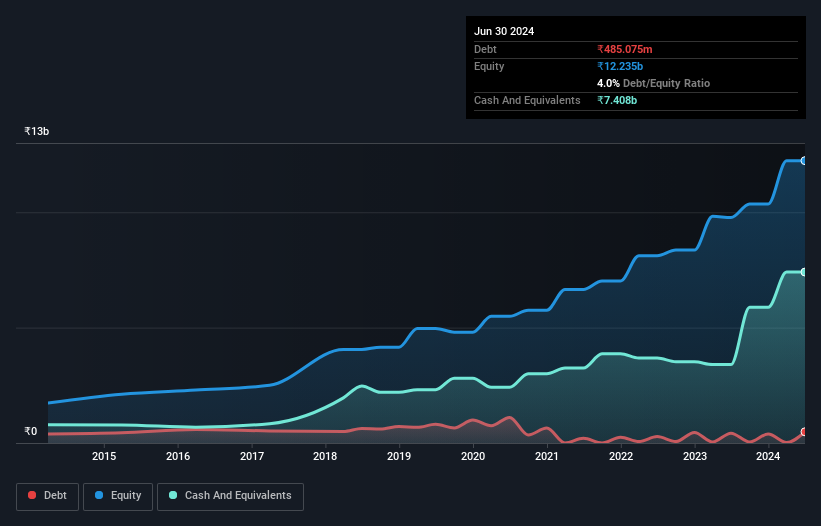

Newgen Software Technologies has shown impressive earnings growth of 43.7% over the past year, outpacing the software industry average of 28.6%. The company’s debt to equity ratio has improved significantly from 16.3% to 4% in five years, indicating prudent financial management. Recent earnings for Q1 FY2025 reported sales at ₹3,147 million and net income at ₹475 million compared to ₹2,517 million and ₹302 million respectively a year ago.

Time Technoplast (NSEI:TIMETECHNO)

Simply Wall St Value Rating: ★★★★★★

Overview: Time Technoplast Limited, along with its subsidiaries, manufactures and sells a variety of technology-based polymer and composite products in India and internationally, with a market cap of ₹87.42 billion.

Operations: Time Technoplast generates revenue primarily from Polymer Products (₹33.43 billion) and Composite Products (₹18.00 billion).

Time Technoplast has shown impressive financial performance recently, with earnings growing by 44.6% over the past year, outpacing the packaging industry’s 8.7%. The company’s debt to equity ratio has improved from 49% to 31.7% over five years, reflecting better financial health. Additionally, its price-to-earnings ratio of 26.2x is attractive compared to the Indian market average of 32.5x, suggesting it might be undervalued given its strong growth trajectory and high-quality earnings.

- Click to explore a detailed breakdown of our findings in Time Technoplast's health report.

Gain insights into Time Technoplast's past trends and performance with our Past report.

Taking Advantage

- Delve into our full catalog of 453 Indian Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Newgen Software Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:NEWGEN

Newgen Software Technologies

A software company, engages in the business of software product development in India, Europe, the Middle East, Africa, the Asia Pacific, Australia, and the United States.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives