As global markets navigate a period of economic uncertainty, small-cap stocks have shown resilience, holding up better than their large-cap counterparts amidst a busy earnings season and mixed economic signals. In this dynamic environment, identifying undiscovered gems requires focusing on companies with strong fundamentals and the potential to thrive despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Payton Industries | NA | 9.38% | 14.12% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Mendelson Infrastructures & Industries | 34.64% | 7.17% | 18.08% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Formula Systems (1985) | 35.62% | 10.91% | 13.89% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Terminal X Online | 22.05% | 11.54% | 9.32% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

ESAB India (NSEI:ESABINDIA)

Simply Wall St Value Rating: ★★★★★☆

Overview: ESAB India Limited manufactures and sells welding and cutting equipment and consumables in India, with a market capitalization of ₹98.79 billion.

Operations: ESAB India's primary revenue stream is from its Fabrication Technology segment, generating ₹12.75 billion. The company focuses on manufacturing and selling welding and cutting equipment along with consumables in the Indian market.

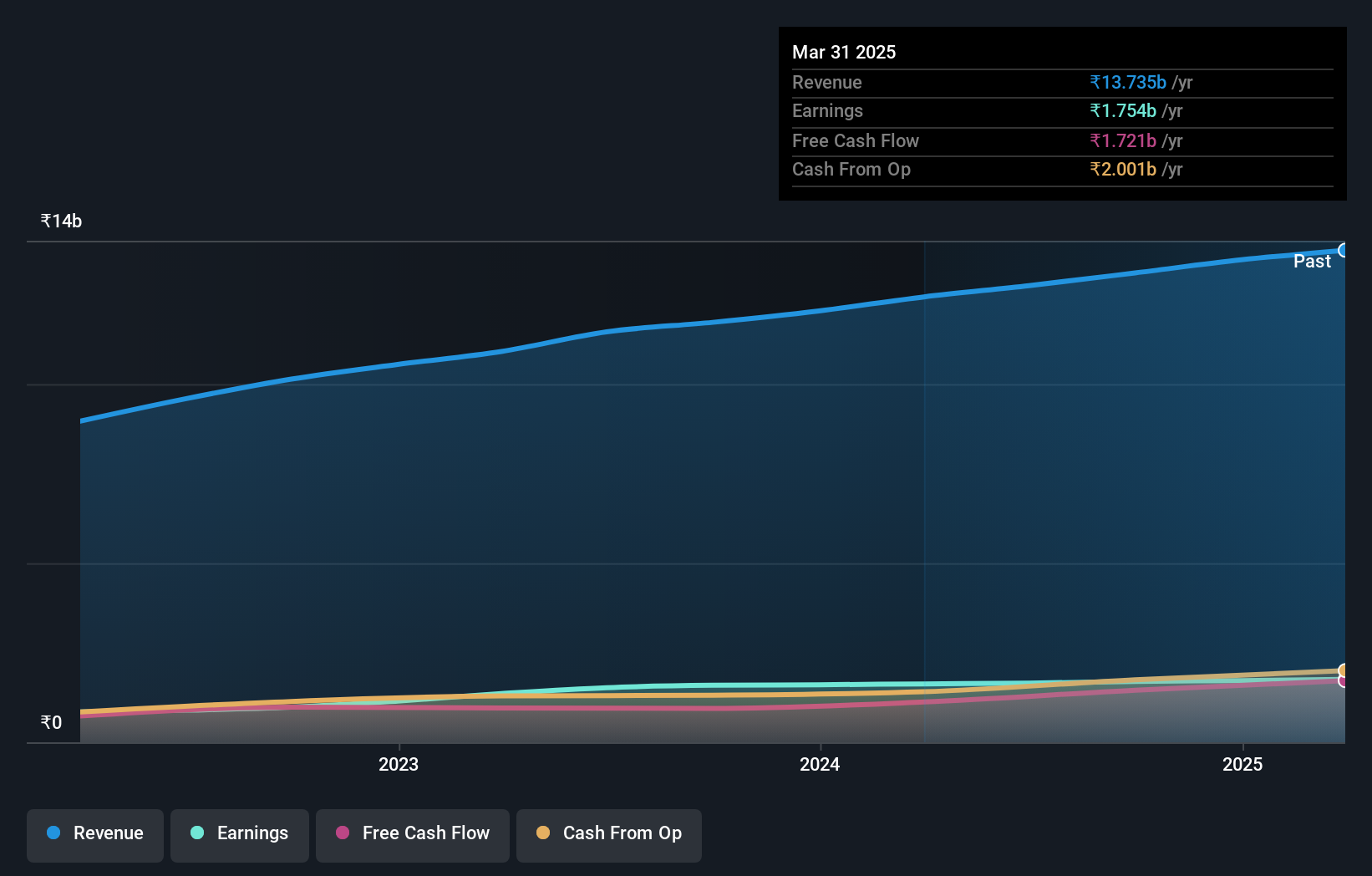

ESAB India, a promising player in the machinery sector, has seen its earnings grow at an impressive 24% annually over the past five years. Despite a modest increase in its debt to equity ratio from 0% to 1.5%, the company maintains more cash than total debt, reflecting prudent financial management. Recent quarterly results show revenue climbing to ₹3.31 billion from ₹3 billion year-on-year, with net income reaching ₹444 million compared to ₹424 million previously. The company declared a hefty dividend of ₹30 per share and appointed Deloitte Haskins & Sells as auditors for five years, signaling confidence in future prospects.

- Take a closer look at ESAB India's potential here in our health report.

Gain insights into ESAB India's past trends and performance with our Past report.

Kaveri Seed (NSEI:KSCL)

Simply Wall St Value Rating: ★★★★★★

Overview: Kaveri Seed Company Limited is engaged in the research, development, production, processing, and marketing of hybrid seeds and vegetable crop seeds in India with a market cap of ₹46.86 billion.

Operations: Kaveri Seed generates revenue primarily from the sale of hybrid and vegetable crop seeds. The company focuses on research, development, production, and marketing activities to support its revenue streams.

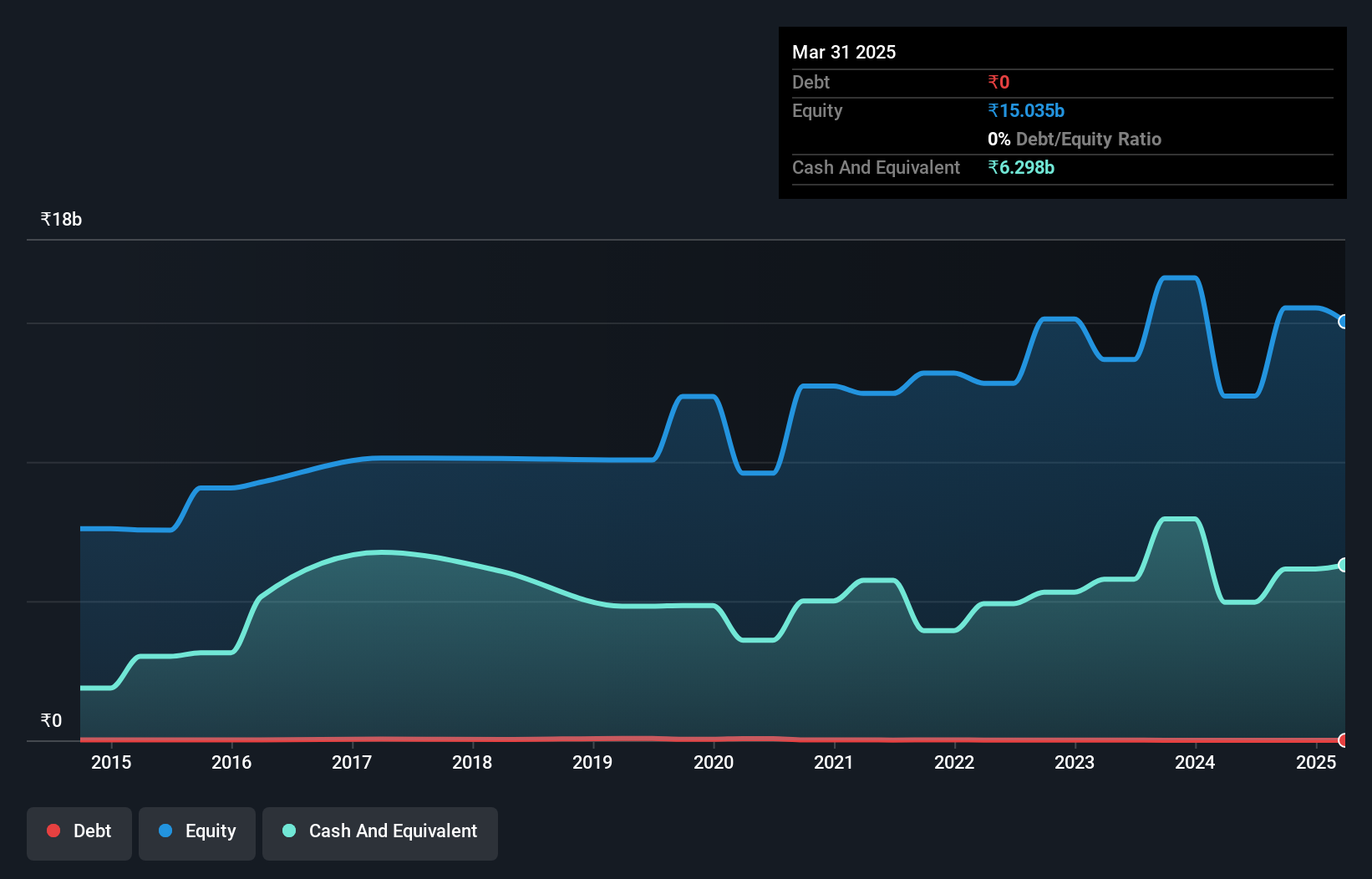

Kaveri Seed, a nimble player in the agricultural sector, boasts a debt to equity ratio that has impressively dropped from 0.7 to 0.01 over five years, highlighting prudent financial management. Despite earnings growth of 4.4% over the past year lagging behind the broader food industry at 17.1%, Kaveri's forecasted annual earnings growth stands at a promising 8.23%. The company trades at an attractive valuation, being priced 30% below its estimated fair value and demonstrates robust financial health with free cash flow positivity and high-quality earnings that comfortably cover interest payments by over a thousand times EBIT coverage.

- Delve into the full analysis health report here for a deeper understanding of Kaveri Seed.

Explore historical data to track Kaveri Seed's performance over time in our Past section.

Betsson (OM:BETS B)

Simply Wall St Value Rating: ★★★★★★

Overview: Betsson AB (publ) is a company that invests in and manages online gaming businesses across various regions including the Nordic countries, Latin America, and Europe, with a market capitalization of SEK19.56 billion.

Operations: Betsson generates revenue primarily from its Casinos & Resorts segment, which reported €1.05 billion. The company's financial performance is influenced by its net profit margin, which has shown variability over recent periods.

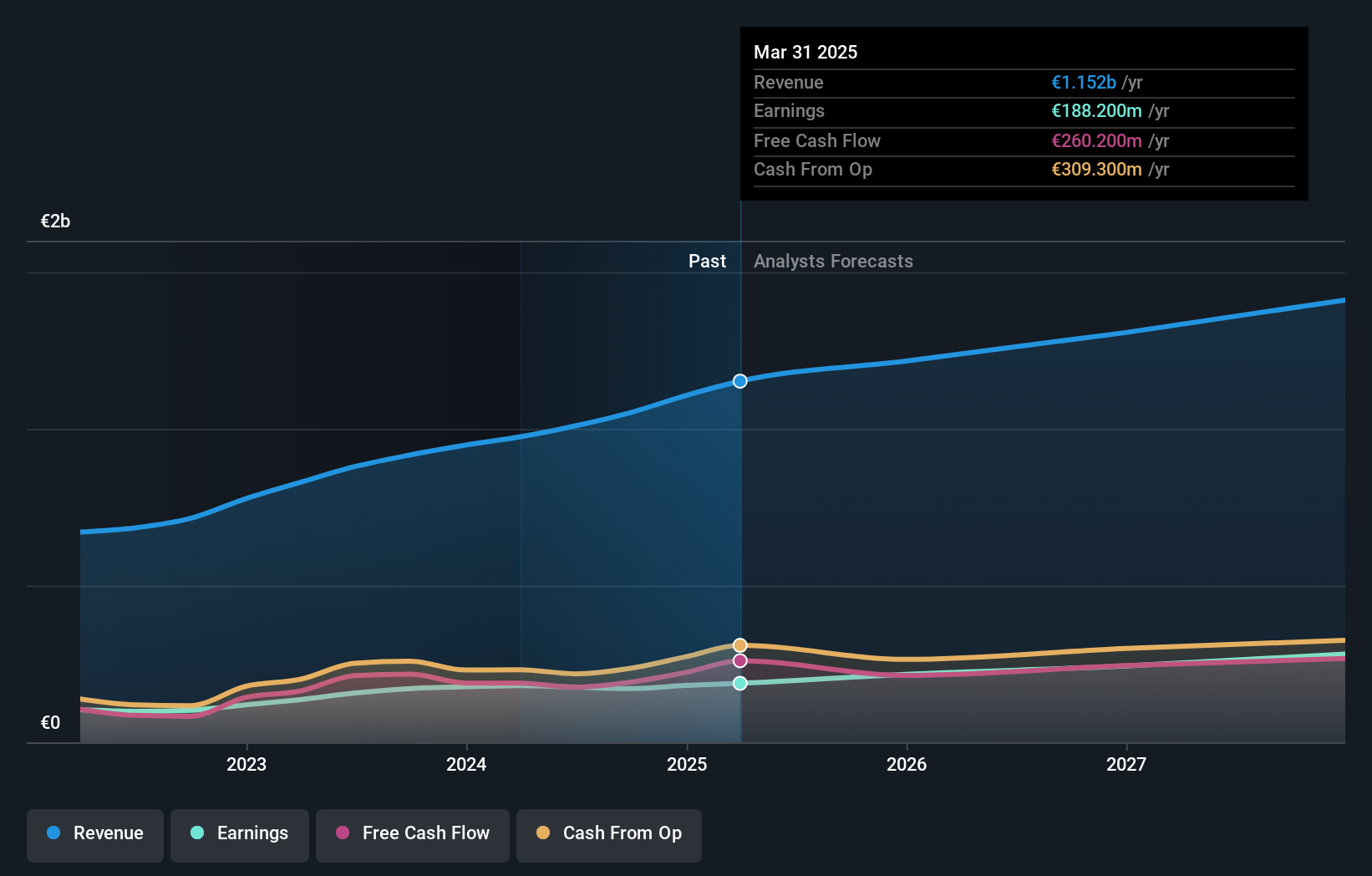

Betsson, a player in the gaming sector, shows promise with its debt to equity ratio improving from 29.7% to 26.9% over five years and interest payments well-covered at 13.8 times by EBIT. Despite trading at 71% below estimated fair value, earnings growth was flat last year against an industry average of 4.9%. Recent financial maneuvers include redeeming bonds and issuing new ones worth SEK 100 million, indicating active debt management strategies. Sales rose to €280 million in Q3 from €237 million prior year, though net income dropped slightly to €42.9 million from €47.7 million previously.

- Get an in-depth perspective on Betsson's performance by reading our health report here.

Assess Betsson's past performance with our detailed historical performance reports.

Where To Now?

- Dive into all 4739 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kaveri Seed might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:KSCL

Flawless balance sheet and fair value.

Market Insights

Community Narratives