- India

- /

- Capital Markets

- /

- NSEI:IEX

Earnings Not Telling The Story For Indian Energy Exchange Limited (NSE:IEX) After Shares Rise 27%

Indian Energy Exchange Limited (NSE:IEX) shareholders have had their patience rewarded with a 27% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 45% in the last year.

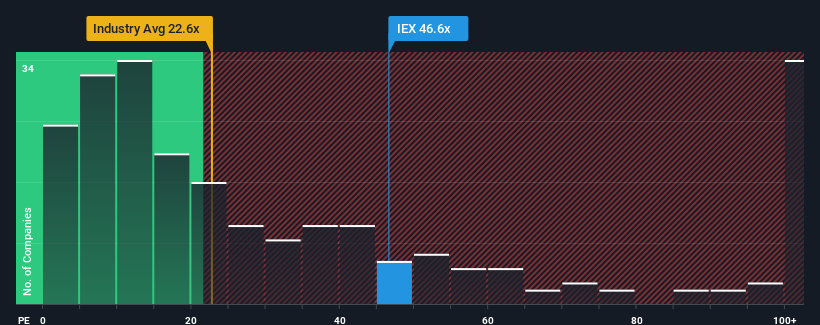

Following the firm bounce in price, Indian Energy Exchange may be sending bearish signals at the moment with its price-to-earnings (or "P/E") ratio of 46.6x, since almost half of all companies in India have P/E ratios under 34x and even P/E's lower than 19x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

Indian Energy Exchange could be doing better as it's been growing earnings less than most other companies lately. One possibility is that the P/E is high because investors think this lacklustre earnings performance will improve markedly. If not, then existing shareholders may be very nervous about the viability of the share price.

Check out our latest analysis for Indian Energy Exchange

How Is Indian Energy Exchange's Growth Trending?

There's an inherent assumption that a company should outperform the market for P/E ratios like Indian Energy Exchange's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 15% last year. The strong recent performance means it was also able to grow EPS by 71% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 8.3% per year as estimated by the six analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 22% per year, which is noticeably more attractive.

With this information, we find it concerning that Indian Energy Exchange is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

Indian Energy Exchange's P/E is getting right up there since its shares have risen strongly. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Indian Energy Exchange currently trades on a much higher than expected P/E since its forecast growth is lower than the wider market. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 1 warning sign for Indian Energy Exchange that you should be aware of.

If these risks are making you reconsider your opinion on Indian Energy Exchange, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:IEX

Indian Energy Exchange

Provides automated trading platform for physical delivery of electricity, renewable energy, and certificates.

Flawless balance sheet with proven track record.