- India

- /

- Metals and Mining

- /

- NSEI:RAMASTEEL

Undiscovered Gems in India to Watch This September 2024

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has dropped 1.0%, yet it boasts an impressive 39% gain over the past year, with earnings forecast to grow by 17% annually. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding for investors seeking undiscovered gems.

Top 10 Undiscovered Gems With Strong Fundamentals In India

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Aeroflex Industries | 0.04% | 14.69% | 33.38% | ★★★★★★ |

| AGI Infra | 61.29% | 29.12% | 33.44% | ★★★★★★ |

| Voith Paper Fabrics India | 0.07% | 10.95% | 9.70% | ★★★★★☆ |

| Ingersoll-Rand (India) | 1.05% | 14.88% | 27.54% | ★★★★★☆ |

| Nibe | 39.26% | 80.75% | 84.68% | ★★★★★☆ |

| Lotus Chocolate | 13.51% | 28.07% | -10.66% | ★★★★★☆ |

| KP Green Engineering | 13.73% | 47.60% | 61.28% | ★★★★★☆ |

| Monarch Networth Capital | 32.66% | 31.02% | 50.24% | ★★★★☆☆ |

| Share India Securities | 24.23% | 37.59% | 48.98% | ★★★★☆☆ |

| Sky Gold | 127.01% | 22.02% | 48.03% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

IIFL Securities (NSEI:IIFLSEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: IIFL Securities Limited offers capital market services in India's primary and secondary markets, with a market cap of ₹98.09 billion.

Operations: IIFL Securities Limited generates revenue primarily from capital market activities (₹20.25 billion), with additional income from facilities and ancillary services (₹375.25 million) and insurance broking and ancillary services (₹2.77 billion).

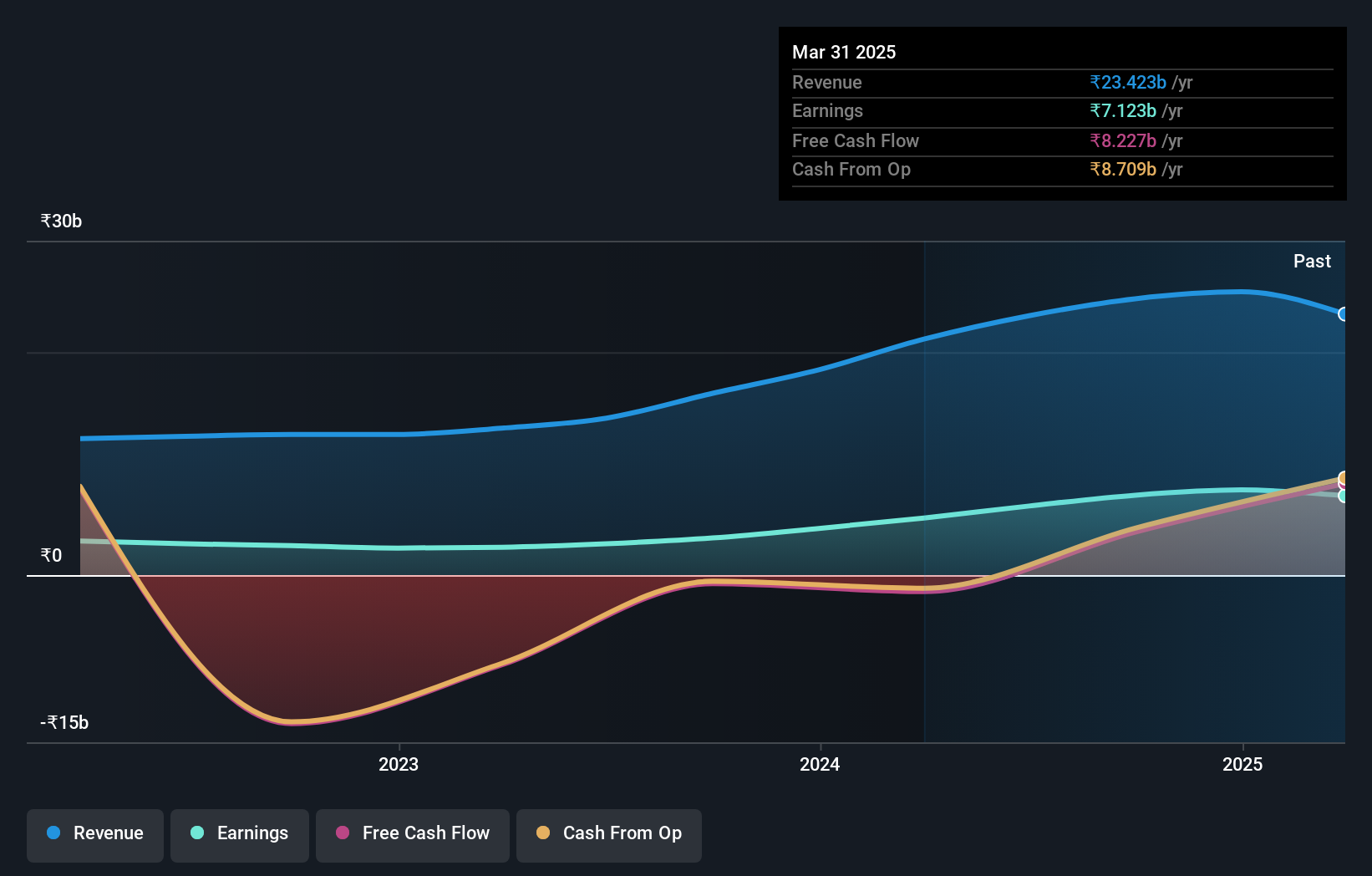

IIFL Securities, a promising player in India's financial sector, has shown impressive earnings growth of 120.4% over the past year, outpacing the industry average of 60.3%. The company's net debt to equity ratio stands at a satisfactory 35.5%, and its price-to-earnings ratio is an attractive 15.8x compared to the Indian market's 34.5x. Despite recent volatility in share price and challenges with free cash flow, IIFLSEC's high-quality earnings and reduced debt from 117.6% to 67.2% over five years highlight its potential for investors seeking undervalued opportunities in India’s market.

- Click here and access our complete health analysis report to understand the dynamics of IIFL Securities.

Review our historical performance report to gain insights into IIFL Securities''s past performance.

Marksans Pharma (NSEI:MARKSANS)

Simply Wall St Value Rating: ★★★★★★

Overview: Marksans Pharma Limited, along with its subsidiaries, focuses on the research, manufacturing, marketing, and sale of pharmaceutical formulations across various international markets including the United States, North America, Europe, the United Kingdom, Australia, and New Zealand with a market cap of ₹119.22 billion.

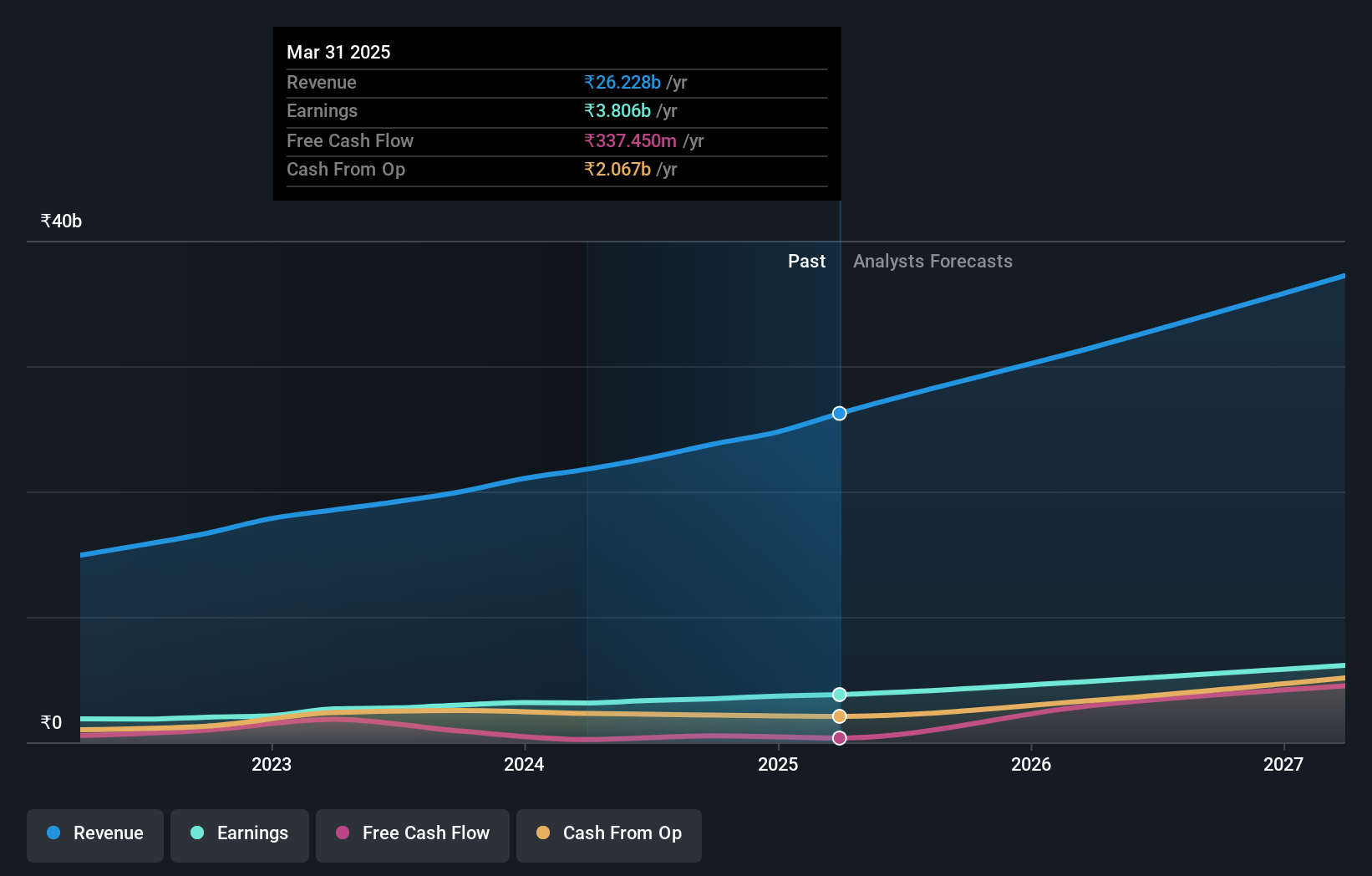

Operations: Marksans Pharma Limited generates revenue primarily from its pharmaceutical segment, amounting to ₹22.68 billion. The company operates in various international markets and has a market capitalization of ₹119.22 billion.

Marksans Pharma, a promising player in the pharmaceutical sector, has shown a notable reduction in its debt-to-equity ratio from 19.9% to 11.7% over the past five years. The company reported earnings growth of 21.7% last year, surpassing the industry average of 19.3%. Trading at a price-to-earnings ratio of 35.7x, below the industry average of 41.9x, Marksans offers good value relative to peers and is actively exploring M&A opportunities to expand into European markets.

- Get an in-depth perspective on Marksans Pharma's performance by reading our health report here.

Explore historical data to track Marksans Pharma's performance over time in our Past section.

Rama Steel Tubes (NSEI:RAMASTEEL)

Simply Wall St Value Rating: ★★★★★☆

Overview: Rama Steel Tubes Limited manufactures and trades steel pipes, tubes, rigid poly vinyl chloride, and galvanized iron pipes in India and internationally with a market cap of ₹25.68 billion.

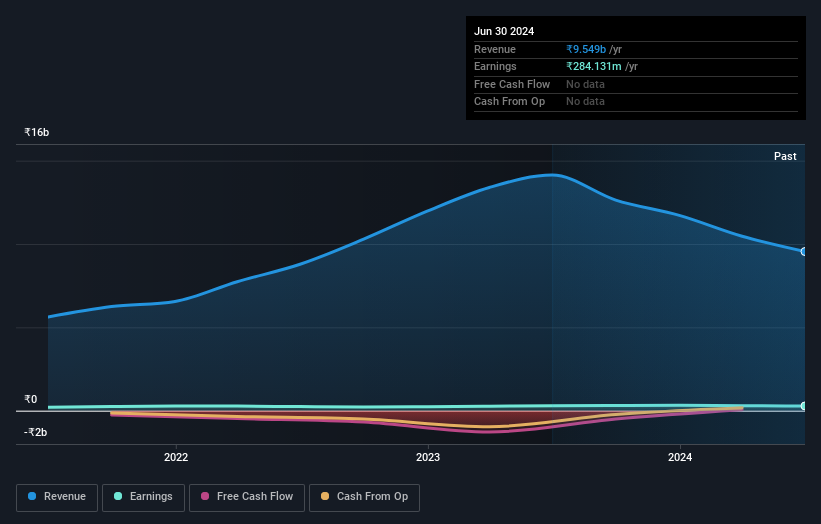

Operations: Rama Steel Tubes generates revenue primarily from manufacturing steel pipes (₹7.16 billion) and trading building materials and steel products (₹2.34 billion). The company’s financial performance is influenced by its revenue streams in both domestic and international markets.

Rama Steel Tubes has seen its debt to equity ratio drop significantly from 103.4% to 41.8% over the past five years, indicating better financial health. Despite negative earnings growth of -3.7% last year compared to the industry average of 17.2%, it remains profitable with high-quality earnings and satisfactory net debt to equity ratio at 36.8%. Recent news includes the incorporation of a subsidiary, Rama Defence Private Limited, and first-quarter sales for FY2025 reported at INR 2,166 million (down from INR 3,125 million a year ago).

- Navigate through the intricacies of Rama Steel Tubes with our comprehensive health report here.

Assess Rama Steel Tubes' past performance with our detailed historical performance reports.

Where To Now?

- Discover the full array of 479 Indian Undiscovered Gems With Strong Fundamentals right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:RAMASTEEL

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Community Narratives