Exploring Three Promising Small Cap Stocks in India with Strong Fundamentals

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has experienced a 4.2% drop, yet it remains up by an impressive 40% over the past year with earnings forecasted to grow by 18% annually. In this dynamic environment, identifying small-cap stocks with strong fundamentals can offer promising opportunities for investors seeking growth potential amidst market fluctuations.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Vidhi Specialty Food Ingredients | 7.27% | 11.00% | 4.02% | ★★★★★★ |

| Yuken India | 27.96% | 12.35% | -44.41% | ★★★★★★ |

| ELANTAS Beck India | NA | 14.89% | 24.83% | ★★★★★★ |

| Timex Group India | 14.33% | 17.75% | 59.68% | ★★★★★★ |

| Force Motors | 23.24% | 21.52% | 44.24% | ★★★★★☆ |

| Wealth First Portfolio Managers | 4.08% | -43.42% | 42.63% | ★★★★★☆ |

| Magadh Sugar & Energy | 85.44% | 6.65% | 13.60% | ★★★★☆☆ |

| SG Mart | 16.77% | 98.09% | 96.54% | ★★★★☆☆ |

| Innovana Thinklabs | 13.59% | 12.51% | 19.96% | ★★★★☆☆ |

| Sanstar | 50.30% | -8.41% | 48.59% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

BLS International Services (NSEI:BLS)

Simply Wall St Value Rating: ★★★★★★

Overview: BLS International Services Limited specializes in outsourcing and administrative tasks for visa, passport, and consular services to various diplomatic missions, with a market cap of ₹156.70 billion.

Operations: The company generates revenue primarily from visa and consular services, amounting to ₹14.71 billion, and digital services contributing ₹3.34 billion.

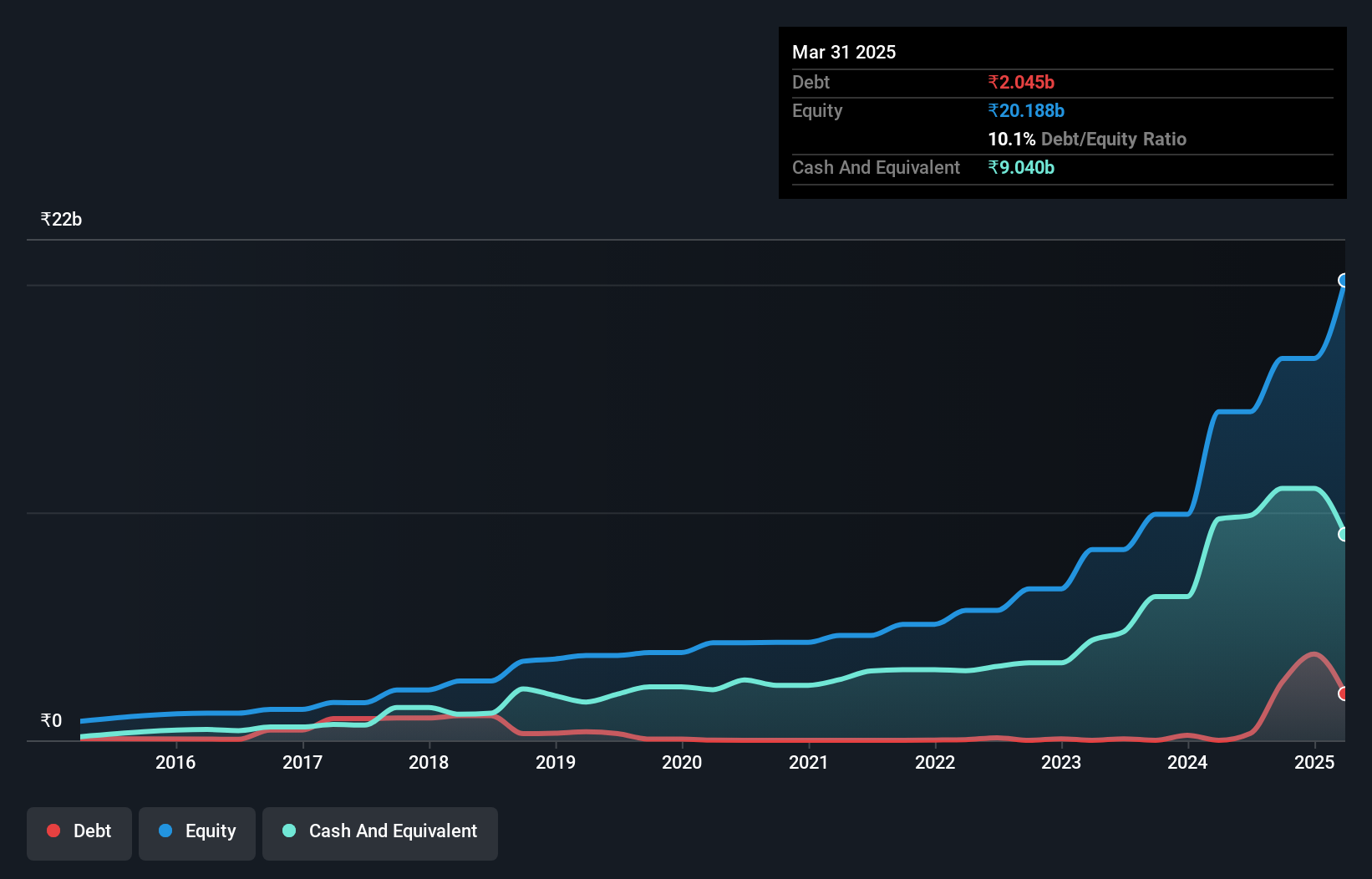

BLS International, a nimble player in the professional services sector, has shown robust financial health with its debt to equity ratio dropping from 7.8% to 2.1% over five years. The company boasts high-quality earnings and impressive growth, with earnings rising by 49.8%, outpacing the industry's average of 11.4%. Recently, BLS approved a final dividend of INR 0.50 per share and plans to acquire a majority stake in SLW Media Private Limited, signaling strategic expansion moves. With interest payments covered by EBIT at an impressive 86.8 times and positive free cash flow, BLS seems well-positioned for continued growth.

- Click here to discover the nuances of BLS International Services with our detailed analytical health report.

Gain insights into BLS International Services' past trends and performance with our Past report.

Gokul Agro Resources (NSEI:GOKULAGRO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Gokul Agro Resources Limited is involved in the manufacture and trading of edible and non-edible oils, meals, and other agro products in India with a market capitalization of ₹39.70 billion.

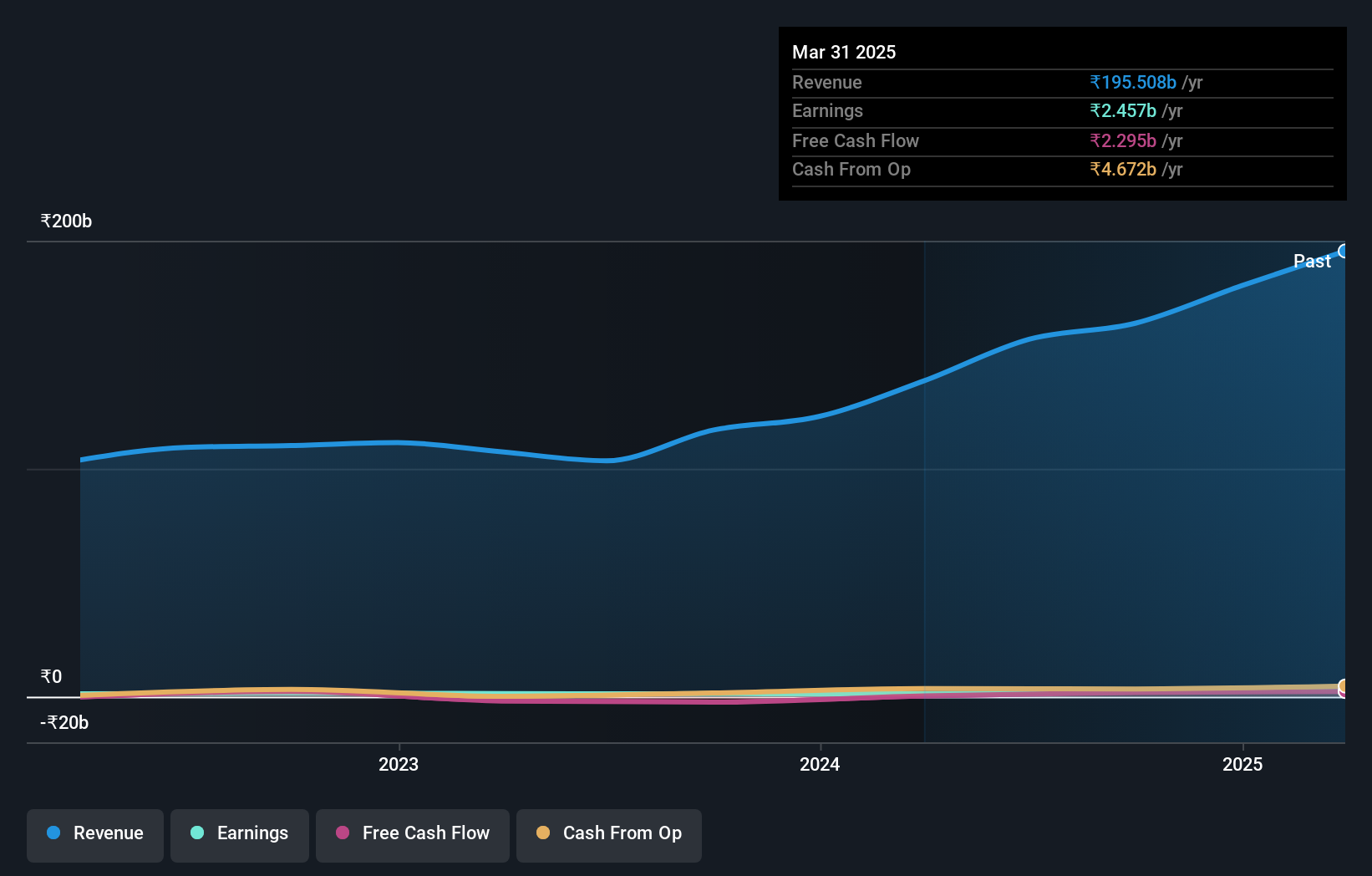

Operations: Gokul Agro derives its revenue primarily from agro-based commodities, amounting to ₹156.80 billion. The company's financial performance is influenced by the dynamics of the agro-products market, which impacts its cost structure and profitability metrics.

Gokul Agro Resources, a small yet intriguing player in India's food industry, has demonstrated robust earnings growth of 28.4% over the past year, outpacing the industry's 18.3%. The company's net debt to equity ratio stands at a satisfactory 20.1%, down from 124.4% five years ago, indicating improved financial health. Despite its profitability and positive free cash flow status, Gokul Agro faces challenges with interest coverage as EBIT only covers interest payments by 2.3 times—below the preferred threshold of three times—though its P/E ratio of 24x is attractively lower than the market average of 33x.

Spectrum Electrical Industries (NSEI:SPECTRUM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Spectrum Electrical Industries Limited operates as a designer, manufacturer, and supplier of electrical, automobile, and irrigation components with a market capitalization of ₹23.44 billion.

Operations: Spectrum Electrical Industries generates revenue primarily from the design and manufacturing of electrical, automobile, and irrigation components, totaling ₹3.28 billion.

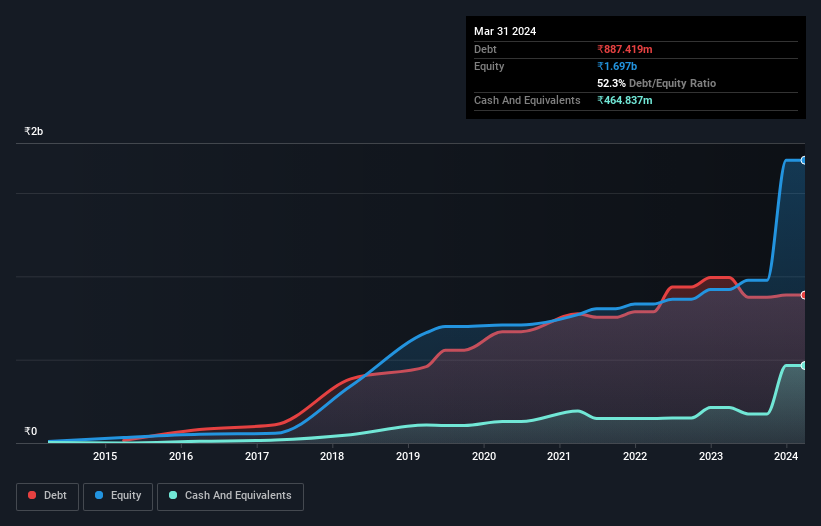

Spectrum Electrical Industries, a player in the electrical sector, showcases promising growth with earnings surging 133.4% over the past year, outpacing the industry's 29.7%. Its net debt to equity ratio stands at a satisfactory 24.9%, reflecting prudent financial management as it has decreased from 69.3% to 52.3% over five years. Despite not having positive free cash flow, its interest payments are well covered by EBIT at 4.1 times coverage. Recently securing an INR 622 million order for MRI machines further boosts its profile, indicating potential for continued momentum in domestic markets through early next year.

Turning Ideas Into Actions

- Investigate our full lineup of 459 Indian Undiscovered Gems With Strong Fundamentals right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:GOKULAGRO

Gokul Agro Resources

Engages in the manufacture and trading of edible and non-edible oils, meals, and other agro products in India.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives