- India

- /

- Capital Markets

- /

- NSEI:IIFLCAPS

Is IIFL Securities Limited (NSE:IIFLSEC) The Right Choice For A Smart Dividend Investor?

Could IIFL Securities Limited (NSE:IIFLSEC) be an attractive dividend share to own for the long haul? Investors are often drawn to strong companies with the idea of reinvesting the dividends. Yet sometimes, investors buy a stock for its dividend and lose money because the share price falls by more than they earned in dividend payments.

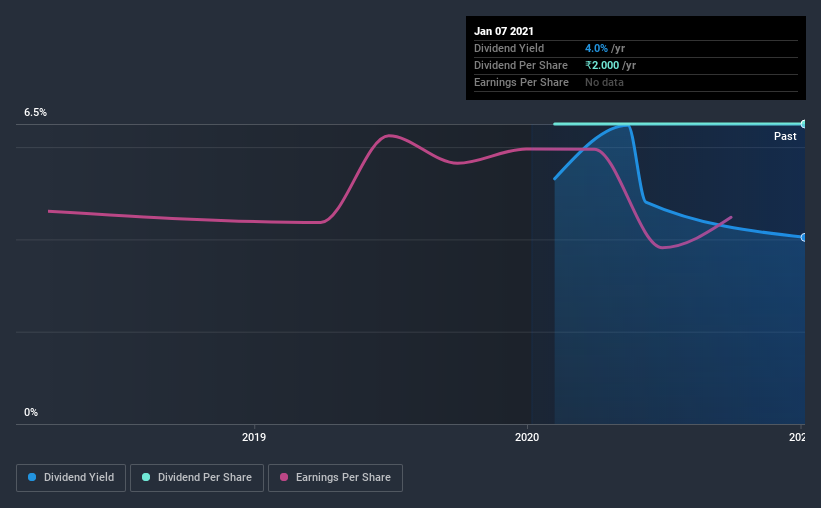

Some readers mightn't know much about IIFL Securities's 4.0% dividend, as it has only been paying distributions for a year or so. Remember though, due to the recent spike in its share price, IIFL Securities's yield will look lower, even though the market may now be factoring in an improvement in its long-term prospects. There are a few simple ways to reduce the risks of buying IIFL Securities for its dividend, and we'll go through these below.

Click the interactive chart for our full dividend analysis

Payout ratios

Companies (usually) pay dividends out of their earnings. If a company is paying more than it earns, the dividend might have to be cut. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. Looking at the data, we can see that 36% of IIFL Securities' profits were paid out as dividends in the last 12 months. A medium payout ratio strikes a good balance between paying dividends, and keeping enough back to invest in the business. One of the risks is that management reinvests the retained capital poorly instead of paying a higher dividend.

Consider getting our latest analysis on IIFL Securities' financial position here.

Dividend Volatility

One of the major risks of relying on dividend income, is the potential for a company to struggle financially and cut its dividend. Not only is your income cut, but the value of your investment declines as well - nasty. With a payment history of less than 2 years, we think it's a bit too soon to think about living on the income from its dividend. Its most recent annual dividend was ₹2.0 per share.

We like that the dividend hasn't been shrinking. However we're conscious that the company hasn't got an overly long track record of dividend payments yet, which makes us wary of relying on its dividend income.

Dividend Growth Potential

Examining whether the dividend is affordable and stable is important. However, it's also important to assess if earnings per share (EPS) are growing. Over the long term, dividends need to grow at or above the rate of inflation, in order to maintain the recipient's purchasing power. IIFL Securities' earnings per share have been essentially flat over the past five years. Flat earnings per share are acceptable for a time, but over the long term, the purchasing power of the company's dividends could be eroded by inflation.

Conclusion

To summarise, shareholders should always check that IIFL Securities' dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. We're glad to see IIFL Securities has a low payout ratio, as this suggests earnings are being reinvested in the business. Earnings per share are down, and to our mind IIFL Securities has not been paying a dividend long enough to demonstrate its resilience across economic cycles. In summary, we're unenthused by IIFL Securities as a dividend stock. It's not that we think it is a bad company; it simply falls short of our criteria in some key areas.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. For example, we've picked out 1 warning sign for IIFL Securities that investors should know about before committing capital to this stock.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

When trading IIFL Securities or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:IIFLCAPS

IIFL Capital Services

Provides capital market services in the primary and secondary markets in India.

Outstanding track record average dividend payer.