Here's Why Hindustan Foods Limited's (NSE:HNDFDS) CEO May Deserve A Raise

Shareholders will be pleased by the impressive results for Hindustan Foods Limited (NSE:HNDFDS) recently and CEO Sameer Kothari has played a key role. This would be kept in mind at the upcoming AGM on 22 September 2022 which will be a chance for them to hear the board review the financial results, discuss future company strategy and vote on resolutions such as executive remuneration and other matters. Let's take a look at why we think the CEO has done a good job and we'll present the case for a bump in pay.

View our latest analysis for Hindustan Foods

How Does Total Compensation For Sameer Kothari Compare With Other Companies In The Industry?

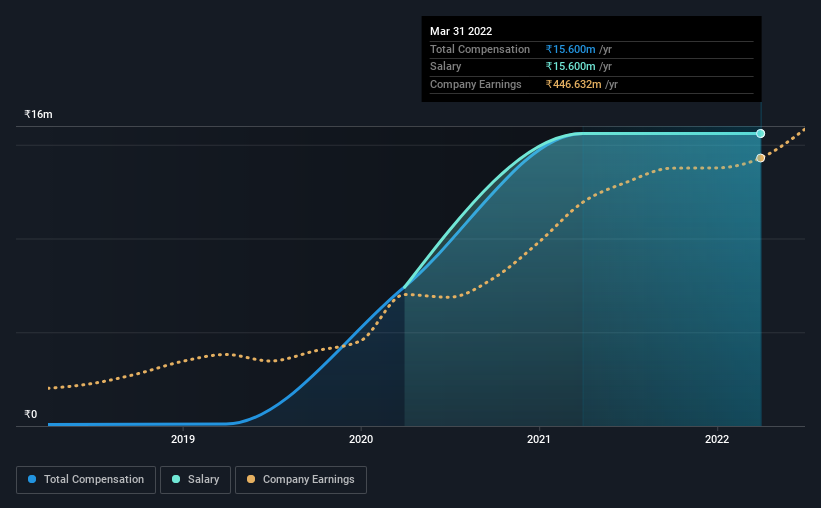

At the time of writing, our data shows that Hindustan Foods Limited has a market capitalization of ₹54b, and reported total annual CEO compensation of ₹16m for the year to March 2022. This was the same amount the CEO received in the prior year. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹16m.

On comparing similar companies from the same industry with market caps ranging from ₹32b to ₹127b, we found that the median CEO total compensation was ₹29m. Accordingly, Hindustan Foods pays its CEO under the industry median. Furthermore, Sameer Kothari directly owns ₹5.8b worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | ₹16m | ₹16m | 100% |

| Other | - | - | - |

| Total Compensation | ₹16m | ₹16m | 100% |

Talking in terms of the industry, salary represents all of total compensation among the companies we analyzed, while other remuneration is, interestingly, completely ignored. Speaking on a company level, Hindustan Foods prefers to tread along a traditional path, disbursing all compensation through a salary. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Hindustan Foods Limited's Growth

Over the past three years, Hindustan Foods Limited has seen its earnings per share (EPS) grow by 40% per year. In the last year, its revenue is up 33%.

This demonstrates that the company has been improving recently and is good news for the shareholders. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Hindustan Foods Limited Been A Good Investment?

Most shareholders would probably be pleased with Hindustan Foods Limited for providing a total return of 396% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Hindustan Foods rewards its CEO solely through a salary, ignoring non-salary benefits completely. Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 2 warning signs for Hindustan Foods you should be aware of, and 1 of them can't be ignored.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Hindustan Foods might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:HNDFDS

Hindustan Foods

Engages in the business of contract manufacturing of fast moving consumer goods in India and internationally.

High growth potential with mediocre balance sheet.