- India

- /

- Oil and Gas

- /

- NSEI:RELIANCE

Little Excitement Around Reliance Industries Limited's (NSE:RELIANCE) Earnings

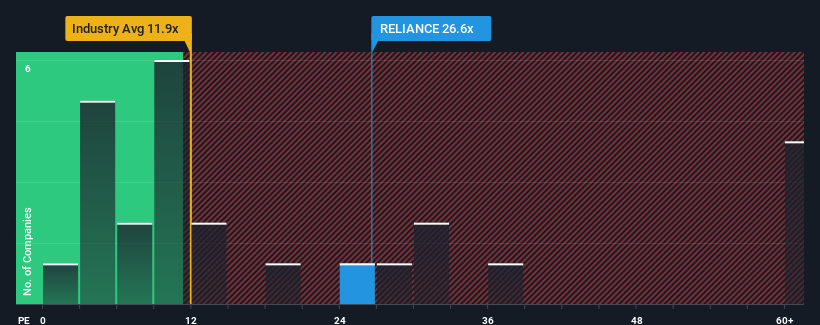

When close to half the companies in India have price-to-earnings ratios (or "P/E's") above 32x, you may consider Reliance Industries Limited (NSE:RELIANCE) as an attractive investment with its 26.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent times haven't been advantageous for Reliance Industries as its earnings have been rising slower than most other companies. It seems that many are expecting the uninspiring earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping earnings don't get any worse and that you could pick up some stock while it's out of favour.

View our latest analysis for Reliance Industries

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Reliance Industries' is when the company's growth is on track to lag the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 9.8% last year. This was backed up an excellent period prior to see EPS up by 69% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 13% per year as estimated by the analysts watching the company. That's shaping up to be materially lower than the 19% each year growth forecast for the broader market.

With this information, we can see why Reliance Industries is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Reliance Industries' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for Reliance Industries with six simple checks will allow you to discover any risks that could be an issue.

You might be able to find a better investment than Reliance Industries. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:RELIANCE

Reliance Industries

Engages in hydrocarbon exploration and production, oil and chemicals, textile, retail, digital, material and composites, renewables, and financial services businesses worldwide.

Flawless balance sheet established dividend payer.