- India

- /

- Diversified Financial

- /

- NSEI:JSWHL

Discovering 3 Undiscovered Gems in India

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has remained flat, yet it boasts a remarkable 40% increase over the past year with earnings forecasted to grow by 17% annually. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can be key to discovering hidden opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Vidhi Specialty Food Ingredients | 7.27% | 11.00% | 4.02% | ★★★★★★ |

| 3B Blackbio Dx | 0.38% | -0.88% | -1.47% | ★★★★★★ |

| Le Travenues Technology | 10.32% | 26.39% | 67.32% | ★★★★★★ |

| TechNVision Ventures | 100.73% | 20.37% | 68.50% | ★★★★★★ |

| Knowledge Marine & Engineering Works | 35.48% | 42.61% | 42.95% | ★★★★★★ |

| Gallantt Ispat | 18.85% | 37.56% | 37.26% | ★★★★★☆ |

| Voith Paper Fabrics India | 0.07% | 10.95% | 9.70% | ★★★★★☆ |

| Master Trust | 37.05% | 27.64% | 41.99% | ★★★★★☆ |

| Macpower CNC Machines | 0.40% | 22.04% | 31.09% | ★★★★★☆ |

| Share India Securities | 24.23% | 37.59% | 48.98% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

IFB Industries (NSEI:IFBIND)

Simply Wall St Value Rating: ★★★★★☆

Overview: IFB Industries Limited, along with its subsidiaries, is engaged in the manufacturing and trading of home appliances both in India and internationally, with a market capitalization of ₹94.40 billion.

Operations: IFB Industries generates revenue primarily from its Home Appliances segment, contributing ₹36.32 billion, followed by the Engineering segment at ₹8.55 billion. The Steel and Motor segments add ₹1.65 billion and ₹670.70 million, respectively, to the total revenue stream.

IFB Industries, a notable player in the consumer durables sector, has shown impressive financial performance. Earnings surged by 612%, outpacing the industry growth of 16.6%. The company reported a net income of ₹375 million for Q1 2024, reversing a loss from the previous year. With cash exceeding total debt and interest payments well-covered at 7.5 times by EBIT, its financial health is robust. However, the debt-to-equity ratio has risen to 22.9% over five years, indicating increased leverage but manageable due to positive free cash flow and high-quality earnings.

- Unlock comprehensive insights into our analysis of IFB Industries stock in this health report.

Gain insights into IFB Industries' past trends and performance with our Past report.

JSW Holdings (NSEI:JSWHL)

Simply Wall St Value Rating: ★★★★★☆

Overview: JSW Holdings Limited is a non-banking financial company focused on investing and financing activities in India, with a market capitalization of ₹119.41 billion.

Operations: JSW Holdings generates revenue primarily through its investing and financing activities, amounting to ₹1.71 billion.

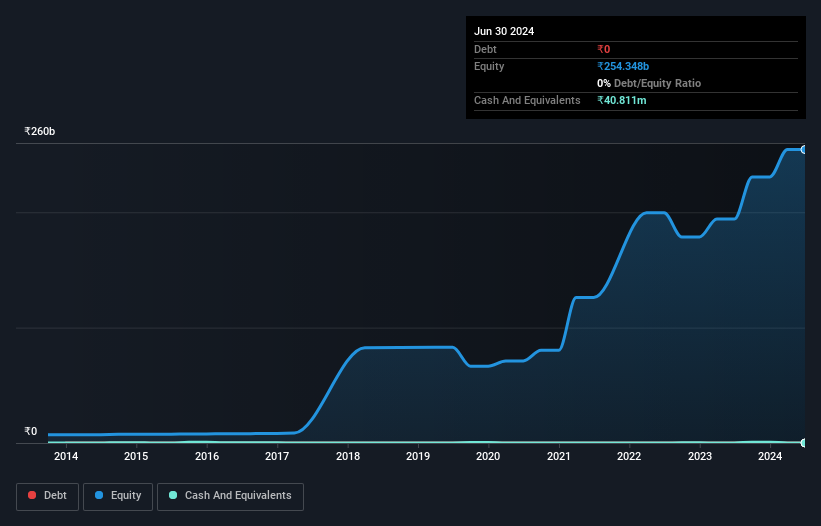

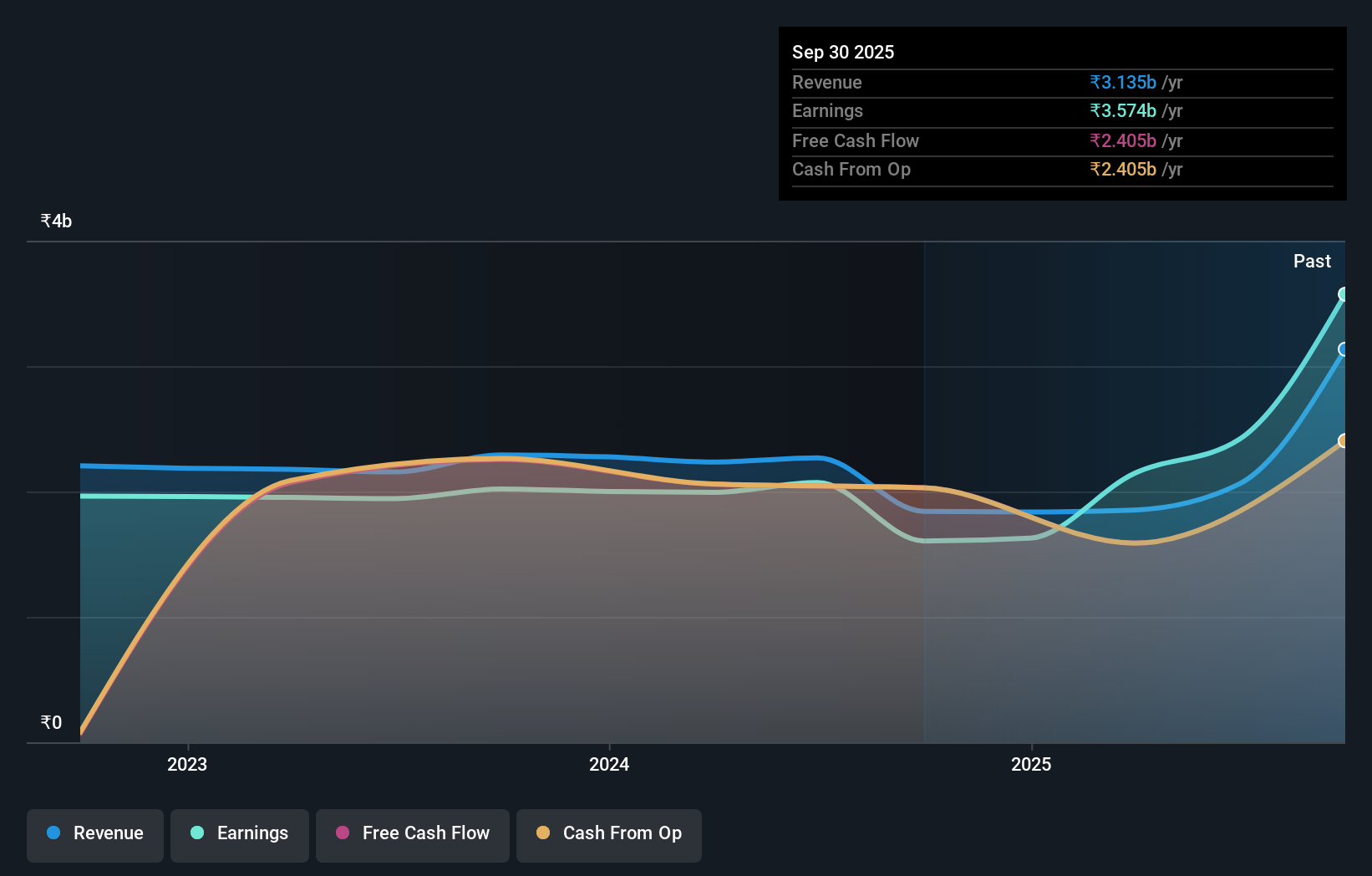

JSW Holdings, a nimble player in the Indian market, showcases a mixed bag of strengths and challenges. Despite being debt-free for five years, it faces hurdles with negative earnings growth of 47.5% compared to an industry average surge of 66.6%. However, its profitability ensures cash runway isn't an issue and free cash flow remains positive. Recent inclusion in the S&P Global BMI Index hints at growing recognition. The first quarter reported net income surged to INR 525 million from INR 244 million last year, with basic earnings per share jumping to INR 47 from INR 22, reflecting robust performance amidst industry headwinds.

- Click to explore a detailed breakdown of our findings in JSW Holdings' health report.

Gain insights into JSW Holdings' historical performance by reviewing our past performance report.

Maharashtra Scooters (NSEI:MAHSCOOTER)

Simply Wall St Value Rating: ★★★★★☆

Overview: Maharashtra Scooters Ltd. specializes in manufacturing and selling pressure die casting dies, jigs, fixtures, and die casting components for the two and three-wheeler industry in India, with a market cap of ₹141.16 billion.

Operations: The company's primary revenue streams are derived from investments, contributing ₹2.14 billion, and manufacturing activities, which add ₹108.10 million.

Maharashtra Scooters, a nimble player in the Indian market, demonstrates high-quality earnings and remains debt-free. Over the past five years, its earnings have grown at an impressive 19.3% annually. Despite this growth, recent performance shows some challenges; revenue for Q2 2024 was ₹1.63 billion compared to ₹2.06 billion last year, with net income at ₹1.51 billion down from ₹1.98 billion previously. The company declared an interim dividend of ₹110 per share and has been actively managing board changes, including appointing Jasmine Chaney as a new independent director while seeing other directors' terms conclude or resignations occur due to professional commitments.

- Click here and access our complete health analysis report to understand the dynamics of Maharashtra Scooters.

Explore historical data to track Maharashtra Scooters' performance over time in our Past section.

Key Takeaways

- Take a closer look at our Indian Undiscovered Gems With Strong Fundamentals list of 467 companies by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:JSWHL

JSW Holdings

A non-banking financial company, primarily engages in investing and financing activities in India.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.