- India

- /

- Consumer Finance

- /

- NSEI:SATIN

Sentiment Still Eluding Satin Creditcare Network Limited (NSE:SATIN)

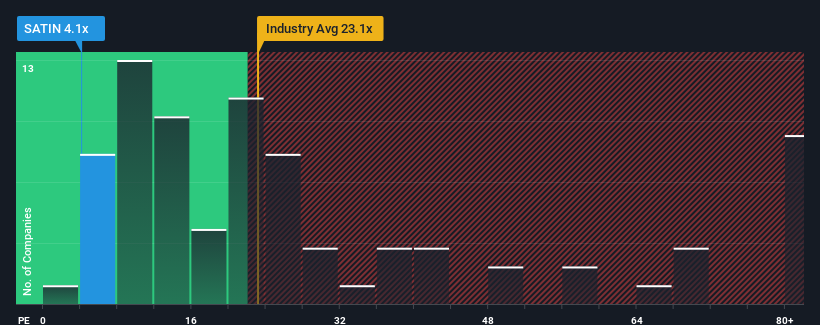

With a price-to-earnings (or "P/E") ratio of 4.1x Satin Creditcare Network Limited (NSE:SATIN) may be sending very bullish signals at the moment, given that almost half of all companies in India have P/E ratios greater than 33x and even P/E's higher than 63x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

While the market has experienced earnings growth lately, Satin Creditcare Network's earnings have gone into reverse gear, which is not great. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

View our latest analysis for Satin Creditcare Network

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, Satin Creditcare Network would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's bottom line. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings should grow by 29% each year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 19% per annum, which is noticeably less attractive.

In light of this, it's peculiar that Satin Creditcare Network's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From Satin Creditcare Network's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Satin Creditcare Network's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. There could be some major unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

You always need to take note of risks, for example - Satin Creditcare Network has 1 warning sign we think you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SATIN

Satin Creditcare Network

A non-banking finance company, provides micro finance services in India.

High growth potential and fair value.

Market Insights

Community Narratives