- India

- /

- Capital Markets

- /

- NSEI:ISEC

This Just In: Analysts Are Boosting Their ICICI Securities Limited (NSE:ISEC) Outlook for This Year

Celebrations may be in order for ICICI Securities Limited (NSE:ISEC) shareholders, with the analysts delivering a significant upgrade to their statutory estimates for the company. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with the analysts modelling a real improvement in business performance.

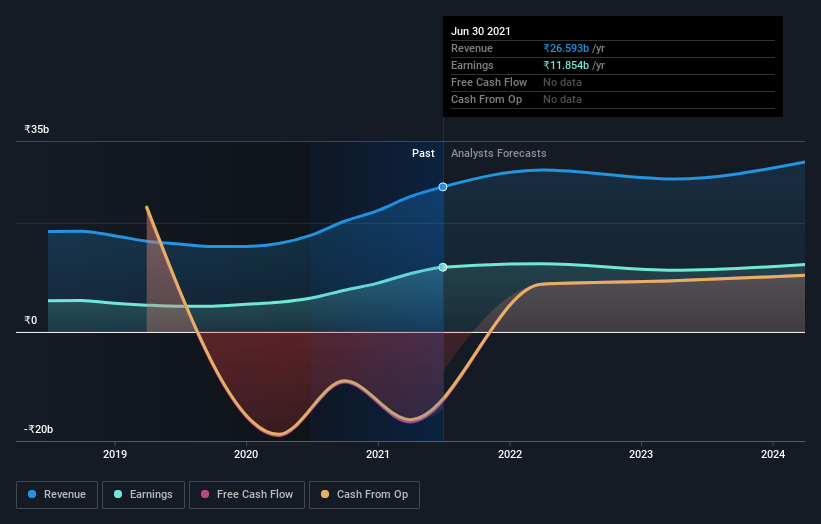

Following the upgrade, the most recent consensus for ICICI Securities from its six analysts is for revenues of ₹29b in 2022 which, if met, would be a solid 9.2% increase on its sales over the past 12 months. Statutory earnings per share are expected to be ₹37.30, roughly flat on the last 12 months. Prior to this update, the analysts had been forecasting revenues of ₹25b and earnings per share (EPS) of ₹30.64 in 2022. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

View our latest analysis for ICICI Securities

It will come as no surprise to learn that the analysts have increased their price target for ICICI Securities 27% to ₹754 on the back of these upgrades. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on ICICI Securities, with the most bullish analyst valuing it at ₹925 and the most bearish at ₹400 per share. Note the wide gap in analyst price targets? This implies to us that there is a fairly broad range of possible scenarios for the underlying business.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. We can infer from the latest estimates that forecasts expect a continuation of ICICI Securities'historical trends, as the 12% annualised revenue growth to the end of 2022 is roughly in line with the 13% annual revenue growth over the past three years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to see their revenues grow 7.0% per year. So it's pretty clear that ICICI Securities is forecast to grow substantially faster than its industry.

The Bottom Line

The most important thing to take away from this upgrade is that analysts upgraded their earnings per share estimates for this year, expecting improving business conditions. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. With a serious upgrade to expectations and a rising price target, it might be time to take another look at ICICI Securities.

Even so, the longer term trajectory of the business is much more important for the value creation of shareholders. We have estimates - from multiple ICICI Securities analysts - going out to 2024, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

When trading ICICI Securities or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade ICICI Securities, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:ISEC

ICICI Securities

Engages in the institutional and retail broking, financial products distribution, merchant banking, private wealth management, and issuer and advisory services in India and internationally.

Second-rate dividend payer low.

Similar Companies

Market Insights

Community Narratives