Do Kriti Nutrients' (NSE:KRITINUT) Earnings Warrant Your Attention?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Kriti Nutrients (NSE:KRITINUT). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Kriti Nutrients

How Fast Is Kriti Nutrients Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Recognition must be given to the that Kriti Nutrients has grown EPS by 44% per year, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

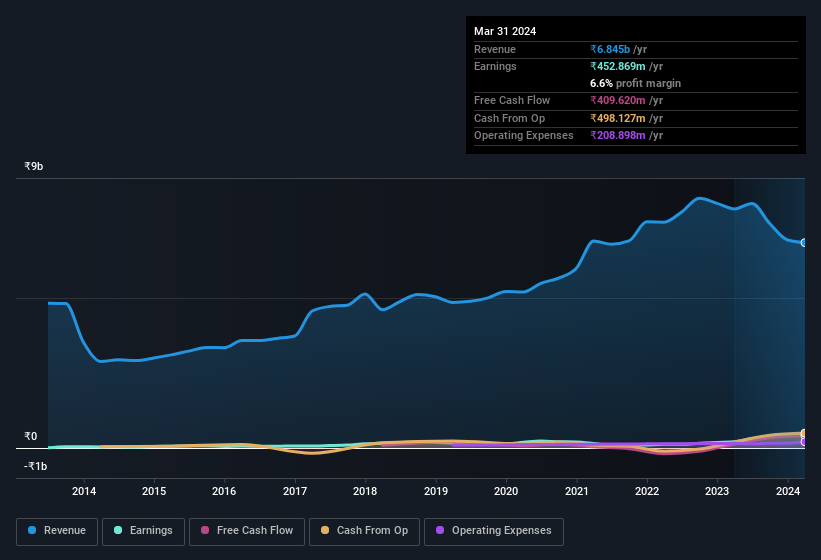

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. We note that while EBIT margins have improved from 3.4% to 8.4%, the company has actually reported a fall in revenue by 14%. While not disastrous, these figures could be better.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

Since Kriti Nutrients is no giant, with a market capitalisation of ₹5.2b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Kriti Nutrients Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

With strong conviction, Kriti Nutrients insiders have stood united by refusing to sell shares over the last year. But the bigger deal is that the Director, Purnima Mehta, paid ₹5.5m to buy shares at an average price of ₹51.89. It seems at least one insider has seen potential in the company's future - and they're willing to put money on the line.

Does Kriti Nutrients Deserve A Spot On Your Watchlist?

Kriti Nutrients' earnings per share have been soaring, with growth rates sky high. Most growth-seeking investors will find it hard to ignore that sort of explosive EPS growth. And in fact, it could well signal a fundamental shift in the business economics. If this these factors intrigue you, then an addition of Kriti Nutrients to your watchlist won't go amiss. Before you take the next step you should know about the 2 warning signs for Kriti Nutrients that we have uncovered.

Keen growth investors love to see insider activity. Thankfully, Kriti Nutrients isn't the only one. You can see a a curated list of Indian companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kriti Nutrients might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KRITINUT

Kriti Nutrients

Manufactures and sells soyabean seeds under the Kriti brand in India and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives