- India

- /

- Energy Services

- /

- NSEI:GLOBALVECT

Global Vectra Helicorp Limited (NSE:GLOBALVECT) Stock Catapults 25% Though Its Price And Business Still Lag The Industry

Global Vectra Helicorp Limited (NSE:GLOBALVECT) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. The annual gain comes to 173% following the latest surge, making investors sit up and take notice.

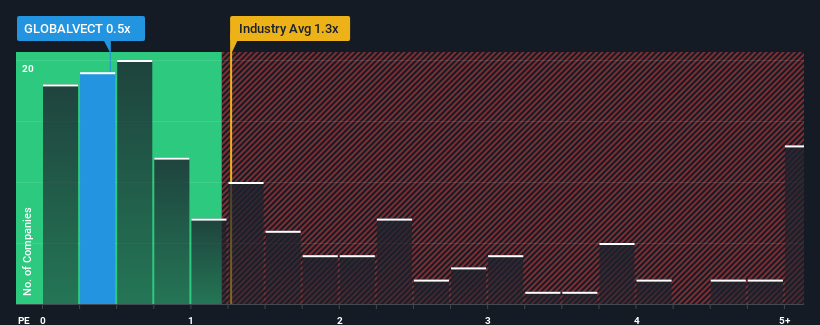

Although its price has surged higher, when around half the companies operating in India's Energy Services industry have price-to-sales ratios (or "P/S") above 4.2x, you may still consider Global Vectra Helicorp as an incredibly enticing stock to check out with its 0.5x P/S ratio. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Global Vectra Helicorp

What Does Global Vectra Helicorp's Recent Performance Look Like?

The revenue growth achieved at Global Vectra Helicorp over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Global Vectra Helicorp's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Global Vectra Helicorp's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. The latest three year period has also seen an excellent 48% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

This is in contrast to the rest of the industry, which is expected to grow by 16% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in consideration, it's easy to understand why Global Vectra Helicorp's P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

What Does Global Vectra Helicorp's P/S Mean For Investors?

Even after such a strong price move, Global Vectra Helicorp's P/S still trails the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Global Vectra Helicorp confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

It is also worth noting that we have found 3 warning signs for Global Vectra Helicorp (1 is a bit concerning!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Global Vectra Helicorp, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GLOBALVECT

Global Vectra Helicorp

Offers helicopter charter services for offshore and onshore transportation in the oil and gas exploration and production sector in India.

Slightly overvalued very low.

Market Insights

Community Narratives