- India

- /

- Diversified Financial

- /

- NSEI:PAYTM

One97 Communications Limited's (NSE:PAYTM) Shares Not Telling The Full Story

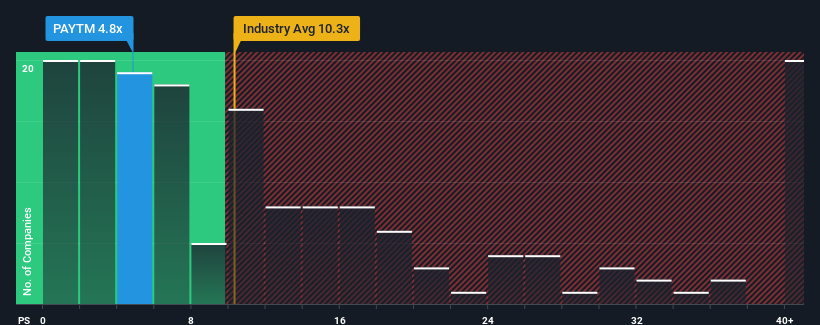

You may think that with a price-to-sales (or "P/S") ratio of 4.8x One97 Communications Limited (NSE:PAYTM) is definitely a stock worth checking out, seeing as almost half of all the Diversified Financial companies in India have P/S ratios greater than 10.3x and even P/S above 21x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for One97 Communications

What Does One97 Communications' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, One97 Communications has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on One97 Communications.Is There Any Revenue Growth Forecasted For One97 Communications?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like One97 Communications' to be considered reasonable.

Retrospectively, the last year delivered an exceptional 41% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 263% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue growth will be highly resilient over the next three years growing by 20% each year. That would be an excellent outcome when the industry is expected to decline by 8.5% each year.

In light of this, it's quite peculiar that One97 Communications' P/S sits below the majority of other companies. Apparently some shareholders are doubtful of the contrarian forecasts and have been accepting significantly lower selling prices.

The Bottom Line On One97 Communications' P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of One97 Communications' analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't contributing to its P/S anywhere near as much as we would have predicted. We believe there could be some underlying risks that are keeping the P/S modest in the context of above-average revenue growth. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. So, the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for One97 Communications with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PAYTM

One97 Communications

Provides payment, commerce and cloud, and financial services to consumers and merchants in India, the United Arab Emirates, Saudi Arabia, and Singapore.

High growth potential with excellent balance sheet.