- India

- /

- Capital Markets

- /

- NSEI:IIFLSEC

3 Undiscovered Gems In India With Strong Potential

Reviewed by Simply Wall St

The Indian market has been flat over the last week but has risen 43% in the past 12 months, with earnings forecast to grow by 17% annually. In this dynamic environment, identifying stocks with strong potential often involves looking beyond well-known names to discover hidden gems that offer promising growth opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Yuken India | 27.96% | 12.35% | -44.41% | ★★★★★★ |

| Bharat Rasayan | 8.15% | 0.10% | -7.93% | ★★★★★★ |

| Timex Group India | 14.33% | 17.75% | 59.68% | ★★★★★★ |

| Force Motors | 23.24% | 21.52% | 44.24% | ★★★★★☆ |

| Om Infra | 13.99% | 43.36% | 27.64% | ★★★★★☆ |

| Ingersoll-Rand (India) | 1.05% | 14.88% | 27.54% | ★★★★★☆ |

| Piccadily Agro Industries | 50.57% | 13.86% | 42.85% | ★★★★★☆ |

| KP Green Engineering | 13.73% | 47.60% | 61.28% | ★★★★★☆ |

| Magadh Sugar & Energy | 85.44% | 6.65% | 13.60% | ★★★★☆☆ |

| SG Mart | 16.77% | 98.09% | 96.54% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

IIFL Securities (NSEI:IIFLSEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: IIFL Securities Limited offers capital market services in the primary and secondary markets in India with a market cap of ₹98.80 billion.

Operations: IIFL Securities Limited generates revenue primarily from capital market activities (₹20.25 billion), with additional income from facilities and ancillary services (₹375.25 million) and insurance broking and ancillary services (₹2.77 billion).

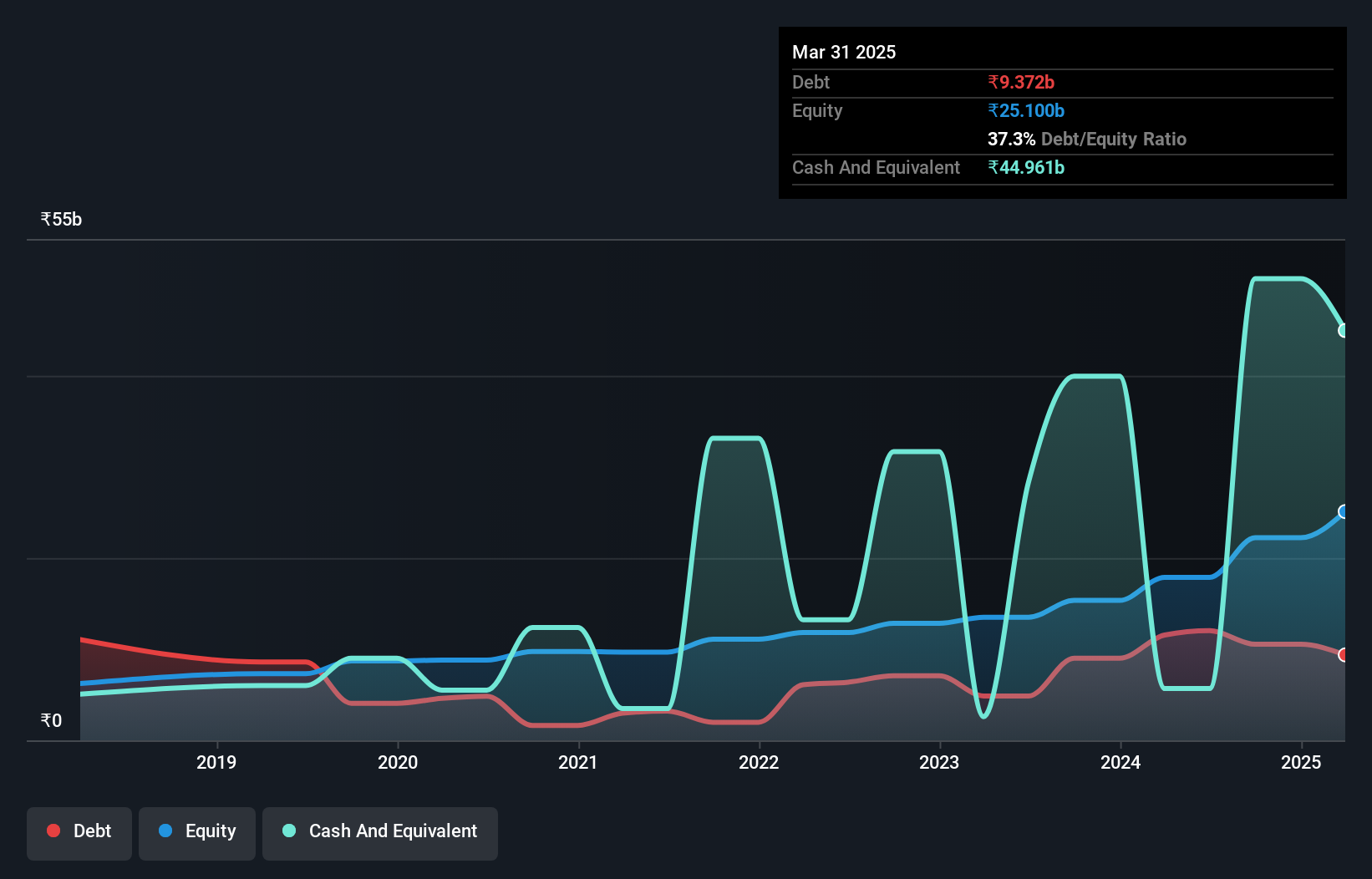

IIFL Securities, a promising player in India's capital markets, has seen its earnings grow by 120.4% over the past year, outpacing the industry's 64%. The company’s price-to-earnings ratio stands at a favorable 15.9x compared to the market's 34.3x. Despite a penalty of INR 3 million from SEBI for technical errors, IIFLSEC reported Q1 revenue of INR 6.44 billion and net income of INR 1.82 billion, showcasing strong financial health and growth potential in an evolving regulatory landscape.

LT Foods (NSEI:LTFOODS)

Simply Wall St Value Rating: ★★★★★★

Overview: LT Foods Limited engages in the milling, processing, and marketing of branded and non-branded basmati rice and rice food products in India with a market cap of ₹138.10 billion.

Operations: The primary revenue stream for LT Foods Limited comes from the manufacture and storage of rice, generating ₹81.21 billion. The company's market cap stands at ₹138.10 billion.

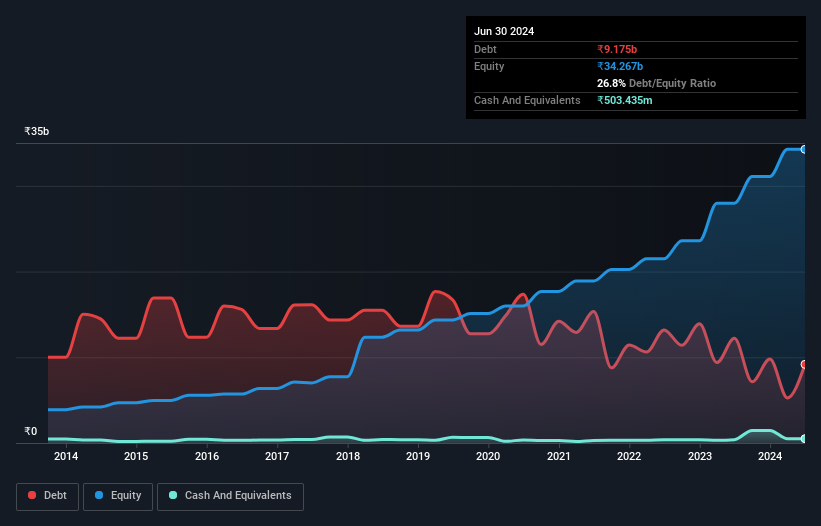

Earnings for LT Foods grew by 35.7% last year, outpacing the food industry's 15%. The price-to-earnings ratio of 22.6x is lower than the Indian market average of 34.3x, suggesting good value. The company’s debt to equity ratio has improved from 116.4% to 26.8% over five years, indicating stronger financial health. Recent developments include a new U.K facility and an approved interim dividend of INR 0.50 per share for FY2024-25.

- Take a closer look at LT Foods' potential here in our health report.

Review our historical performance report to gain insights into LT Foods''s past performance.

Marksans Pharma (NSEI:MARKSANS)

Simply Wall St Value Rating: ★★★★★★

Overview: Marksans Pharma Limited, along with its subsidiaries, focuses on the research, manufacturing, marketing, and sale of pharmaceutical formulations across various international markets including the United States, North America, Europe, the United Kingdom, Australia, and New Zealand; it has a market cap of ₹118.41 billion.

Operations: Marksans Pharma Limited generates revenue primarily from its pharmaceutical segment, amounting to ₹22.68 billion. The company focuses on international markets including the United States, North America, Europe, the United Kingdom, Australia, and New Zealand.

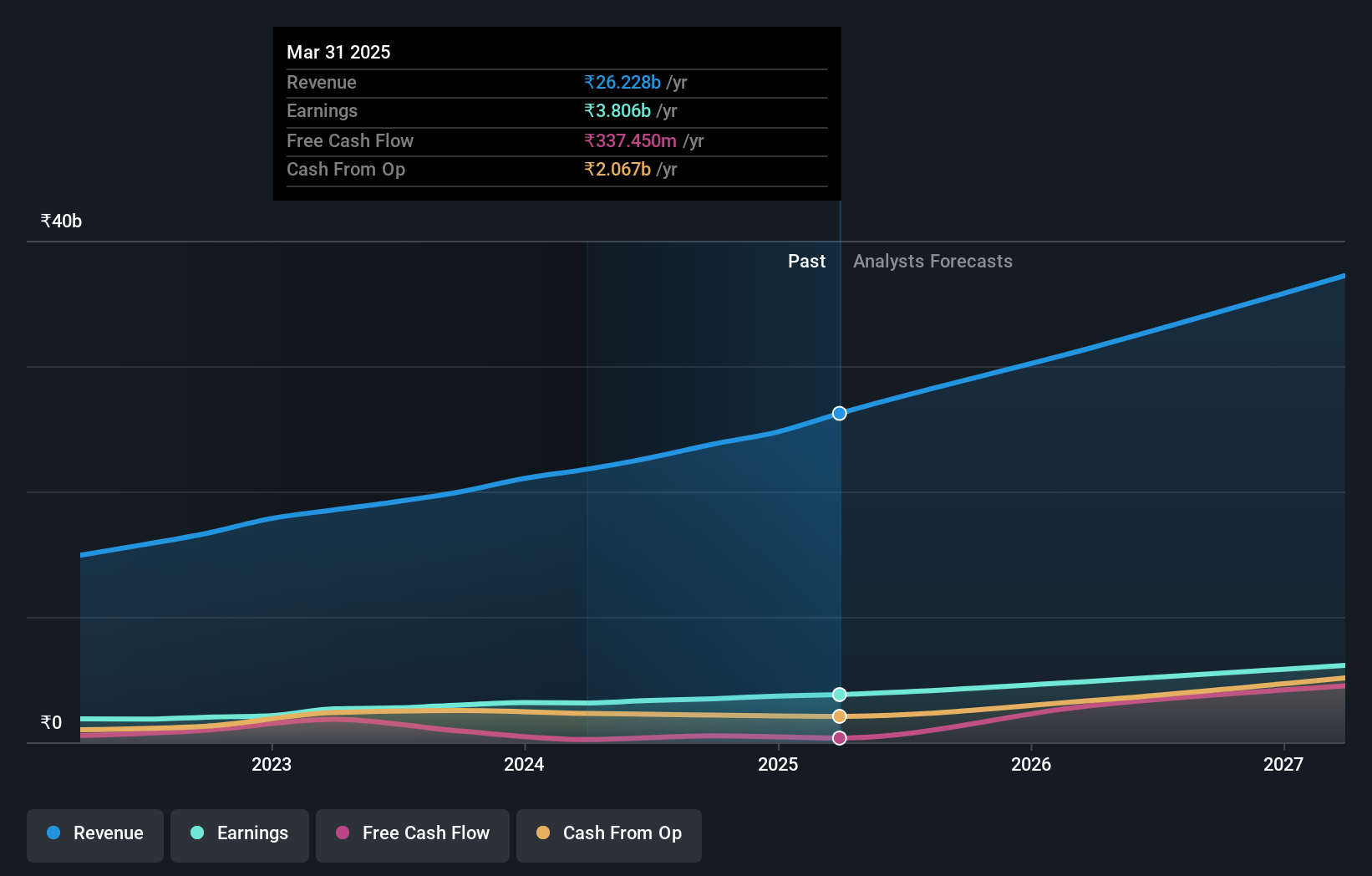

Marksans Pharma, a small cap in the pharmaceuticals sector, has shown impressive performance with earnings growing 21.7% over the past year, surpassing industry growth of 19.3%. The company’s debt to equity ratio improved from 19.9% to 11.7% in five years and its interest payments are well covered by EBIT (32.2x). Recent news includes a successful USFDA inspection and plans for M&A to expand into Europe, indicating robust future prospects.

- Delve into the full analysis health report here for a deeper understanding of Marksans Pharma.

Explore historical data to track Marksans Pharma's performance over time in our Past section.

Key Takeaways

- Gain an insight into the universe of 473 Indian Undiscovered Gems With Strong Fundamentals by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:IIFLSEC

IIFL Capital Services

Provides capital market services in the primary and secondary markets in India.

Outstanding track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives