- India

- /

- Diversified Financial

- /

- NSEI:PFC

Power Finance Corporation Limited's (NSE:PFC) Price Is Right But Growth Is Lacking After Shares Rocket 26%

Power Finance Corporation Limited (NSE:PFC) shareholders have had their patience rewarded with a 26% share price jump in the last month. The last month tops off a massive increase of 268% in the last year.

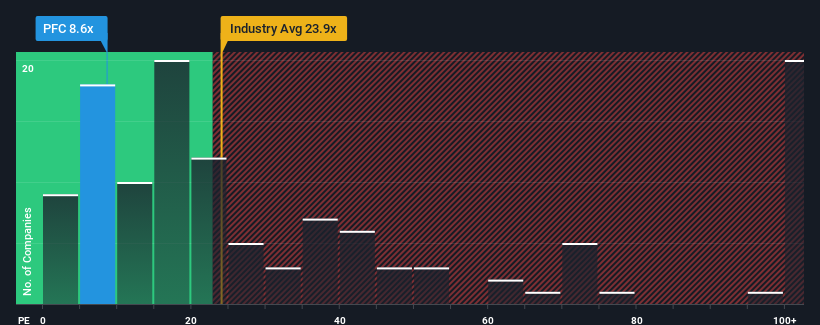

In spite of the firm bounce in price, given about half the companies in India have price-to-earnings ratios (or "P/E's") above 32x, you may still consider Power Finance as a highly attractive investment with its 8.6x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Power Finance's earnings growth of late has been pretty similar to most other companies. It might be that many expect the mediocre earnings performance to degrade, which has repressed the P/E. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

See our latest analysis for Power Finance

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Power Finance's to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 24%. The strong recent performance means it was also able to grow EPS by 68% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the five analysts covering the company suggest earnings growth is heading into negative territory, declining 1.4% per year over the next three years. Meanwhile, the broader market is forecast to expand by 21% each year, which paints a poor picture.

In light of this, it's understandable that Power Finance's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Key Takeaway

Shares in Power Finance are going to need a lot more upward momentum to get the company's P/E out of its slump. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Power Finance maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

It is also worth noting that we have found 3 warning signs for Power Finance (2 are significant!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PFC

Power Finance

A non-banking finance company, provides financial products and related advisory, and other services to the power sector in India.

Undervalued average dividend payer.

Market Insights

Community Narratives