- India

- /

- Oil and Gas

- /

- NSEI:ONGC

Lacklustre Performance Is Driving Oil and Natural Gas Corporation Limited's (NSE:ONGC) Low P/E

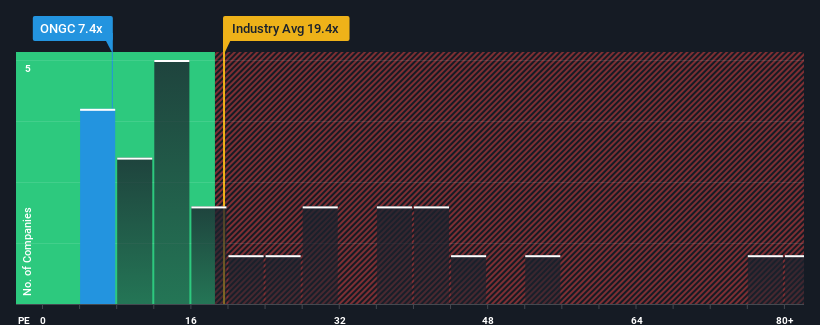

With a price-to-earnings (or "P/E") ratio of 7.4x Oil and Natural Gas Corporation Limited (NSE:ONGC) may be sending very bullish signals at the moment, given that almost half of all companies in India have P/E ratios greater than 34x and even P/E's higher than 63x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Recent times haven't been advantageous for Oil and Natural Gas as its earnings have been rising slower than most other companies. The P/E is probably low because investors think this lacklustre earnings performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Oil and Natural Gas

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Oil and Natural Gas would need to produce anemic growth that's substantially trailing the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 18% last year. The latest three year period has also seen an excellent 100% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 6.7% each year as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 19% per year, which is noticeably more attractive.

With this information, we can see why Oil and Natural Gas is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Oil and Natural Gas maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware Oil and Natural Gas is showing 1 warning sign in our investment analysis, you should know about.

If these risks are making you reconsider your opinion on Oil and Natural Gas, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade Oil and Natural Gas, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:ONGC

Oil and Natural Gas

Engages in the exploration, development, and production of crude oil and natural gas in India and internationally.

Undervalued established dividend payer.