Hoac Foods India Limited's (NSE:HOACFOODS) Popularity With Investors Is Under Threat From Overpricing

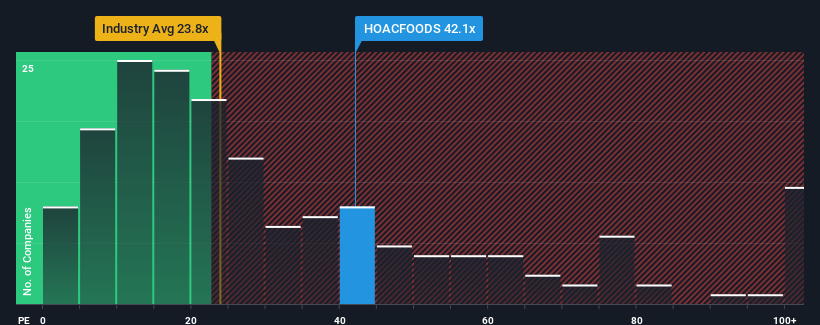

With a price-to-earnings (or "P/E") ratio of 42.1x Hoac Foods India Limited (NSE:HOACFOODS) may be sending bearish signals at the moment, given that almost half of all companies in India have P/E ratios under 30x and even P/E's lower than 17x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Earnings have risen firmly for Hoac Foods India recently, which is pleasing to see. It might be that many expect the respectable earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for Hoac Foods India

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Hoac Foods India would need to produce impressive growth in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 22% last year. The latest three year period has also seen an excellent 76% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 26% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that Hoac Foods India's P/E sits above the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Hoac Foods India revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

And what about other risks? Every company has them, and we've spotted 5 warning signs for Hoac Foods India (of which 4 shouldn't be ignored!) you should know about.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

If you're looking to trade Hoac Foods India, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hoac Foods India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HOACFOODS

Hoac Foods India

Manufactures and sells cereals, flour, and spices in India.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives