- India

- /

- Capital Markets

- /

- NSEI:VLSFINANCE

Is Now The Time To Put VLS Finance (NSE:VLSFINANCE) On Your Watchlist?

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

In contrast to all that, I prefer to spend time on companies like VLS Finance (NSE:VLSFINANCE), which has not only revenues, but also profits. Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

Check out our latest analysis for VLS Finance

How Fast Is VLS Finance Growing Its Earnings Per Share?

Over the last three years, VLS Finance has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a falcon taking flight, VLS Finance's EPS soared from ₹51.43 to ₹70.38, over the last year. That's a impressive gain of 37%.

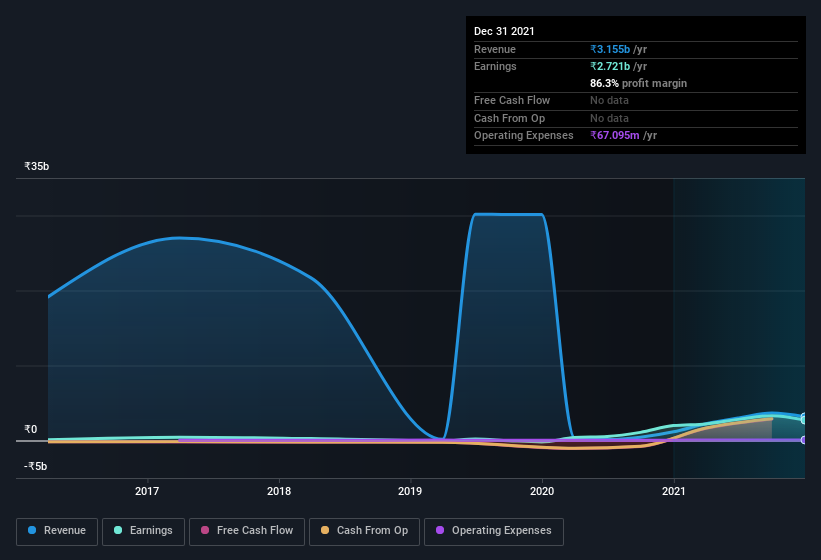

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. I note that VLS Finance's revenue from operations was lower than its revenue in the last twelve months, so that could distort my analysis of its margins. VLS Finance maintained stable EBIT margins over the last year, all while growing revenue 172% to ₹3.2b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

VLS Finance isn't a huge company, given its market capitalization of ₹5.5b. That makes it extra important to check on its balance sheet strength.

Are VLS Finance Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Like a sturdy phalanx VLS Finance insiders have stood united by refusing to sell shares over the last year. But the bigger deal is that the Additional Non Executive Non Independent Director, Divya Mehrotra, paid ₹7.0m to buy shares at an average price of ₹169.

Should You Add VLS Finance To Your Watchlist?

For growth investors like me, VLS Finance's raw rate of earnings growth is a beacon in the night. The growth rate whets my appetite for research, and the insider buying only increases my interest in the stock. To put it succinctly; VLS Finance is a strong candidate for your watchlist. Before you take the next step you should know about the 4 warning signs for VLS Finance that we have uncovered.

As a growth investor I do like to see insider buying. But VLS Finance isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:VLSFINANCE

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026