- India

- /

- Energy Services

- /

- NSEI:AAKASH

We Think Aakash Exploration Services (NSE:AAKASH) Can Stay On Top Of Its Debt

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Aakash Exploration Services Limited (NSE:AAKASH) makes use of debt. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Aakash Exploration Services

What Is Aakash Exploration Services's Debt?

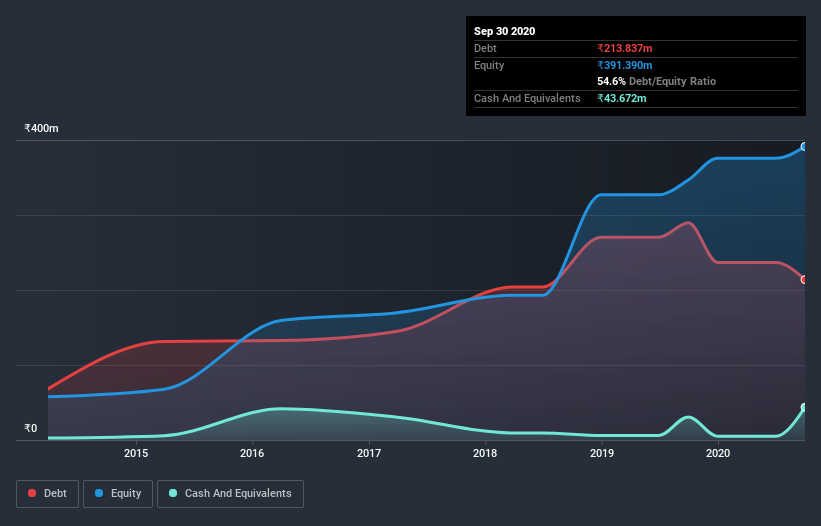

You can click the graphic below for the historical numbers, but it shows that Aakash Exploration Services had ₹213.8m of debt in September 2020, down from ₹289.5m, one year before. However, it does have ₹43.7m in cash offsetting this, leading to net debt of about ₹170.2m.

How Strong Is Aakash Exploration Services's Balance Sheet?

According to the last reported balance sheet, Aakash Exploration Services had liabilities of ₹107.5m due within 12 months, and liabilities of ₹164.4m due beyond 12 months. Offsetting this, it had ₹43.7m in cash and ₹161.2m in receivables that were due within 12 months. So it has liabilities totalling ₹67.1m more than its cash and near-term receivables, combined.

Given Aakash Exploration Services has a market capitalization of ₹589.8m, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Looking at its net debt to EBITDA of 1.1 and interest cover of 3.9 times, it seems to us that Aakash Exploration Services is probably using debt in a pretty reasonable way. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. Also relevant is that Aakash Exploration Services has grown its EBIT by a very respectable 22% in the last year, thus enhancing its ability to pay down debt. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Aakash Exploration Services will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. Over the last three years, Aakash Exploration Services saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

Aakash Exploration Services's conversion of EBIT to free cash flow was a real negative on this analysis, although the other factors we considered were considerably better. In particular, we are dazzled with its EBIT growth rate. When we consider all the factors mentioned above, we do feel a bit cautious about Aakash Exploration Services's use of debt. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Aakash Exploration Services you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you decide to trade Aakash Exploration Services, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:AAKASH

Aakash Exploration Services

Provides oil and gas field services in India.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives