- India

- /

- Specialty Stores

- /

- NSEI:MOTISONS

Spotlighting Undiscovered Gems with Potential In November 2024

Reviewed by Simply Wall St

As global markets navigate the complexities of political shifts and economic indicators, small-cap stocks have shown varied performances, with indices like the S&P 600 reflecting both opportunities and challenges. In this environment, investors are increasingly focused on discovering lesser-known stocks that may offer potential growth amidst broader market fluctuations. Identifying a promising stock often involves assessing its fundamentals, market position, and adaptability to current economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Gallantt Ispat | 15.54% | 36.20% | 40.12% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Macpower CNC Machines | NA | 22.62% | 35.18% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| TechNVision Ventures | 100.73% | 20.37% | 68.50% | ★★★★★★ |

| Shree Pushkar Chemicals & Fertilisers | 21.25% | 18.34% | 4.43% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

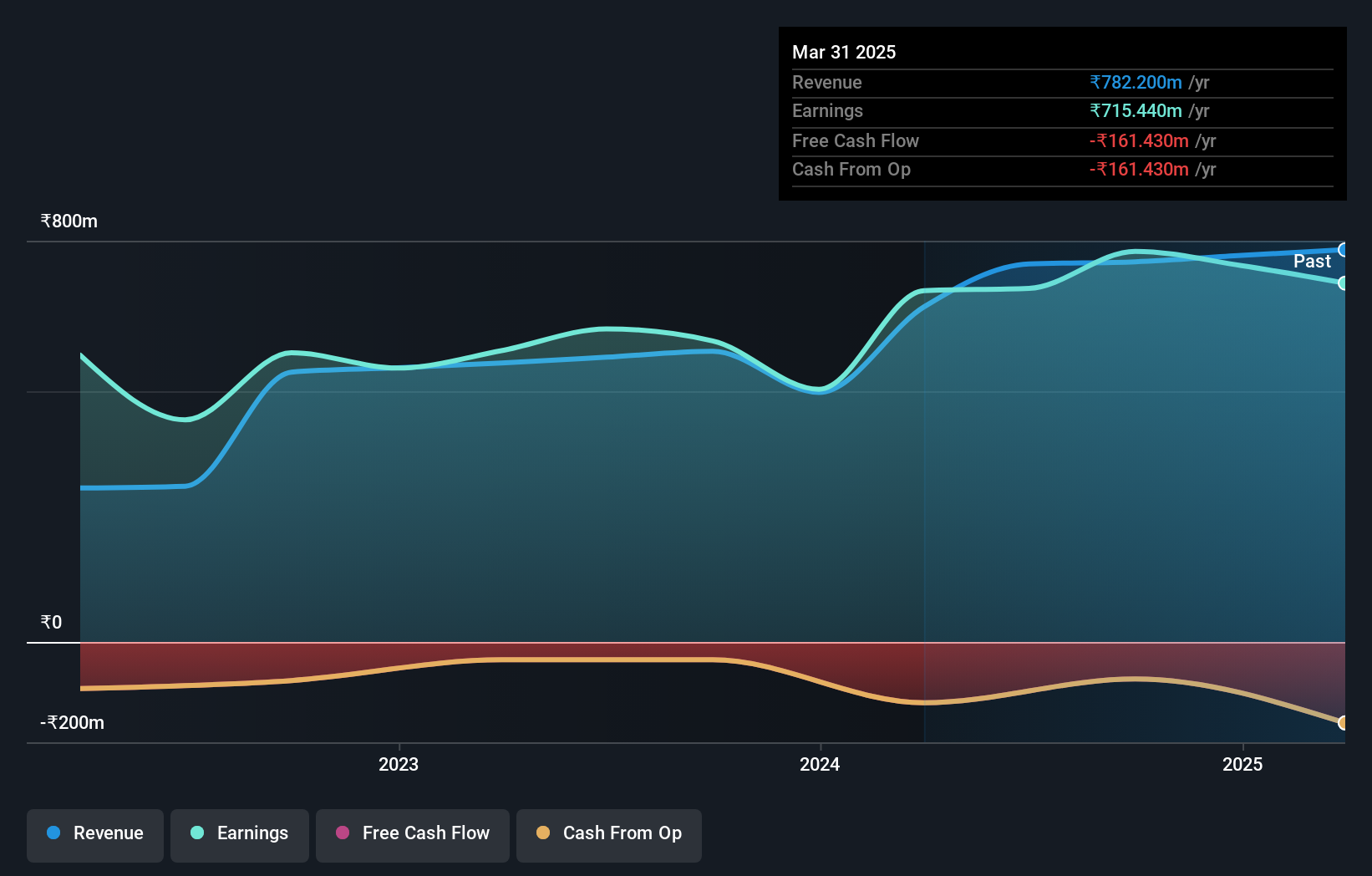

Ingersoll-Rand (India) (NSEI:INGERRAND)

Simply Wall St Value Rating: ★★★★★★

Overview: Ingersoll-Rand (India) Limited focuses on the manufacturing and sale of industrial air compressors within India, with a market capitalization of ₹131.50 billion.

Operations: The company generates revenue primarily from its Air Solutions segment, amounting to ₹12.73 billion.

Ingersoll-Rand (India) is carving a niche in the machinery sector with impressive financial health and consistent growth. Over the past five years, earnings have surged by 28% annually, showcasing robust performance despite not outpacing the industry's recent 25.6% growth. The company remains debt-free, reflecting prudent financial management and ensuring no interest coverage concerns. Recent earnings reports highlight a net income of INR 603 million for Q2 2024, up from INR 497 million last year, with basic EPS rising to INR 19.12 from INR 15.75. Additionally, a new managing director appointment signals strategic leadership changes aimed at sustaining momentum in key markets across EMEIA regions.

- Navigate through the intricacies of Ingersoll-Rand (India) with our comprehensive health report here.

Gain insights into Ingersoll-Rand (India)'s past trends and performance with our Past report.

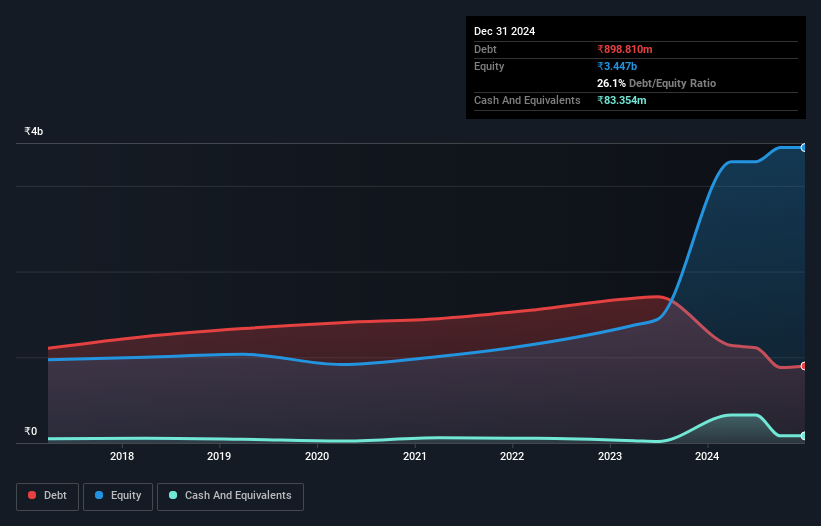

Kalyani Investment (NSEI:KICL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Kalyani Investment Company Limited is a non-deposit taking core investment company focused on investing in group companies in India, with a market capitalization of ₹30.45 billion.

Operations: The company generates revenue primarily through investments in its group companies. Its financial performance is influenced by the returns on these investments. The market capitalization stands at ₹30.45 billion, reflecting its position in the investment sector.

Kalyani Investment, a nimble player in the financial sector, showcases robust performance despite industry challenges. The company reported INR 463.52 million in revenue for Q2 2024, up from INR 386.78 million last year, with net income rising to INR 384.7 million from INR 310.81 million. Earnings per share improved to INR 88.13 compared to INR 71.2 previously, reflecting solid growth over the past five years at an annual rate of about 10%. With no debt on its books and high-quality earnings, Kalyani remains financially healthy though it trails behind industry growth rates recently seen at nearly double its pace.

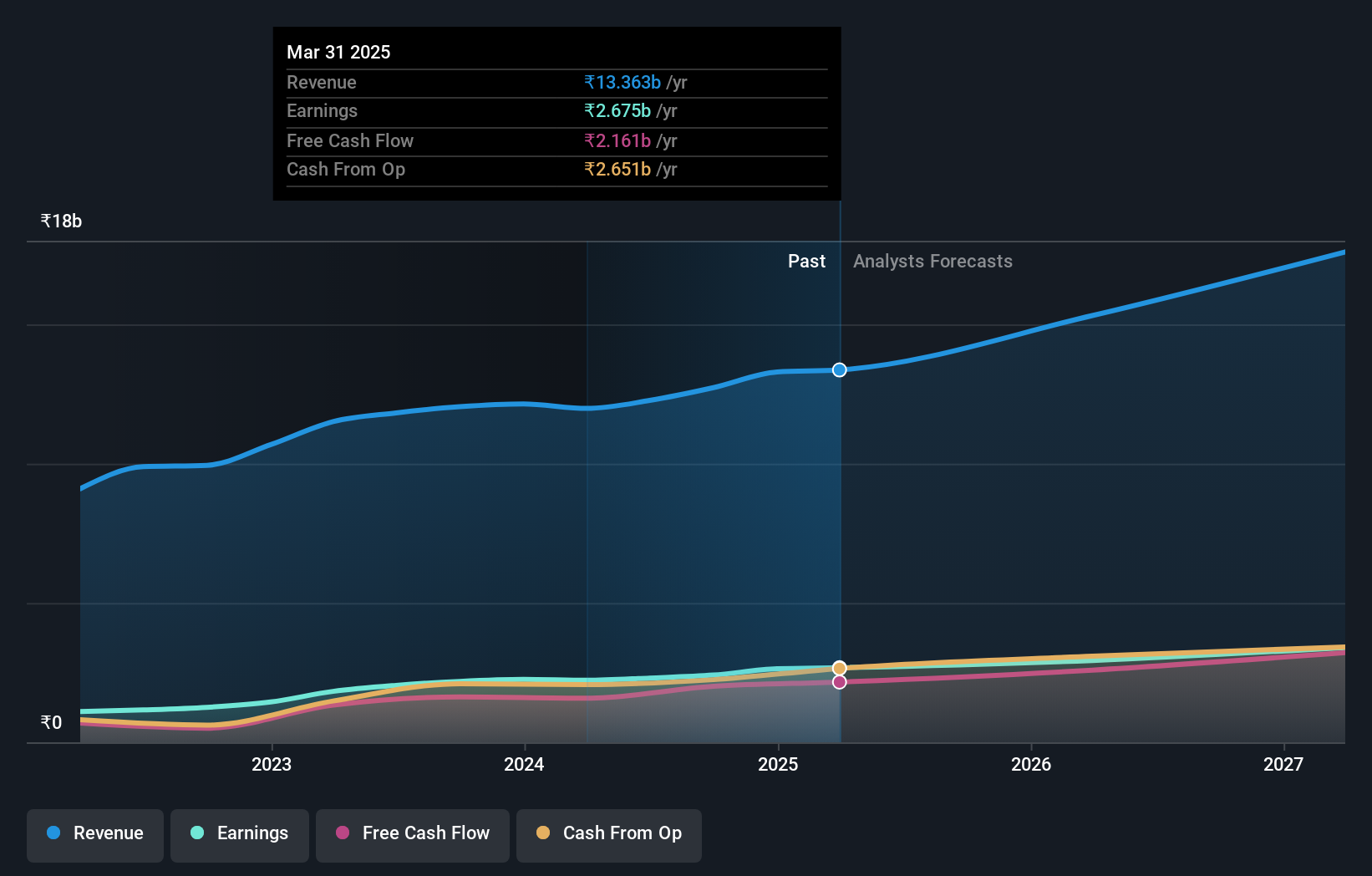

Motisons Jewellers (NSEI:MOTISONS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Motisons Jewellers Limited is involved in the manufacture and retail of jewelry in India, with a market capitalization of ₹29.04 billion.

Operations: Motisons Jewellers generates revenue primarily from its retail segment, focusing on jewelry and watches, with reported revenues of ₹4.19 billion.

Motisons Jewellers, a relatively small player in the specialty retail sector, has demonstrated robust earnings growth of 45.9% over the past year, outpacing the industry average of 30.8%. Their net debt to equity ratio stands at a satisfactory 23.9%, reflecting prudent financial management as it has decreased from 137.2% over five years. Despite high-quality earnings and well-covered interest payments with an EBIT coverage of 4.1x, their share price has been highly volatile recently. Notably, they executed a significant stock split on November 8, adjusting the face value of shares from INR 10 to INR 1 each.

- Click here to discover the nuances of Motisons Jewellers with our detailed analytical health report.

Make It Happen

- Dive into all 4640 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:MOTISONS

Motisons Jewellers

Engages in the manufacture and retail of jewelry in India.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives