- India

- /

- Electronic Equipment and Components

- /

- NSEI:REDINGTON

Indian Dividend Stocks To Watch In July 2024

Reviewed by Simply Wall St

The Indian market has shown robust performance recently, with a 1.2% increase over the last week and an impressive 45% rise over the past year. In this context of strong market growth and positive earnings forecasts, dividend stocks can be particularly appealing for investors looking for potential income combined with capital appreciation opportunities.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Balmer Lawrie Investments (BSE:532485) | 3.82% | ★★★★★★ |

| Gulf Oil Lubricants India (NSEI:GULFOILLUB) | 3.37% | ★★★★★☆ |

| D. B (NSEI:DBCORP) | 3.58% | ★★★★★☆ |

| HCL Technologies (NSEI:HCLTECH) | 3.26% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 8.25% | ★★★★★☆ |

| Bharat Petroleum (NSEI:BPCL) | 6.60% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.64% | ★★★★★☆ |

| Oil and Natural Gas (NSEI:ONGC) | 3.69% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.01% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.62% | ★★★★★☆ |

Click here to see the full list of 16 stocks from our Top Indian Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Indian Oil (NSEI:IOC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Indian Oil Corporation Limited operates in refining, pipeline transportation, and marketing of petroleum products across India, with a market capitalization of approximately ₹2.34 trillion.

Operations: Indian Oil Corporation Limited generates revenue primarily from petroleum products, which contributed approximately ₹83.35 billion, and petrochemicals with about ₹2.62 billion in revenue.

Dividend Yield: 8.3%

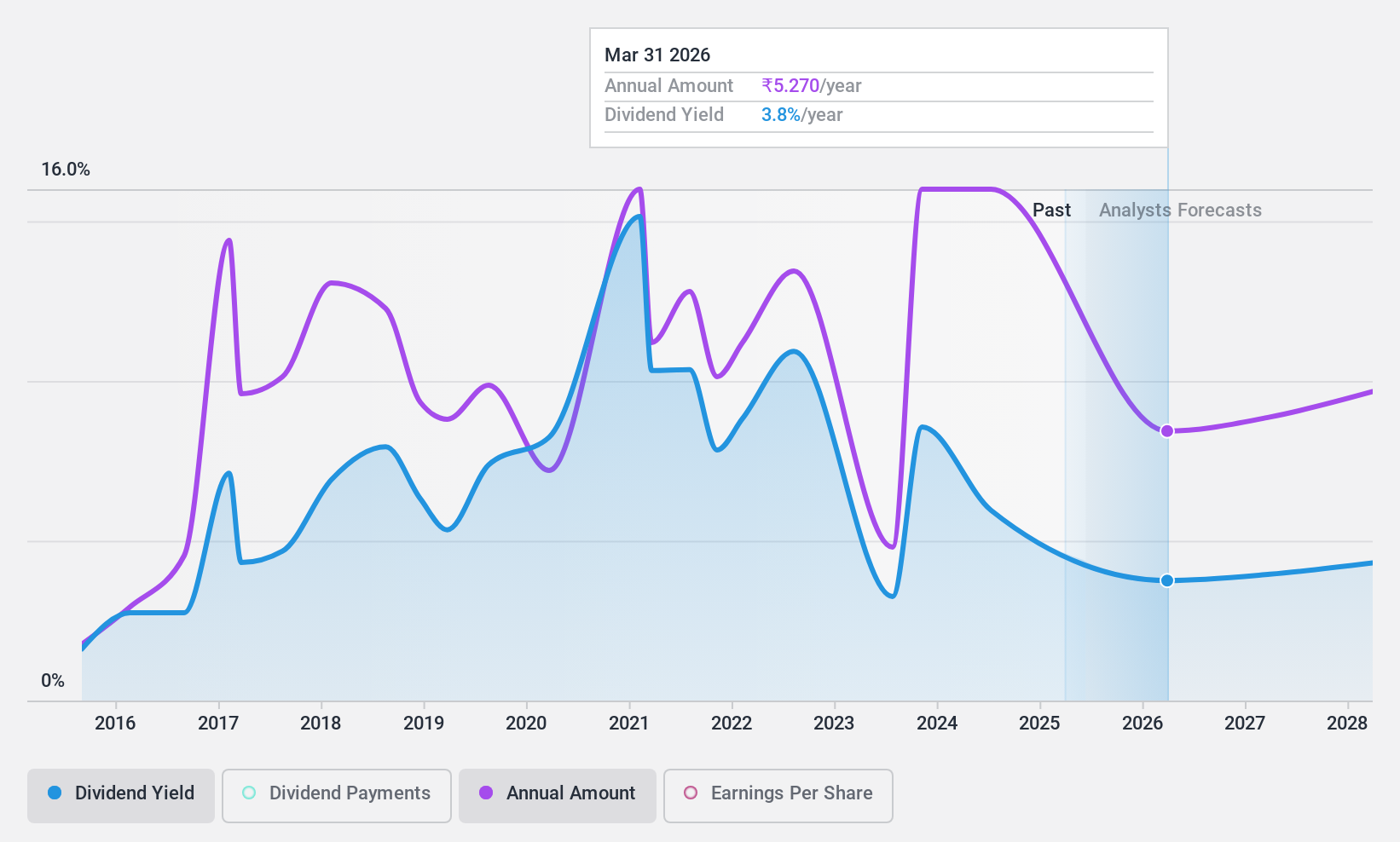

Indian Oil Corporation Limited (IOC) offers a dividend yield of 8.25%, ranking in the top 25% of Indian dividend payers, though its history reveals both volatility and unreliability in payouts over the last decade. Despite this, dividends are well-covered by earnings with a payout ratio of 39.6% and cash flows at 56.8%. However, IOC's financial outlook is clouded by an expected average earnings decline of 22.3% annually over the next three years, casting uncertainty on future dividend sustainability despite current coverage levels. Additionally, recent strategic moves include forming joint ventures aimed at enhancing biofuel adoption and battery swapping services for electric vehicles, aligning with broader environmental goals but also adding layers to its operational focus.

- Get an in-depth perspective on Indian Oil's performance by reading our dividend report here.

- The analysis detailed in our Indian Oil valuation report hints at an deflated share price compared to its estimated value.

Oil and Natural Gas (NSEI:ONGC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Oil and Natural Gas Corporation Limited (NSEI: ONGC) is engaged in the exploration, development, and production of crude oil and natural gas both domestically in India and internationally, with a market capitalization of approximately ₹4.17 trillion.

Operations: Oil and Natural Gas Corporation Limited generates revenue primarily through its refining and marketing segment in India, which accounted for ₹56.75 billion, supplemented by exploration and production activities with ₹4.39 billion from onshore operations and ₹9.43 billion from offshore operations; additionally, it earned ₹0.96 billion from international markets.

Dividend Yield: 3.7%

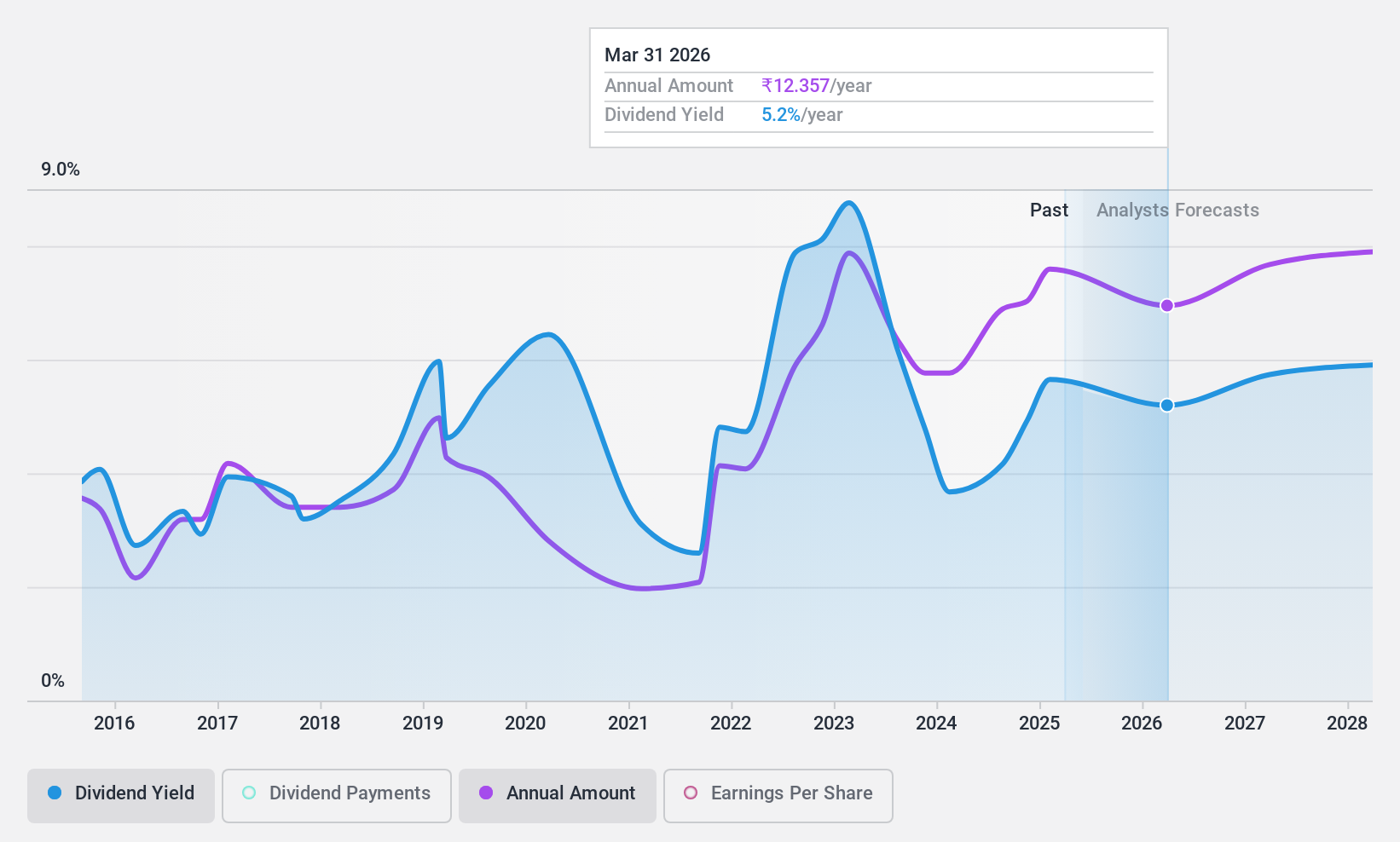

Oil and Natural Gas Corporation Limited (ONGC) has experienced fluctuations in its dividend reliability over the past decade, indicating a somewhat unstable track record. However, the dividends appear sustainable with a low payout ratio of 31.3% and a cash payout ratio of 32.5%, suggesting that both earnings and cash flows adequately cover the dividend payments. The recent appointment of Shri Vivek Chandrakant Tongaonkar as CFO could bring fresh perspectives to financial strategies, potentially influencing future dividend policies and overall financial health.

- Click here and access our complete dividend analysis report to understand the dynamics of Oil and Natural Gas.

- The valuation report we've compiled suggests that Oil and Natural Gas' current price could be quite moderate.

Redington (NSEI:REDINGTON)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Redington Limited operates as a supply chain solutions provider both in India and internationally, with a market capitalization of approximately ₹161.14 billion.

Operations: Redington Limited generates its revenue through supply chain solutions across both Indian and international markets.

Dividend Yield: 3%

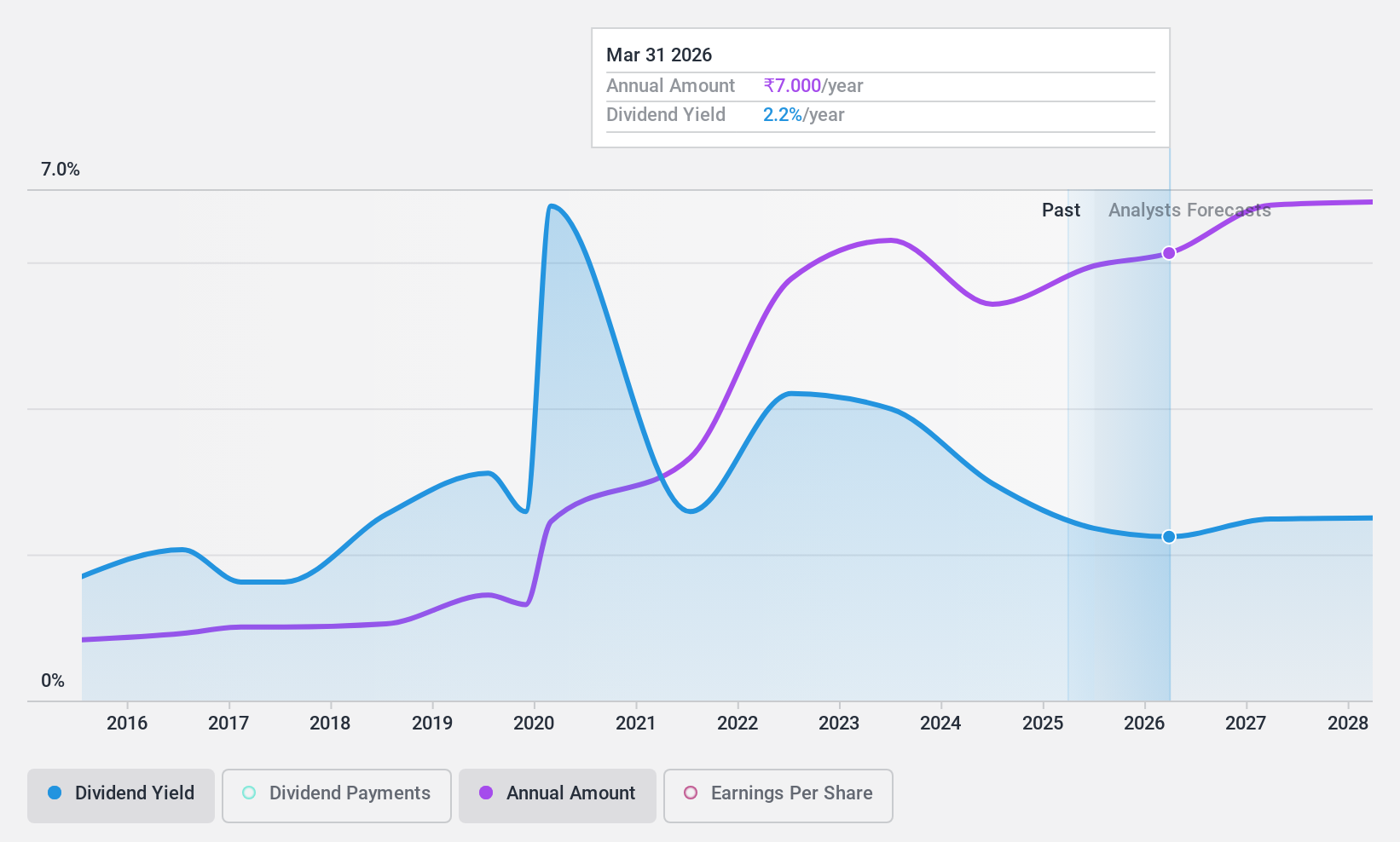

Redington's recent dividend announcement of INR 6.20 per share reflects a cautious approach amidst its unstable dividend history, with past payments showing significant variability. Despite this, the dividends are well-supported by a payout ratio of 39.8% and a cash payout ratio of 50.6%, indicating that both earnings and cash flows are sufficient to cover distributions. The company's price-to-earnings ratio at 13.2x is attractively below the Indian market average, suggesting good value relative to peers despite its erratic dividend track record.

- Click to explore a detailed breakdown of our findings in Redington's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Redington shares in the market.

Taking Advantage

- Navigate through the entire inventory of 16 Top Indian Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:REDINGTON

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives