- India

- /

- Consumer Finance

- /

- NSEI:SATIN

Would Shareholders Who Purchased Satin Creditcare Network's (NSE:SATIN) Stock Three Years Be Happy With The Share price Today?

Satin Creditcare Network Limited (NSE:SATIN) shareholders will doubtless be very grateful to see the share price up 35% in the last month. But that is meagre solace in the face of the shocking decline over three years. In that time the share price has melted like a snowball in the desert, down 82%. So we're relieved for long term holders to see a bit of uplift. Only time will tell if the company can sustain the turnaround.

We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

View our latest analysis for Satin Creditcare Network

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

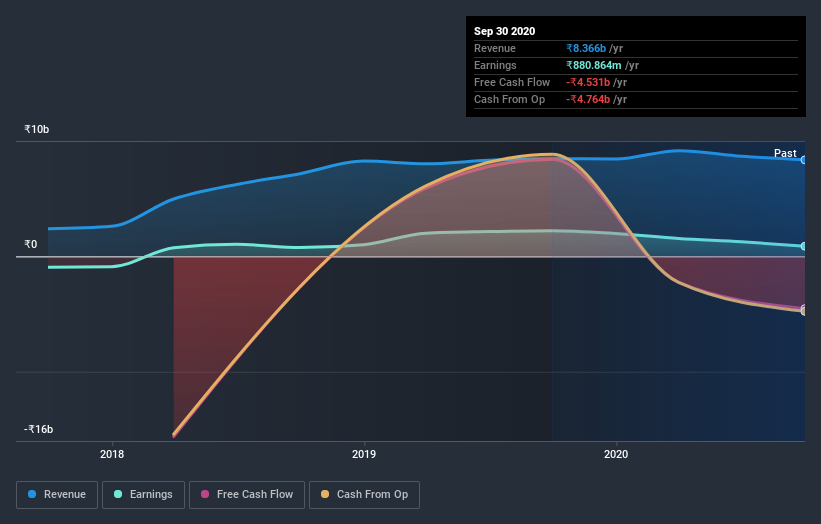

During five years of share price growth, Satin Creditcare Network moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. So given the share price is down it's worth checking some other metrics too.

Revenue is actually up 29% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching Satin Creditcare Network more closely, as sometimes stocks fall unfairly. This could present an opportunity.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

This free interactive report on Satin Creditcare Network's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

Investors in Satin Creditcare Network had a tough year, with a total loss of 65%, against a market gain of about 10.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 12% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Satin Creditcare Network is showing 5 warning signs in our investment analysis , and 1 of those doesn't sit too well with us...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading Satin Creditcare Network or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:SATIN

Satin Creditcare Network

A non-banking finance company, provides micro finance services in India.

Good value with mediocre balance sheet.