- India

- /

- Consumer Finance

- /

- NSEI:MUTHOOTFIN

Is Now The Time To Put Muthoot Finance (NSE:MUTHOOTFIN) On Your Watchlist?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Muthoot Finance (NSE:MUTHOOTFIN). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Muthoot Finance

How Quickly Is Muthoot Finance Increasing Earnings Per Share?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. Over the last three years, Muthoot Finance has grown EPS by 4.8% per year. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

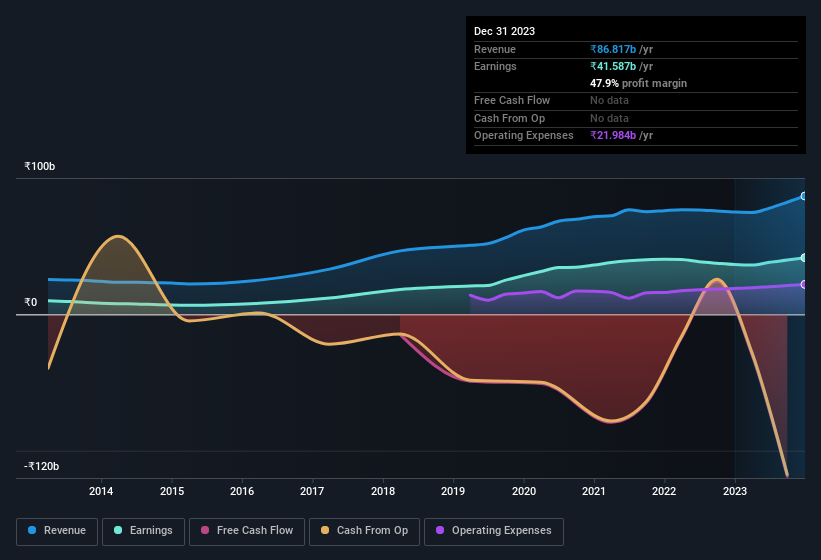

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Not all of Muthoot Finance's revenue this year is revenue from operations, so keep in mind the revenue and margin numbers used in this article might not be the best representation of the underlying business. Muthoot Finance maintained stable EBIT margins over the last year, all while growing revenue 16% to ₹87b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Muthoot Finance's forecast profits?

Are Muthoot Finance Insiders Aligned With All Shareholders?

Theory would suggest that it's an encouraging sign to see high insider ownership of a company, since it ties company performance directly to the financial success of its management. So as you can imagine, the fact that Muthoot Finance insiders own a significant number of shares certainly is appealing. Indeed, with a collective holding of 68%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. And their holding is extremely valuable at the current share price, totalling ₹364b. That means they have plenty of their own capital riding on the performance of the business!

Should You Add Muthoot Finance To Your Watchlist?

One positive for Muthoot Finance is that it is growing EPS. That's nice to see. For those who are looking for a little more than this, the high level of insider ownership enhances our enthusiasm for this growth. These two factors are a huge highlight for the company which should be a strong contender your watchlists. We don't want to rain on the parade too much, but we did also find 2 warning signs for Muthoot Finance (1 is potentially serious!) that you need to be mindful of.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in IN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MUTHOOTFIN

Muthoot Finance

A non-banking financing company, primarily engages in the provision of gold loan in India.

Average dividend payer and fair value.