- India

- /

- Diversified Financial

- /

- NSEI:PAYTM

Investors Still Aren't Entirely Convinced By One97 Communications Limited's (NSE:PAYTM) Revenues Despite 30% Price Jump

One97 Communications Limited (NSE:PAYTM) shares have continued their recent momentum with a 30% gain in the last month alone. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 20% in the last twelve months.

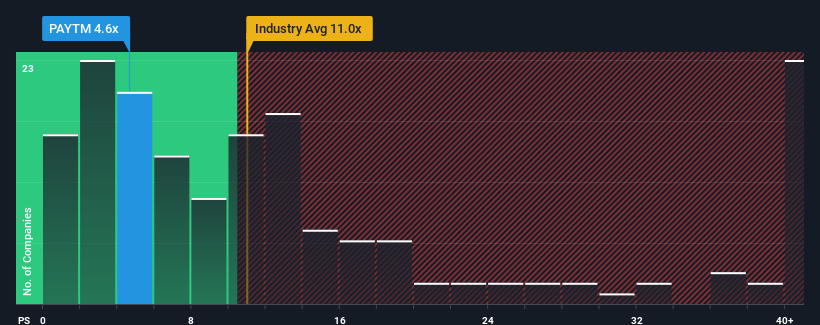

Although its price has surged higher, One97 Communications may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 4.6x, since almost half of all companies in the Diversified Financial industry in India have P/S ratios greater than 11x and even P/S higher than 19x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for One97 Communications

What Does One97 Communications' P/S Mean For Shareholders?

One97 Communications could be doing better as it's been growing revenue less than most other companies lately. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on One97 Communications.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like One97 Communications' to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 5.6%. This was backed up an excellent period prior to see revenue up by 191% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 10% per year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 11% per year, which is not materially different.

With this information, we find it odd that One97 Communications is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

Shares in One97 Communications have risen appreciably however, its P/S is still subdued. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've seen that One97 Communications currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for One97 Communications with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:PAYTM

One97 Communications

Provides payment, commerce and cloud, and financial services to consumers and merchants in India.

Excellent balance sheet with reasonable growth potential.