- India

- /

- Capital Markets

- /

- NSEI:MOTILALOFS

Do Motilal Oswal Financial Services' (NSE:MOTILALOFS) Earnings Warrant Your Attention?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Motilal Oswal Financial Services (NSE:MOTILALOFS). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Motilal Oswal Financial Services

How Quickly Is Motilal Oswal Financial Services Increasing Earnings Per Share?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. That makes EPS growth an attractive quality for any company. To the delight of shareholders, Motilal Oswal Financial Services has achieved impressive annual EPS growth of 51%, compound, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

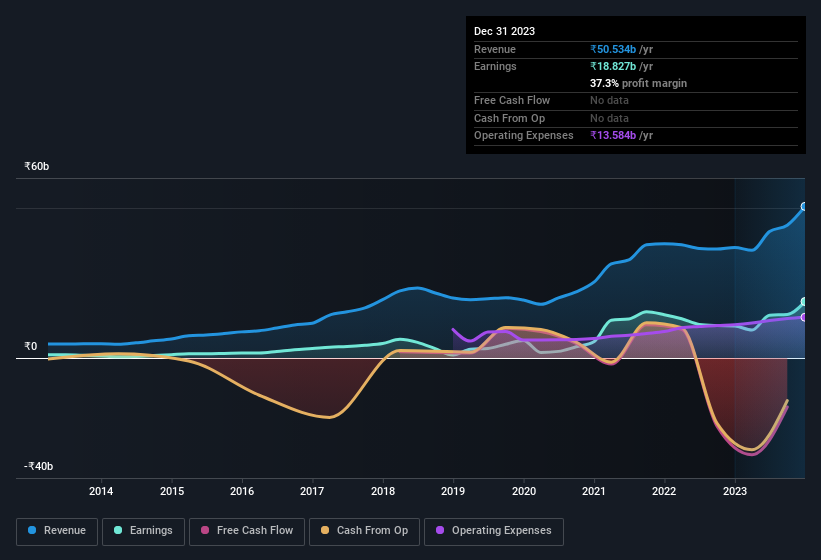

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. It's noted that Motilal Oswal Financial Services' revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. While we note Motilal Oswal Financial Services achieved similar EBIT margins to last year, revenue grew by a solid 37% to ₹51b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Motilal Oswal Financial Services?

Are Motilal Oswal Financial Services Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Although we did see some insider selling (worth ₹17m) this was overshadowed by a mountain of buying, totalling ₹205m in just one year. We find this encouraging because it suggests they are optimistic about Motilal Oswal Financial Services'future. It is also worth noting that it was Co-Founder Motilal Oswal who made the biggest single purchase, worth ₹73m, paying ₹562 per share.

On top of the insider buying, we can also see that Motilal Oswal Financial Services insiders own a large chunk of the company. In fact, they own 76% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. This insider holding amounts to That level of investment from insiders is nothing to sneeze at.

While insiders are apparently happy to hold and accumulate shares, that is just part of the big picture. That's because on our analysis the CEO, Motilal Oswal, is paid less than the median for similar sized companies. For companies with market capitalisations between ₹165b and ₹530b, like Motilal Oswal Financial Services, the median CEO pay is around ₹45m.

Motilal Oswal Financial Services offered total compensation worth ₹24m to its CEO in the year to March 2023. That comes in below the average for similar sized companies and seems pretty reasonable. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Does Motilal Oswal Financial Services Deserve A Spot On Your Watchlist?

Motilal Oswal Financial Services' earnings have taken off in quite an impressive fashion. Just as heartening; insiders both own and are buying more stock. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Motilal Oswal Financial Services belongs near the top of your watchlist. Even so, be aware that Motilal Oswal Financial Services is showing 2 warning signs in our investment analysis , and 1 of those shouldn't be ignored...

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Motilal Oswal Financial Services, you'll probably love this curated collection of companies in IN that have witnessed growth alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:MOTILALOFS

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives