- India

- /

- Capital Markets

- /

- NSEI:SHAREINDIA

Does Share India Securities (NSE:SHAREINDIA) Deserve A Spot On Your Watchlist?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Share India Securities (NSE:SHAREINDIA). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

See our latest analysis for Share India Securities

Share India Securities' Improving Profits

Over the last three years, Share India Securities has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. So it would be better to isolate the growth rate over the last year for our analysis. In impressive fashion, Share India Securities' EPS grew from ₹25.31 to ₹63.05, over the previous 12 months. It's not often a company can achieve year-on-year growth of 149%. Shareholders will be hopeful that this is a sign of the company reaching an inflection point.

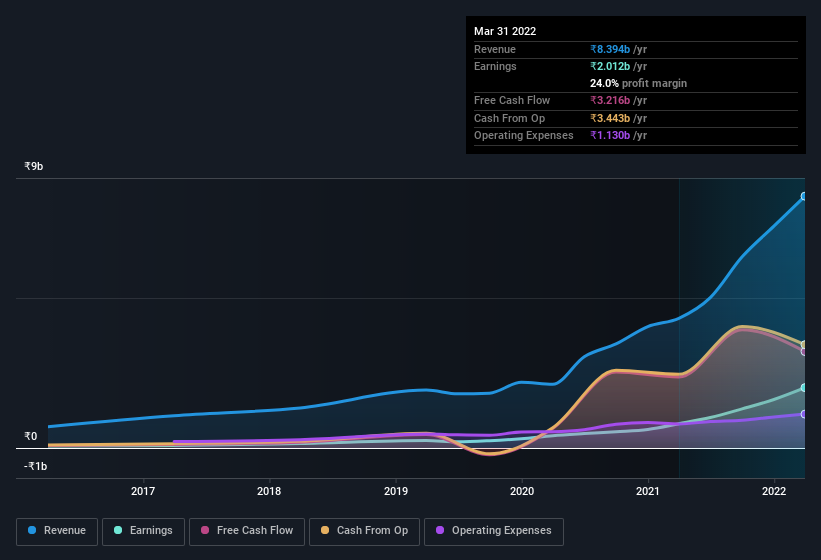

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Share India Securities maintained stable EBIT margins over the last year, all while growing revenue 94% to ₹8.4b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Share India Securities' balance sheet strength, before getting too excited.

Are Share India Securities Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We haven't seen any insiders selling Share India Securities shares, in the last year. Add in the fact that Ankit Choksi, the company insider of the company, paid ₹1.1m for shares at around ₹642 each. It seems that at least one insider is prepared to show the market there is potential within Share India Securities.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Share India Securities insiders own more than a third of the company. Indeed, with a collective holding of 69%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. And their holding is extremely valuable at the current share price, totalling ₹25b. That level of investment from insiders is nothing to sneeze at.

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. That's because Share India Securities' CEO, Sachin Gupta, is paid at a relatively modest level when compared to other CEOs for companies of this size. For companies with market capitalisations between ₹16b and ₹62b, like Share India Securities, the median CEO pay is around ₹21m.

The CEO of Share India Securities was paid just ₹2.0m in total compensation for the year ending March 2021. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Is Share India Securities Worth Keeping An Eye On?

Share India Securities' earnings per share growth have been climbing higher at an appreciable rate. The icing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Share India Securities deserves timely attention. We don't want to rain on the parade too much, but we did also find 1 warning sign for Share India Securities that you need to be mindful of.

Keen growth investors love to see insider buying. Thankfully, Share India Securities isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

If you're looking to trade Share India Securities, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SHAREINDIA

Share India Securities

Operates as a financial services company in India.

Adequate balance sheet and fair value.